Starting to invest as a beginner with no experience can seem daunting, but with the right guidance, anyone can embark on a successful investment journey. Taking the first step is crucial for building financial security and growing wealth over time, regardless of prior knowledge or resources. Understanding the fundamentals and setting clear goals can transform uncertainty into confidence and opportunity.

This guide provides a comprehensive overview of how to begin investing, covering essential investment concepts, goal setting, strategy development, platform selection, and risk management. It aims to empower new investors by offering practical advice and resources to help navigate the initial stages with ease and assurance.

Introduction to Investing for Beginners with No Experience

Embarking on an investment journey can seem daunting, especially for those with little to no prior experience. However, starting early provides a significant advantage, as it allows your investments to grow over time through the power of compounding. Regardless of your financial background or knowledge level, taking the first step towards investing is a vital move towards securing your financial future.

The key is to approach the process methodically, gaining knowledge, setting clear goals, and gradually building your confidence.

For beginners, understanding the initial steps of investing is crucial. It involves a clear pathway—from assessing your financial situation and establishing your investment goals, to choosing suitable investment vehicles and understanding the importance of diversification and risk management. This step-by-step overview aims to demystify the process, offering practical guidance to help you transition from a novice to a confident investor.

Remember, every seasoned investor started somewhere, and your commitment today can lead to financial stability and growth in the future.

Understanding the Investment Journey for Beginners

Starting your investment journey involves a series of deliberate steps designed to build a solid foundation for your financial plans. Each phase is important and lays the groundwork for successful investing over the long term. Here is an Artikel of the essential steps that novice investors should follow:

- Assess Your Financial Situation: Before investing, evaluate your income, expenses, debts, and savings. Establish an emergency fund that covers three to six months of living expenses to ensure financial stability before allocating funds to investments.

- Define Your Investment Goals: Clarify what you aim to achieve—be it saving for retirement, purchasing a home, or funding education. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals helps tailor your investment strategy.

- Educate Yourself on Investment Options: Learn about different asset classes such as stocks, bonds, mutual funds, ETFs, and real estate. Understanding their risk profiles, potential returns, and liquidity helps in making informed decisions.

- Create an Investment Plan: Decide on the amount to invest regularly, your risk tolerance, and the investment horizon. An initial plan provides direction and helps maintain discipline during market fluctuations.

- Select Appropriate Investment Accounts: Open brokerage accounts, retirement accounts (like IRAs or 401(k)s), or robo-advisors based on your goals and preferences. Ensure that the accounts align with your investment strategy.

- Start Small and Diversify: Begin with manageable investment amounts, and diversify across various assets to mitigate risk. Diversification reduces the impact of a poor-performing asset on your overall portfolio.

- Monitor and Adjust Your Portfolio: Regularly review your investments to ensure they align with your goals. Rebalance your portfolio periodically to maintain your desired asset allocation and adapt to changing circumstances.

By following these structured steps, beginners can approach investing with confidence and clarity. Patience and continuous learning are key elements of successful investing, ensuring that your financial journey remains on track regardless of market fluctuations or initial uncertainties.

Understanding Basic Investment Concepts

For beginners venturing into the world of investing, grasping fundamental concepts is essential. These building blocks form the foundation for making informed decisions and developing a successful investment strategy. Recognizing the key terms and how different investment options work will enhance confidence and clarity as you begin your financial journey.

Investment concepts involve various financial instruments and the principles that govern their use. Knowing the distinctions and relationships among stocks, bonds, ETFs, and mutual funds enables investors to create diversified portfolios aligned with their risk tolerance and financial goals. Additionally, understanding the balance between risk and reward helps in making prudent investment choices suited to your comfort level and objectives.

Key Investment Terms

Understanding the terminology used in investing is crucial for navigating financial markets effectively. Below are some of the most common investment terms that every beginner should familiarize themselves with:

- Stocks: Represent ownership shares in a company. When you buy stocks, you become a partial owner, and your returns depend on the company’s performance and stock price movements.

- Bonds: Are debt securities issued by corporations or governments. Investors lend money to the issuer in exchange for periodic interest payments and the return of principal at maturity.

