Understanding how to invest for retirement through a Roth IRA is essential for building a solid financial future. This investment vehicle offers unique advantages that can significantly enhance your retirement planning, making it a popular choice among savers seeking tax-efficient growth.

This guide will walk you through the fundamentals of Roth IRAs, including how to start investing, manage contributions and investments, and optimize your growth potential. By exploring these key areas, you will be better equipped to make informed decisions and maximize your retirement savings.

Overview of Roth IRA and Retirement Investment Strategies

Establishing a robust retirement strategy is essential for ensuring financial security in later years. Among various options, the Roth IRA has gained popularity due to its unique benefits and flexible contributions. Understanding how a Roth IRA fits into overall retirement planning allows investors to make informed decisions that align with their long-term financial goals.

The Roth IRA is a retirement savings account that offers distinct advantages over traditional accounts. Its tax structure, contribution limits, and eligibility criteria make it an attractive choice for many individuals seeking tax-efficient growth and tax-free withdrawals in retirement. Comparing it with other retirement accounts helps clarify its role and advantages within a diversified investment strategy.

Concept and Benefits of a Roth IRA for Retirement Savings

A Roth IRA is an individual retirement account funded with after-tax dollars, meaning contributions are made with income that has already been taxed. The primary benefit of this arrangement is that qualified withdrawals during retirement are entirely tax-free, providing significant tax savings and flexibility. Additionally, Roth IRAs allow for tax-free growth on investments, which can compound over time, maximizing retirement savings potential.

One of the key advantages is the absence of required minimum distributions (RMDs) during the account holder’s lifetime, allowing the funds to grow tax-free for a longer period. This feature makes Roth IRAs especially appealing for individuals who anticipate being in a higher tax bracket during retirement or who wish to pass on tax-advantaged wealth to heirs.

Differences Between Roth IRA and Traditional IRA Contributions

While both Roth and traditional IRAs serve as valuable tools for retirement savings, their contribution mechanics and tax implications differ significantly. Understanding these differences is crucial for selecting the account that best matches your financial situation and retirement goals.

The following comparison highlights the key distinctions:

| Feature | Roth IRA | Traditional IRA | Key Difference | Eligibility Criteria |

|---|---|---|---|---|

| Tax Treatment of Contributions | Contributions made with after-tax dollars | Contributions often tax-deductible | Roth has tax-free qualified withdrawals; traditional offers immediate tax deductions | |

| Tax Treatment of Withdrawals | Tax-free after age 59½, provided the account has been open at least five years | Taxable as ordinary income if deductible contributions were made | Roth provides tax-free income in retirement; traditional may incur taxes upon withdrawal | |

| Required Minimum Distributions (RMDs) | Not required during the owner’s lifetime | Mandatory starting at age 72 | Roth offers more flexibility to leave funds invested longer | |

| Contribution Limits (2023) | $6,500 per year ($7,500 if age 50 or older) | $6,500 per year ($7,500 if age 50 or older) | Same limit, but income eligibility varies |

Key Eligibility Criteria for Opening a Roth IRA

Eligibility to open and contribute to a Roth IRA is governed by income levels and tax filing status. These criteria ensure that the benefits of the Roth IRA are accessible to individuals within certain financial ranges, while higher earners may be phased out based on their Modified Adjusted Gross Income (MAGI).

To qualify for a Roth IRA, an individual must meet the following criteria:

- Earned income: The individual must have taxable compensation or earned income from employment or self-employment.

- Income limitations: For 2023, the ability to contribute to a Roth IRA begins to phase out at a MAGI of $138,000 for single filers and $218,000 for married filing jointly, with contributions phased out completely at $153,000 and $228,000 respectively.

- Contribution limits: The total annual contribution cannot exceed the set limit ($6,500 or $7,500 for those aged 50 or over).

- Tax filing status: Typically, individuals must file taxes using single, head of household, married filing jointly, or qualifying widow(er) status.

Understanding these criteria helps ensure that contributions are compliant and that the account holder maximizes the benefits available through the Roth IRA within the legal framework.