- ETFs (Exchange-Traded Funds): Are investment funds traded on stock exchanges, combining features of stocks and mutual funds. They typically track specific indices, sectors, or commodities, offering diversification with liquidity.

- Mutual Funds: Are pooled investment vehicles managed by professional fund managers. Investors buy shares in the fund, which invests in a diversified portfolio of stocks, bonds, or other assets.

Comparison of Investment Types

Investors should understand how various investment options differ in terms of risk, return potential, liquidity, and management. The following table provides a clear comparison of stocks, bonds, ETFs, and mutual funds:

| Investment Type | Ownership/Ownership Stake | Risk Level | Potential Return | Liquidity | Management |

|---|---|---|---|---|---|

| Stocks | Partial ownership in a company | High | Variable; can be high in growth stocks | High; traded daily on exchanges | Market-driven; no active management required |

| Bonds | Debt instrument; lender’s position | Lower than stocks, but varies with issuer | Moderate; fixed interest payments | High; traded on secondary markets | Passive; managed by issuers or fund managers |

| ETFs | Ownership in a fund that holds diverse assets | Varies; generally moderate | Depends on underlying assets | High; traded like stocks | Passive or active management |

| Mutual Funds | Ownership in a managed portfolio | Varies; often moderate | Depends on fund’s holdings | Moderate; bought and sold at end-of-day NAV | Active management by professional fund managers |

Risk Versus Reward in Investments

Investing inherently involves balancing risk and potential return. To understand this relationship, consider the following analogy:

Investing is like climbing a mountain. The higher you go, the better the view — representing higher potential rewards. However, the ascent gets steeper and more challenging as you climb higher, symbolizing increased risk. A safe, gentle hike offers a steady but limited view, akin to low-risk investments like bonds. A daring climb could lead to a stunning vista but also involves the danger of slips and falls, similar to the risk of stocks or volatile assets.

The key for beginners is to assess their comfort with risk and choose investments that align with their financial goals. Diversification across different asset classes can help manage risk while striving for reasonable returns, making the journey toward wealth accumulation both achievable and sustainable.

Setting Investment Goals and Assessing Financial Situation

Establishing clear investment goals and thoroughly evaluating your financial situation are crucial steps for any beginner investor. These actions help create a solid foundation for making informed decisions, managing risks, and ensuring your investment activities align with your personal circumstances and future aspirations. By setting realistic objectives and understanding your current financial health, you can develop a tailored investment plan that supports your journey toward financial stability and growth.

Assessing your finances involves a comprehensive review of income, expenses, debts, and savings. This process allows you to determine how much you can comfortably invest without jeopardizing your financial security. Additionally, clearly defined short-term and long-term goals help prioritize investment strategies, measure progress, and adjust plans as needed. The following sections guide you through evaluating your personal finances, setting achievable goals, and creating a plan aligned with your financial objectives.

Checklist for Evaluating Personal Finances Before Investing

Before committing to any investment, it is essential to analyze your current financial situation. This checklist helps identify whether you are financially prepared and highlights areas needing attention to avoid potential setbacks.

- Review your total monthly income from all sources, including salary, freelance work, or passive income streams.

- Calculate your monthly expenses, such as housing, utilities, groceries, transportation, insurance, and discretionary spending.

- Determine your total debt obligations, including credit cards, student loans, car loans, and mortgages.

- Establish an emergency fund equivalent to three to six months of living expenses to cover unforeseen circumstances.

- Assess your current savings and investment accounts to understand your starting point.

- Identify any upcoming significant expenses, like education, medical costs, or major purchases, that could impact your investment plan.

- Evaluate your credit score and financial stability to ensure access to favorable borrowing options if needed.

Setting Realistic Short-term and Long-term Investment Goals

Defining specific, measurable, and attainable goals provides direction and motivation for your investment journey. Short-term goals typically span from a few months to a couple of years, while long-term objectives extend beyond five years.