Steps to Start Investing in a Roth IRA

Initiating your Roth IRA investment journey involves a structured process that ensures your account is set up correctly and aligned with your retirement goals. This step-by-step guide simplifies the process, making it accessible whether you prefer to open an account online or visit a financial institution in person. Understanding each stage helps you confidently navigate the establishment of your retirement savings account.

Embarking on this process requires attention to detail and preparation. From gathering essential documents to choosing the right financial partner, each step plays a crucial role in laying a solid foundation for your future financial security.

Creating a Step-by-Step Guide for Opening a Roth IRA

| Step | Description |

|---|---|

| 1. Research Financial Institutions | Compare banks, credit unions, and brokerage firms to identify those offering Roth IRA accounts with favorable terms, low fees, and suitable investment options. |

| 2. Gather Necessary Documents | Prepare personal identification, proof of income, and other relevant documents such as Social Security number, driver’s license or passport, and proof of address. |

| 3. Choose Your Account Type | Decide between opening an account online through a brokerage platform or visiting a physical branch of a bank or financial services provider. |

| 4. Complete Application Forms | Fill out the application with accurate personal information, employment details, and financial background. |

| 5. Fund Your Account | Set up initial deposits via bank transfer, check, or other available funding options, considering minimum deposit requirements. |

| 6. Select Investment Options | Choose appropriate investments such as mutual funds, ETFs, or individual stocks within your Roth IRA based on your risk tolerance and retirement timeline. |

| 7. Review and Submit | Double-check all entered information, review account terms, and submit your application for approval. |

| 8. Confirm and Access Account | Receive confirmation of your account opening and access your account online to monitor and manage your investments. |

Below is a flowchart illustrating this account setup process:

| Start | ||

| ↓ | ||

|

||

| ↓ | ||

|

||

| ↓ | ||

|

||

| ↓ | ||

|

||

| ↓ | ||

|

||

| ↓ | ||

|

||

| ↓ | ||

|

||

| ↓ | ||

|

Necessary Documents and Personal Information for Account Opening

When establishing a Roth IRA, having the appropriate documentation ready ensures a smooth application process. Financial institutions require specific personal details to verify your identity and comply with regulatory standards.

- Valid government-issued identification (driver’s license, passport, or state ID)

- Social Security Number (SSN) or Taxpayer Identification Number (TIN)

- Proof of income, such as recent pay stubs or tax returns

- Proof of residence, including utility bills or bank statements with your name and address

- Employment details and financial information as requested on the application form

Choosing a Financial Institution or Brokerage for Roth IRA Investments

Selecting the right institution is vital to ensuring your investments are managed effectively and costs are minimized. Consider factors such as fees, investment options, customer service, and digital platform usability when making your choice.

- Assess fee structures, including annual account fees, trading commissions, and fund expense ratios

- Review available investment options—mutual funds, ETFs, stocks, bonds, and target-date funds

- Evaluate the quality of customer support and educational resources offered

- Ensure the platform is user-friendly and provides essential tools for monitoring and managing your investments

- Check for additional services, such as automatic contributions, rebalancing tools, and financial planning support

Contribution Limits and Rules

Understanding the contribution limits and associated rules for Roth IRAs is crucial for maximizing your retirement savings while avoiding penalties. These limits are set annually by the IRS and can change over time based on inflation adjustments and legislative updates. Staying informed about these thresholds helps you plan your contributions effectively and ensures compliance with regulations.

Contributions to a Roth IRA are subject to specific annual limits, which are adjusted periodically to reflect inflation. These limits determine the maximum amount you can contribute each year, regardless of how many accounts you hold. It is essential to understand these constraints to optimize your retirement savings strategy without risking penalties or tax issues.

Annual Contribution Limits and Adjustments

The IRS sets the maximum contribution limits for Roth IRAs annually. For example, in 2023, the limit was $6,500 for individuals under age 50, with an additional catch-up contribution of $1,000 allowed for those age 50 and older. These amounts are typically adjusted each year to account for inflation, ensuring the contribution limits keep pace with rising living costs.

In 2024, the IRS has increased the contribution limit to $6,750 for individuals under age 50, with a catch-up contribution of $1,000 for those age 50 and above, making it a total of $7,750 for eligible participants aged 50+.