For short-term goals, examples include building an emergency fund, saving for a vacation, or purchasing a new gadget. These goals require relatively low risk investments with liquidity to access funds quickly when needed. Conversely, long-term goals often involve retirement savings, funding children’s education, or buying a home. These objectives can tolerate higher risk investments with the potential for greater growth over time.

To set effective goals, consider the following factors:

- Determine the specific amount of money needed to achieve each goal.

- Set a realistic timeline based on your income, expenses, and future plans.

- Assess your risk tolerance to ensure your investment choices align with your comfort level.

- Periodically review and adjust your goals as your financial situation and priorities evolve.

Example: To save $10,000 for a car purchase in three years, you need to save approximately $278 per month, assuming no interest earned. If you aim for a higher return through investments, your monthly contributions may vary depending on the expected growth rate.

Developing a Sample Investment Plan for Aligning with Financial Objectives

Creating an actionable plan involves translating your goals and financial assessment into specific investment strategies. A well-structured plan ensures your investments support your objectives while managing risks appropriately.

Sample plan Artikel:

| Financial Goal | Timeline | Target Amount | Investment Strategy | Expected Risk Level |

|---|---|---|---|---|

| Build Emergency Fund | 6 months | USD 10,000 | Savings account or money market fund for liquidity | Low |

| Save for Retirement | 20-30 years | USD 500,000 (example estimate) | Contributions to a diversified retirement account, such as an IRA or 401(k), investing in index funds | Moderate to high, depending on investment choices |

| Save for a House Down Payment | 5 years | USD 50,000 | Balanced portfolio including bonds and stocks, with periodic rebalancing | Moderate |

Align your investment choices with your risk tolerance, time horizon, and financial goals. Regularly monitor your progress, rebalance your portfolio as needed, and adjust your contributions based on changes in your income or expenses. By maintaining this disciplined approach, you can effectively work toward achieving your financial objectives while safeguarding your overall financial health.

Building a Beginner Investment Strategy

Developing a strategic approach to investing is essential for beginners aiming to grow their wealth while managing risk effectively. A well-structured investment plan helps in maintaining discipline, making informed decisions, and aligning investments with personal financial goals. This section guides you through the fundamentals of creating a diversified and resilient investment strategy tailored for those just starting out.

By focusing on diversification, choosing appropriate investment vehicles, and understanding how to select low-cost index funds and ETFs, beginners can establish a solid foundation for long-term financial growth. Implementing these methods ensures that your investments are balanced, cost-efficient, and aligned with your risk tolerance.