Comparison of Contribution Limits by Age and Income

While the annual contribution limits are uniform regardless of income level, eligibility to contribute directly to a Roth IRA depends on income thresholds. For individuals under a certain income level, the full contribution limit applies. Higher earners may face reduced contribution limits or be ineligible to contribute directly, though they might consider options like a backdoor Roth IRA.

Below is a simplified comparison to illustrate the contribution rules based on age:

| Age Group | 2023 Contribution Limit | Additional Catch-up Contribution | Total Possible Contribution |

|---|---|---|---|

| Under 50 | $6,500 | N/A | $6,500 |

| 50 and Over | $6,500 | $1,000 | $7,500 |

Note that income levels can influence eligibility, with phase-out ranges applying for higher earners. For example, in 2023, single filers with Modified Adjusted Gross Income (MAGI) over $138,000 were ineligible for direct Roth IRA contributions, phasing out completely at $153,000.

Rules for Making Contributions

Contributions to a Roth IRA must be made within specific timeframes and according to set guidelines to avoid penalties. The primary deadline for making contributions for a given tax year is typically April 15 of the following year. This allows for flexibility in planning and ensures contributions are aligned with your tax filings.

Catch-up contributions, applicable to those aged 50 and above, can be made up until the tax filing deadline, including extensions, for that year.

Contributions must not exceed the annual limit set by the IRS, and over-contributions are subject to penalties. Individuals can contribute to multiple Roth IRAs, but the aggregate contribution cannot surpass the annual limit. For example, if the limit is $6,500, contributing $4,000 to one account and $3,000 to another would be in violation, as the total exceeds the allowable amount.

Penalties for Exceeding Limits and Early Withdrawals

Exceeding contribution limits results in a penalty of 6% per year on the excess amount until it is corrected. This penalty is assessed annually until the excess is withdrawn or properly reclassified. It is important to monitor contributions carefully to avoid unintended fees and complications.

In cases where an early withdrawal is made—before age 59½—on earnings, a 10% IRS penalty applies, along with applicable income taxes, unless an exception such as first-time home purchase or qualified education expenses is met.

Contributions made to a Roth IRA can generally be withdrawn at any time without taxes or penalties, as these are made with after-tax dollars. However, earnings are subject to restrictions; withdrawing earnings before age 59½ without qualifying criteria can trigger penalties and taxes, emphasizing the importance of understanding the rules for early withdrawals.

Investment Options within a Roth IRA

Choosing the right investment vehicles within a Roth IRA is essential for building a diversified and resilient retirement portfolio. The variety of available options allows investors to tailor their investments according to their risk tolerance, time horizon, and growth objectives. Understanding the characteristics of each investment type helps in making informed decisions that align with long-term retirement goals.

Within a Roth IRA, investors can select from a broad spectrum of investment vehicles, including stocks, bonds, exchange-traded funds (ETFs), mutual funds, and other assets. Each option offers different levels of risk, liquidity, and growth potential, making it important to evaluate them carefully. Diversification across multiple asset classes can help optimize returns while managing risk exposure, ensuring a balanced approach to retirement savings.

Stocks

Stocks represent ownership shares in individual companies and are known for their potential to generate high returns over the long term. They tend to have higher volatility but can significantly contribute to growth in a retirement portfolio. Investors should consider stocks with strong fundamentals, consistent earnings, and growth prospects aligned with their risk tolerance.

Bonds

Bonds are fixed-income securities that provide regular interest payments and return of principal at maturity. They are generally less volatile than stocks and serve as a stabilizing component in a diversified portfolio. Bonds are suitable for conservative investors or those nearing retirement, seeking income and capital preservation.

Exchange-Traded Funds (ETFs)

ETFs are investment funds traded on stock exchanges, offering exposure to a diversified basket of securities such as stocks, bonds, or commodities. They combine the diversification benefits of mutual funds with the flexibility of trading like individual stocks. ETFs often have lower expense ratios and can be tailored to specific investment themes or sectors.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio managed by professional fund managers. They provide access to a broad range of asset classes and investment strategies, making them suitable for investors seeking professional management and diversification. Mutual funds may have higher fees compared to ETFs but offer convenience and expert oversight.