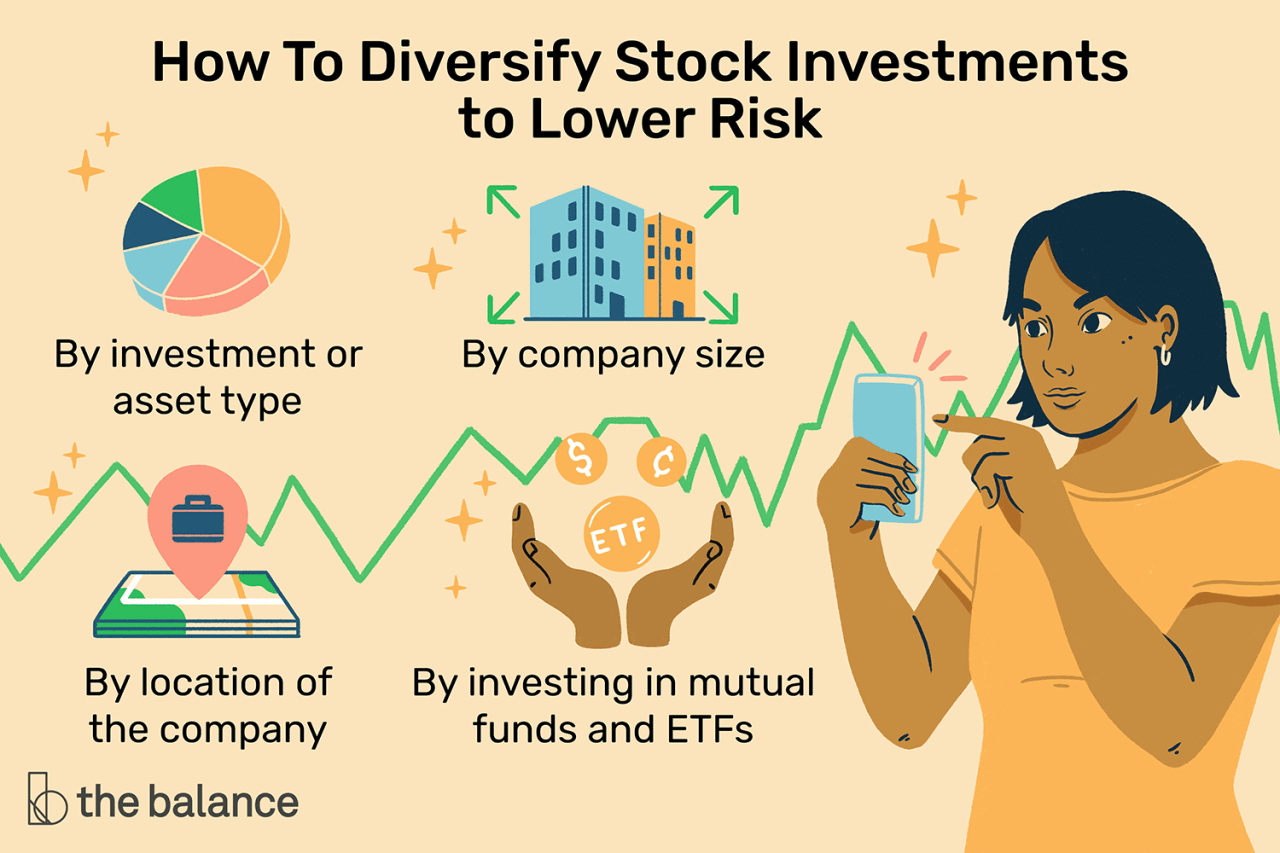

Diversifying Investments to Minimize Risk

One of the most effective ways to protect your investment portfolio from market volatility is through diversification. Spreading investments across different asset classes, industries, and geographic regions reduces the impact of any single investment’s poor performance. Diversification aims to balance risk and reward by not putting all your eggs in one basket.

For beginners, diversification can seem complex, but it can be achieved simply by investing in a mix of stocks, bonds, and other assets. For instance, allocating a portion of your funds to both domestic and international stocks, along with government or corporate bonds, can create a more stable overall portfolio. Regularly rebalancing your investments ensures that your portfolio remains aligned with your desired risk level and financial goals.

Common Beginner-Friendly Investment Approaches

When starting your investment journey, it is advisable to choose approaches that are straightforward, transparent, and cost-effective. Here are some of the most common methods suitable for beginners:

- Buy and Hold Investing: Purchasing quality assets with the intention to hold them over the long term, regardless of short-term market fluctuations.

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals, which mitigates the risk of market timing and reduces the impact of volatility.

- Automatic Investment Plans: Setting up automatic transfers to your investment accounts to maintain consistent contributions without manual intervention.

- Using Robo-Advisors: Leveraging automated platforms that create and manage diversified portfolios based on your risk preferences and goals, often with low fees.

Choosing Low-Cost Index Funds and ETFs

For beginners, low-cost index funds and exchange-traded funds (ETFs) are excellent investment options due to their diversification, transparency, and minimal management fees. These funds track specific market indices, such as the S&P 500, offering broad exposure with relatively simple investment strategies.

To select appropriate funds:

- Identify your investment goals and risk tolerance to determine the target index or sector.

- Compare expense ratios, which represent the annual fees charged by the fund. Opt for funds with the lowest fees to maximize returns over time.

- Assess the fund’s tracking error, which measures how closely it replicates the performance of its underlying index. A lower tracking error indicates more accurate tracking.

- Review fund size and liquidity; larger, well-established funds tend to offer better stability and ease of trading.

For example, a beginner may choose to invest in an S&P 500 ETF, such as the Vanguard S&P 500 ETF (VOO), which offers exposure to 500 of the largest U.S. companies with a low expense ratio. Regularly investing in such funds through dollar-cost averaging can help build wealth steadily while minimizing fees and risks associated with individual stock picking.

Choosing the Right Investment Platforms and Accounts

Selecting an appropriate investment platform and account type is a vital step for beginners to start their investment journey confidently. The right platform will provide ease of use, security, and suitable investment options aligned with your financial goals and experience level. Understanding the different types of accounts and evaluating various platforms can significantly enhance your investment experience and help you achieve your financial objectives efficiently.

Investment platforms serve as the gateway to the financial markets, offering various tools and services tailored to different investor needs. For beginners, choosing a platform that balances simplicity, cost-effectiveness, and educational resources is essential. This section explores common account types and compares popular platforms suitable for newcomers, along with criteria for selecting a dependable and user-friendly investment platform.

Types of Investment Accounts

Investment accounts come in various forms, each designed to cater to different investment goals, tax considerations, and user preferences. Understanding these account types helps beginners choose the one that best fits their financial situation and investment strategy.

- Brokerage Accounts: These are standard investment accounts offered by brokerage firms, allowing investors to buy and sell a wide range of assets such as stocks, bonds, ETFs, and mutual funds. They often provide extensive research tools and access to various markets. However, earnings may be subject to taxes, and there are typically no tax advantages associated with these accounts.

- Robo-Advisors: Automated investment platforms that rely on algorithms to manage your portfolio based on your risk tolerance and goals. They usually require minimal involvement, making them ideal for beginners. Robo-advisors often charge lower fees than traditional financial advisors and include automatic rebalancing and tax-loss harvesting functionalities.

- Retirement Accounts (e.g., IRA, Roth IRA): Designed specifically for retirement savings, these accounts offer tax advantages, such as tax-deferred growth or tax-free withdrawals, depending on the account type. They may have contribution limits and specific rules regarding withdrawals.

Comparison of Popular Platforms Suitable for Beginners

When selecting an investment platform, it’s crucial to evaluate factors such as ease of use, fees, available investment options, educational resources, and customer support. Below is a comparison table of some well-known platforms catering to beginner investors:

| Platform | Account Types | Fees | Ease of Use | Investment Options | Educational Resources |

|---|---|---|---|---|---|

| Robinhood | Brokerage | No commission on trades; optional margin and premium services may incur fees | High – User-friendly interface suitable for beginners | Stocks, ETFs, options, cryptocurrencies | Basic tutorials, articles, and in-app guidance |

| Betterment | Robo-advisor | Annual management fee of around 0.25% – 0.40% | High – Automated platform with simple onboarding | ETFs across various asset classes | Extensive educational content and financial planning tools |

| Vanguard | Brokerage, Retirement accounts | Account minimums vary; low expense ratios on funds | Moderate – Slightly more complex but user-friendly | Stocks, bonds, ETFs, mutual funds, retirement accounts | Comprehensive investment education and tools |

| Fidelity | Brokerage, Retirement, Robo-advisor | Commission-free ETFs, low fees on funds | High – Intuitive platform with helpful guidance | Wide range of investment options | Robust educational resources and research tools |

Criteria for Selecting a Reliable and User-Friendly Investment Platform

The choice of an investment platform should be based on several key criteria to ensure a secure, efficient, and supportive investing experience. Consider the following factors:

Security and Regulation: Ensure the platform is regulated by relevant authorities such as the SEC or FINRA, and employs robust security measures to protect your data and funds.

Fee Structure: Review all associated costs, including trading fees, management fees, and inactivity charges. Low or zero commissions are often preferred for beginners to minimize costs.

Ease of Use and User Interface: Look for a platform with an intuitive design, straightforward navigation, and clear instructions to facilitate learning and reduce mistakes.

Educational Resources and Customer Support: Availability of tutorials, FAQs, live support, and educational materials can significantly aid your understanding and confidence as a new investor.

Investment Options and Tools: Ensure the platform offers a variety of investment choices suitable for beginners and provides useful tools for research, analysis, and portfolio management.