Comparison of Investment Options

| Investment Vehicle | Risk | Liquidity | Growth Potential |

|---|---|---|---|

| Stocks | High | High | High |

| Bonds | Low to Moderate | Moderate | Moderate |

| ETFs | Variable (depends on underlying assets) | High | Variable |

| Mutual Funds | Variable (based on fund holdings) | Moderate | Variable |

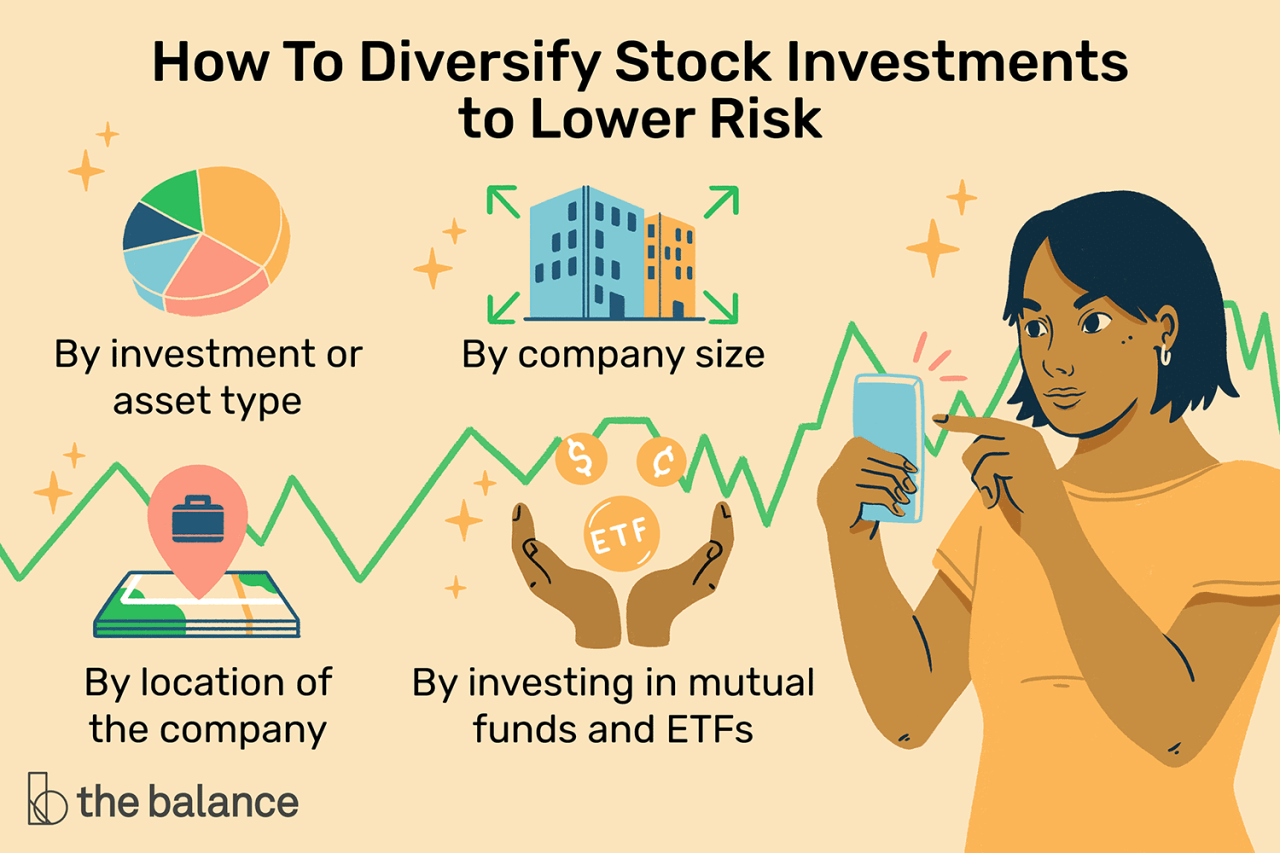

Strategies for Diversifying Investments within a Roth IRA

Diversification is a vital strategy to mitigate risk and enhance potential returns within a Roth IRA. By spreading investments across different asset classes, sectors, and geographic regions, investors can protect their portfolio from the adverse effects of market volatility. Combining stocks, bonds, ETFs, and mutual funds helps create a balanced portfolio that can withstand various economic conditions.