Evaluating these aspects will help you select a platform that not only meets your current needs but also supports your growth as an investor while ensuring your financial security and comfort in managing your investments.

Step-by-Step Guide to Making Your First Investment

Embarking on your investment journey can seem daunting at first, but breaking it down into clear, manageable steps can make the process straightforward and less intimidating. This guide provides a detailed pathway for beginners to confidently make their initial investment, ensuring a secure and informed start to building wealth through investing.

From opening your investment account to executing your first trade, understanding each phase is essential. Proper research, secure procedures, and strategic planning form the foundation of successful investing. Let’s explore each step involved in making your first investment with clarity and simplicity.

Opening an Investment Account

Establishing an investment account is the foundational step that enables you to buy and sell securities. The process involves selecting a suitable platform, completing necessary documentation, and verifying your identity to comply with financial regulations. Here is a detailed flowchart outlining the process:

| Step | Description |

|---|---|

| 1. Research Investment Platforms | Compare brokerage firms or online investment platforms based on fees, available investment options, customer support, and user reviews. |

| 2. Choose a Platform | Select a platform that aligns with your investment goals, budget, and preferred features. |

| 3. Complete Application | Fill out the application form with personal details, financial information, and investment objectives. |

| 4. Submit Identity Verification Documents | Provide necessary identification documents such as a passport, driver’s license, or national ID to comply with KYC (Know Your Customer) regulations. |

| 5. Wait for Account Approval | The platform reviews your application and documents, which may take a few business days. |

| 6. Fund Your Account | Link your bank account and deposit funds into your investment account, ensuring sufficient balance for your planned initial investments. |

| 7. Confirm and Access Your Account | Receive confirmation of account setup and gain access to your dashboard to begin investing. |

Having a clear and stepwise approach ensures a smooth account opening experience. It also encourages careful selection of a reliable platform that meets your needs for security, ease of use, and cost-effectiveness.

Researching and Selecting Initial Investments

Choosing the right initial investments is crucial for setting a solid foundation for your portfolio. Adequate research helps you understand potential risks and returns, aligning your choices with your financial goals and risk tolerance. Here are key considerations and steps for conducting research and selecting investments:

- Identify Investment Types: Explore options such as stocks, bonds, mutual funds, ETFs, or index funds. Each offers different risk levels and growth potentials.

- Analyze Market Trends: Review recent performance data, economic indicators, and industry outlooks to identify sectors with growth potential.

- Assess Company Fundamentals: For stocks, evaluate financial statements, earnings, debt levels, and competitive advantages using reputable financial news and analysis platforms.

- Review Fund Performance: When choosing mutual funds or ETFs, examine historical returns, expense ratios, and fund manager reputation.

- Diversify Your Selections: Spread investments across different asset classes and sectors to mitigate risk and enhance potential stability.

Utilize credible sources such as official financial data platforms, reputable news outlets, and analysis tools. Remember to compare options, consider your risk appetite, and align investments with your predefined goals. Starting with a diversified, well-researched selection minimizes the risk of significant losses and sets the stage for informed investment decisions.

Executing Your First Trade Securely

Placing your first trade involves careful steps to ensure security, accuracy, and compliance. Proper execution reduces errors and helps protect your financial information. Follow this detailed procedure for a successful first transaction:

- Log into Your Account: Use secure login credentials, and enable two-factor authentication if available, to safeguard your account access.

- Review Your Investment Choice: Double-check the investment instrument, quantity, and current price before proceeding.

- Set Your Trade Parameters: Decide whether to place a market order (executed immediately at current market prices) or a limit order (executed only when the price reaches a specified level).

- Confirm Transaction Details: Carefully verify all information, including the security symbol, number of shares or units, and order type.

- Execute the Trade: Submit your order through the platform, ensuring that your internet connection is secure to prevent unauthorized access or interference.

- Record the Transaction: Save confirmation details, including the transaction ID, date, time, and trade specifics for future reference.

- Monitor Your Investment: Track the performance of your first investment via your account dashboard, and stay updated with market news related to your holdings.

“Always execute trades through secure, trusted platforms, and avoid sharing sensitive login details to prevent unauthorized access.”

Through these steps, you establish a disciplined approach to investing while safeguarding your assets. Over time, gaining confidence and familiarity with the process will help you make more complex and strategic investment decisions.

Risk Management and Avoiding Common Mistakes

Managing risk is a fundamental aspect of successful investing, especially for beginners who are navigating unfamiliar territory. Implementing effective risk management strategies helps protect your investments from significant losses and builds confidence over time. Equally important is understanding common pitfalls that can undermine your investment journey, enabling you to avoid costly errors. Regularly monitoring your investments and making informed adjustments are essential practices to ensure your portfolio remains aligned with your financial goals and risk tolerance.

Strategies for Managing Risk as a Beginner Investor

Effective risk management involves a combination of techniques designed to minimize potential losses while maximizing growth opportunities. As a beginner, adopting these strategies can foster a disciplined approach to investing:

- Diversification: Spreading investments across various asset classes, sectors, and geographic regions reduces exposure to any single source of risk. For example, combining stocks, bonds, and real estate can help cushion the impact of poor performance in one area.

- Asset Allocation: Adjusting the proportions of different investment types based on your risk tolerance and time horizon ensures a balanced portfolio. Typically, younger investors may allocate more towards equities for growth, while those nearing retirement might favor bonds for stability.

- Use of Stop-Loss Orders: Setting predefined exit points for specific investments can limit potential losses. For instance, placing a stop-loss order at 10% below the purchase price automatically sells the asset if it declines by that amount.

- Regular Portfolio Rebalancing: Periodically reviewing and adjusting your investments to maintain your desired asset allocation helps manage risk as market values fluctuate over time.

- Investing with a Long-Term Perspective: Avoid reacting to short-term market volatility by focusing on your long-term goals. Patience and discipline often lead to better outcomes than attempting to time the market.

Common Pitfalls to Avoid

Awareness of typical mistakes can significantly enhance your investment experience. Learning from these pitfalls helps safeguard your capital and promotes sustainable growth:

New investors often fall into traps that can hinder their progress. Recognizing and avoiding these mistakes is crucial:

- Overconcentration in a Single Asset or Sector: Putting too much money into one stock, sector, or asset class increases risk. For example, heavily investing in a single technology company exposes you to sector-specific downturns.

- Chasing Recent Performance: Buying assets solely because they have recently performed well can lead to buying high and selling low. Historical data shows that hot stocks often underperform in the subsequent months.

- Timing the Market: Attempting to predict market highs and lows is exceedingly difficult, even for professionals. Staying invested and practicing dollar-cost averaging is a more reliable approach.

- Neglecting Due Diligence: Failing to research investments thoroughly can lead to poor choices. Relying solely on tips or hearsay without understanding the fundamentals increases the risk of losses.

- Ignoring Fees and Costs: High transaction fees, management expenses, and fund loads can erode returns. Opt for low-cost index funds or ETFs where appropriate.

Monitoring and Adjusting Investments Over Time

Continuous oversight of your investment portfolio is vital to adapt to changing market conditions and personal circumstances. Implementing systematic review processes helps maintain alignment with your goals:

- Set Regular Review Periods: Schedule reviews monthly, quarterly, or semi-annually to evaluate performance, re-assess risk tolerance, and ensure your investments meet your objectives.

- Track Performance Against Benchmarks: Compare your portfolio’s returns with relevant indices to gauge effectiveness. For example, compare stock investments to the S&P 500 or a bond portfolio to the Barclays Aggregate Bond Index.

- Rebalance When Necessary: If certain assets have grown disproportionately, rebalance by selling some of the outperforming investments and reallocating funds to underperformers to maintain your target asset allocation.

- Stay Informed on Market Developments: Keep up with economic news, interest rate changes, and geopolitical events that could impact your investments.

- Adjust Based on Life Changes: Major life events such as marriage, childbirth, or a change in income may necessitate revisiting your investment strategy and risk profile.