Implementing dollar-cost averaging—investing a fixed amount at regular intervals—reduces the impact of market fluctuations and promotes disciplined investing. Rebalancing the portfolio periodically ensures that asset allocation remains aligned with the investor’s risk tolerance and retirement timeline, preventing overexposure to any one asset class.

Choosing Investments Aligned with Retirement Goals and Risk Tolerance

Aligning investment choices with individual retirement goals involves assessing the timeline until retirement, income needs, and comfort with market fluctuations. Younger investors with a longer horizon may prioritize growth-oriented assets like stocks and equity ETFs, accepting higher short-term volatility for potential higher returns. Conversely, those nearing retirement might focus on bonds and income-generating mutual funds to preserve capital and ensure income stability.

It is advisable to regularly review and adjust the portfolio based on changes in personal circumstances, market conditions, and evolving risk appetite. Consulting with a financial advisor can provide personalized guidance to craft an investment strategy that effectively balances risk and growth, ensuring a secure and comfortable retirement.

Strategies for Maximizing Roth IRA Growth

Achieving optimal growth within a Roth IRA requires strategic planning and disciplined investment practices. By implementing effective methods to contribute consistently, leverage compound interest, and maintain an actively managed portfolio, investors can significantly enhance their retirement savings over time. Understanding how to maximize tax advantages through strategic contributions and withdrawals further amplifies the potential benefits of a Roth IRA. This section explores actionable strategies to help investors grow their Roth IRA effectively and secure a more comfortable retirement.To maximize growth in a Roth IRA, investors should adopt consistent contribution habits, utilize the power of compound interest, and periodically rebalance their portfolios.

Additionally, strategic management of contributions and withdrawals can optimize tax benefits and ensure sustainable growth.

Consistent Contributions and Compound Interest

Regular contributions are fundamental to building substantial retirement savings. By setting up automatic contributions, investors can ensure steady investment, regardless of market fluctuations. Consistency allows the contribution amount to benefit from dollar-cost averaging, reducing the impact of market volatility and potentially lowering the average purchase price of investments over time.The power of compound interest plays a vital role in growing Roth IRA assets.

As earnings generate additional gains, these gains are reinvested, creating a snowball effect that accelerates growth exponentially. For example, contributing $500 monthly with an average annual return of 7% can grow to over $190,000 in 20 years, illustrating how disciplined contributions combined with compound growth lead to substantial retirement funds.

“Start early, contribute regularly, and let the power of compound interest do the heavy lifting.”

Optimizing Tax Benefits through Strategic Contributions and Withdrawals

While Roth IRAs offer tax-free growth and qualified withdrawals, strategic planning around contribution timing and withdrawal sequencing can maximize these benefits. Making contributions during high-income years when tax rates are favorable or utilizing catch-up contributions after age 50 enhances the overall tax efficiency of the account.It is also advantageous to plan withdrawals to minimize tax implications. Since qualified withdrawals are tax-free, investors should aim to withdraw funds only when needed or after reaching age 59½, avoiding early withdrawals that may incur taxes and penalties.

Additionally, understanding the five-year rule ensures that withdrawals remain tax-free, emphasizing the importance of timing and record-keeping.

Rebalancing the Portfolio Periodically for Growth

Maintaining an appropriate asset allocation is crucial for sustained growth and risk management. Market fluctuations can cause portfolio weights to drift from target allocations, potentially increasing risk or diminishing growth potential. Periodic rebalancing restores the original investment proportions, ensuring the portfolio remains aligned with long-term goals.Rebalancing involves selling some assets that have appreciated significantly and reinvesting in those that lag, thus maintaining a diversified and balanced portfolio.

For instance, if equities perform exceptionally well and grow to comprise 70% of the portfolio, rebalancing might involve reallocating some gains into bonds or cash equivalents to bring the equity portion back to the desired 60%. This disciplined approach prevents overexposure to risky assets and secures consistent growth.

Setting Automatic Contributions and Investment Reallocation

Automation simplifies ongoing investment management and ensures consistent progress toward retirement goals. Setting up automatic contributions ensures regular deposits, which can be scheduled monthly or quarterly, reinforcing disciplined saving habits.Furthermore, establishing automatic investment reallocation—also known as target asset allocation adjustments—can help maintain desired risk levels and investment strategies without manual intervention. Many financial institutions offer tools to automatically rebalance a Roth IRA portfolio periodically, such as quarterly or annually, based on predefined target allocations.

This proactive approach facilitates disciplined investing, reduces emotional decision-making, and helps capitalize on market opportunities through systematic rebalancing.

Withdrawal Rules and Tax Implications

Understanding the rules surrounding withdrawals from a Roth IRA is essential for maximizing its benefits while avoiding unnecessary penalties and taxes. Proper knowledge of qualified versus non-qualified withdrawals can significantly impact your retirement planning and financial security.

Withdrawals from a Roth IRA are governed by specific regulations that distinguish between contributions, earnings, and the purpose of the withdrawal. These rules determine whether the distributions are tax-free or subject to penalties, making it crucial to adhere to the IRS guidelines to preserve the account’s tax advantages.

Qualified and Non-Qualified Withdrawals

Distributions from a Roth IRA fall into two categories: qualified and non-qualified. A qualified withdrawal is tax-free and penalty-free, provided certain conditions are met. Non-qualified withdrawals may be subject to taxes and penalties, affecting your retirement savings and overall financial health.

To be considered qualified, the distribution must meet the following criteria:

- The account has been open for at least five years.

- The withdrawal occurs after age 59½, or in specific circumstances such as a first-time home purchase (up to $10,000), disability, or death.

Non-qualified withdrawals occur when these conditions are not satisfied. In such cases, earnings may be subject to income tax and a 10% early withdrawal penalty, unless an exception applies.

Tax Consequences and Penalties in Different Withdrawal Scenarios

The table below summarizes common withdrawal scenarios, highlighting potential tax liabilities and penalties:

| Scenario | Withdrawals of Contributions | Withdrawals of Earnings | Tax Implications | Penalties |

|---|---|---|---|---|

| Qualified withdrawal after age 59½ with >5 years of account | Tax-free | Tax-free | None | None |

| Withdrawal before age 59½ with <5 years of account | Tax-free (contributions) | Subject to income tax and 10% penalty (earnings) | Contributions are tax-free; earnings taxed as ordinary income | 10% penalty on earnings |

| First-time home purchase (up to $10,000), disability, death | Tax-free | Tax-free | None | None |

| Withdrawal for education expenses | Tax-free | Tax-free | None | None |

| Early withdrawal for reasons other than exceptions | Tax-free (contributions) | Taxed and penalized (earnings) | Earnings taxed as ordinary income | 10% penalty on earnings |

Strategies to Avoid Taxes and Penalties

Proper planning can ensure that withdrawals from a Roth IRA are tax-efficient and penalty-free. The key strategies include:

- Maintaining a record of contributions to distinguish them from earnings, as contributions can be withdrawn at any time without taxes or penalties.

- Waiting until the account is at least five years old and reaching age 59½ before making withdrawals, to qualify for tax-free distributions.

- Utilizing exceptions such as first-time home purchases, disability, or qualified education expenses to withdraw earnings penalty-free.

- Consulting with a financial advisor to plan withdrawals in a manner that minimizes tax impact and preserves long-term growth.

Impact of Early Withdrawals on Retirement Planning

Early withdrawals from a Roth IRA can undermine the primary goal of retirement savings by reducing the compounding potential of your investments. Penalties and taxes on earnings diminish the overall growth of your account, potentially delaying your retirement timeline or decreasing the amount available during retirement.

While certain exceptions allow penalty-free early withdrawals, these should be used judiciously. It is advisable to consider alternative funding sources for emergencies or significant expenses to preserve your Roth IRA’s integrity. Planning ahead and understanding withdrawal rules can help maintain a strong retirement nest egg and ensure financial stability in later years.

Common Mistakes to Avoid When Investing for Retirement via Roth IRA

Investing for retirement through a Roth IRA offers significant advantages, including tax-free growth and qualified withdrawals. However, many investors inadvertently make errors that can diminish these benefits or complicate their retirement planning. Understanding and avoiding these common mistakes can help ensure you maximize your Roth IRA’s potential and secure your financial future with confidence.Mistakes in Roth IRA investing can stem from missteps such as over-contributing, neglecting diversification, or mishandling withdrawals.