Effective risk management involves balancing potential rewards with mitigation strategies, avoiding common errors, and maintaining vigilance through regular review and adjustment of your portfolio.

Education Resources and Continuing Learning

Embarking on your investment journey as a beginner requires a commitment to ongoing education and staying informed about market developments. Access to reliable resources and continuous learning are essential to building confidence and making informed decisions that align with your financial goals.

By leveraging a variety of educational materials, online platforms, and market updates, new investors can deepen their understanding of investment strategies, adapt to changing market conditions, and develop the skills necessary for long-term success. Developing disciplined habits for tracking your investment performance and learning from your experiences will further enhance your financial growth and resilience.

Recommended Books, Websites, and Online Courses for Beginners

Access to quality educational resources provides foundational knowledge and practical insights into investing. Below is a curated list of books, websites, and online courses suitable for individuals starting with little or no experience:

- Books:

- The Little Book of Common Sense Investing by John C. Bogle — Offers straightforward advice on index investing and the importance of low-cost, passive investment strategies.

- Invested by Danielle and Phil Town — Provides practical guidance on value investing and developing an investor mindset.

- The Simple Path to Wealth by JL Collins — Focuses on saving, investing, and achieving financial independence using simple, effective principles.

- Websites:

- Investopedia — A comprehensive resource for investing terms, strategies, and market news with beginner-friendly explanations.

- Morningstar — Offers investment research, mutual fund analysis, and portfolio tracking tools.

- Kiplinger — Provides financial advice, investment tips, and updates on market trends tailored for individual investors.

- Online Courses:

- Coursera — Courses like “Introduction to Finance and Accounting” or “Investment Management” offered by top universities.

- Udemy — Offers beginner courses such as “Stock Market Investing for Beginners” that include practical tutorials and case studies.

- edX — Provides courses like “Finance for Everyone” and “Personal Finance Essentials” for foundational knowledge.

Staying Updated with Market Trends and Investment News

Keeping abreast of market trends and current news is critical for making informed investment decisions. Constantly evolving financial environments require investors to be proactive in monitoring relevant developments that could impact their portfolios. Reliable sources and disciplined habits are key components of staying well-informed:

- Subscribe to reputable financial news outlets such as Bloomberg, CNBC, and Reuters for timely updates on market movements, economic indicators, and geopolitical factors that influence investments.

- Follow industry experts and analysts on social media platforms like Twitter and LinkedIn to gain diverse perspectives and real-time insights.

- Join investment forums and online communities such as Bogleheads or Reddit’s r/investing to exchange ideas, ask questions, and learn from experienced investors.

- Utilize mobile apps and newsletters that compile daily or weekly summaries of market news, helping you to stay informed without feeling overwhelmed.

Tracking Investment Performance and Learning from Experience

Developing a systematic approach to tracking your investment performance enables you to evaluate progress, identify patterns, and refine your strategies over time. Consistent review and reflection on your investment activities foster a learning environment that benefits your financial growth:

- Maintain a detailed investment journal or spreadsheet, recording purchase dates, purchase prices, current values, and dividend or interest income.

- Set periodic review intervals—monthly or quarterly—and compare actual performance against your initial goals and benchmarks.

- Analyze your winners and losers to understand the reasons behind their performance. Recognize whether your decisions were influenced by market trends, personal biases, or external factors.

- Identify lessons learned from both successful and unsuccessful investments to improve future decision-making processes.

- Leverage online portfolio tracking tools provided by brokerage platforms or independent apps to automate updates and simplify performance monitoring.

“The best investment you can make is in yourself—your knowledge, skills, and resilience.”

Regularly reflecting on your investment journey, adapting your strategies based on experience, and committing to continuous education will significantly contribute to your long-term financial success.

Final Review

Embarking on your investment journey as a beginner with no experience is a significant step toward achieving financial independence. By understanding key concepts, setting realistic goals, choosing suitable platforms, and continuously educating yourself, you can develop a resilient and rewarding investment strategy. Remember, consistent learning and prudent decision-making are the pillars of long-term success in investing.