Recognizing these pitfalls and implementing best practices can help you stay compliant with IRS rules and optimize your investment strategy. Below, we explore prevalent errors, offer practical advice, and highlight case studies to illustrate both mistakes and effective corrections.

Over-Contributing to the Roth IRA

Contributing more than the annual limit set by the IRS is a frequent mistake among investors eager to accelerate their retirement savings. The IRS enforces strict contribution caps, which for 2024 stand at $6,500 for individuals under 50 and $7,500 for those 50 and above. Excess contributions can lead to a 6% annual penalty until corrected.To avoid over-contributing, investors should regularly check their total contributions, especially if they have multiple retirement accounts or receive unexpected income.

Utilizing IRS tools or consulting a financial advisor can help ensure contributions stay within permissible limits.

Neglecting Diversification of Investment Options

Many investors place a disproportionate portion of their Roth IRA into a single asset class, such as stocks or bonds, overlooking the importance of diversification. Lack of diversification increases risk and can result in significant losses during market downturns.Implementing a diversified portfolio that includes a mix of stocks, bonds, index funds, and other assets aligned with your risk tolerance can help mitigate market volatility.

Rebalancing your portfolio periodically ensures that your asset allocation remains aligned with your retirement goals.

Mismanaging Withdrawals and Penalty Risks

Incorrectly handling withdrawals from a Roth IRA can lead to unexpected taxes and penalties. While qualified withdrawals are tax-free, non-qualified distributions of earnings before age 59½ may incur income taxes and a 10% early withdrawal penalty.It is crucial to understand the rules governing qualified distributions, such as the five-year rule and exceptions like first-time home purchases or significant medical expenses.

Proper planning and record-keeping help avoid inadvertent mistakes that could diminish your savings.

Best Practices to Maximize Roth IRA Benefits and Minimize Risks

Adhering to best practices can significantly improve your retirement investment outcomes. Consider the following recommendations:

- Regularly review and adjust your investment allocations to maintain diversification.

- Track contribution limits diligently and utilize tools or professional advice to prevent over-contributing.

- Understand the rules for qualified withdrawals, and plan distributions accordingly to avoid penalties.

- Reinvest dividends and capital gains to harness the power of compounding over time.

- Keep detailed records of contributions, conversions, and withdrawals for IRS compliance.

- Stay informed about IRS updates and contribution limits annually to adapt your strategy.

Case Studies Illustrating Mistakes and Corrective Actions

Case Study 1: Over-Contribution Leading to Penalty John contributed $8,000 in 2023, exceeding the limit by $1,500. The IRS imposed a 6% penalty on the excess amount annually. Recognizing the mistake, John withdrew the excess contribution plus earnings before the tax deadline, avoiding further penalties. He also adjusted his contributions for subsequent years to stay within limits.Case Study 2: Lack of Diversification Increasing Risk Sara invested 90% of her Roth IRA in a single technology stock, which plummeted during a market correction.

She faced significant losses. In response, Sara reallocated her investments into a diversified mix of mutual funds and bonds, reducing risk and stabilizing her portfolio.

Ensuring compliance with IRS contribution limits and maintaining a diversified portfolio are essential steps to safeguard your retirement savings.

Roth IRA Compliance Checklist

To help ensure adherence to rules and maximize your Roth IRA benefits, review this checklist regularly:

- Confirm total contributions do not exceed annual limits.

- Track all contributions, conversions, and withdrawals meticulously.

- Ensure all withdrawals meet the criteria for tax-free, qualified distributions.

- Maintain documentation of investment transactions for IRS records.

- Stay updated on IRS contribution limits and regulations annually.

- Consult a financial advisor when planning significant transactions or portfolio adjustments.

Outcome Summary

In summary, mastering how to invest for retirement through a Roth IRA empowers you to take control of your financial future with strategic planning, disciplined contributions, and smart investment choices. Staying informed and avoiding common pitfalls can ensure your retirement goals are achieved effectively and confidently.