Understanding how to invest for retirement if self employed is essential for ensuring a financially stable future. Unlike traditional employees, self-employed individuals face unique challenges and opportunities in planning their retirement savings. Early and strategic planning can significantly enhance financial security, allowing self-employed workers to achieve their lifestyle goals without reliance on employer-sponsored programs.

This guide explores various retirement account options tailored for self-employed individuals, effective strategies for setting goals, and practical tips for maximizing savings. By comprehensively addressing tax benefits, investment choices, and planning approaches, it empowers self-employed persons to make informed decisions and build a robust retirement plan.

Overview of Retirement Planning for Self-Employed Individuals

Retirement planning is a critical aspect of financial stability for self-employed individuals, who do not benefit from employer-sponsored retirement schemes. Unlike conventional employees, self-employed persons bear the full responsibility of establishing and maintaining their retirement savings, making early and strategic planning essential. Without proper preparation, these individuals may face financial insecurity during their retirement years, emphasizing the importance of proactive measures.

Self-employed workers encounter unique challenges when saving for retirement, including irregular income streams, limited access to group insurance plans, and fluctuating cash flow. These factors necessitate tailored strategies to ensure consistent savings and adequate coverage. Recognizing these challenges and understanding available retirement options empowers self-employed individuals to make informed decisions and secure a comfortable future.

Unique Challenges Faced by Self-Employed Persons in Saving for Retirement

Self-employed individuals often operate with unpredictable income levels that can hinder consistent contributions to retirement accounts. This variability makes it difficult to set aside fixed amounts regularly, potentially delaying accumulation of sufficient funds. Additionally, the absence of employer-sponsored retirement plans means they must independently establish and manage their savings vehicles, which can involve complex decisions and administrative responsibilities.

Moreover, self-employed persons frequently lack access to employer-based health benefits, increasing the need for separate health coverage and increasing overall expenses. The lack of a safety net can lead to prioritization of immediate financial needs over long-term retirement savings, especially during lean periods. Limited financial literacy or awareness about suitable retirement vehicles may further complicate effective planning, underscoring the importance of education and professional guidance.

Comparison Table of Retirement Options Suited for Self-Employed Individuals

Understanding the distinct features, benefits, and limitations of various retirement options enables self-employed persons to select those most aligned with their financial goals and circumstances. The following table provides an overview of common retirement savings vehicles suitable for self-employed individuals:

| Retirement Option | Key Features | Contribution Limits | Tax Advantages | Suitability |

|---|---|---|---|---|

| Solo 401(k) | High contribution limits, allows both salary deferrals and profit sharing | Up to $66,000 for 2023 (including catch-up contributions) | Pre-tax contributions reduce taxable income; earnings grow tax-deferred | |

| Simplified Employee Pension (SEP) IRA | Easy to establish, flexible contributions based on income | Up to 25% of net earnings, maximum $66,000 for 2023 | Contributions are tax-deductible; earnings grow tax-deferred | |

| Savings Incentive Match Plan for Employees (SIMPLE) IRA | Designed for small businesses, easy to administer | Employee contributions up to $15,500 for 2023; employer match required | Contributions are tax-deductible; earnings grow tax-deferred | |

| Traditional IRA | Widely accessible, flexible investment options | Up to $6,500 for 2023 (additional $1,000 catch-up for age 50+) | Tax-deductible contributions depending on income and participation in other plans | Suitable for supplementary retirement savings |

| Roth IRA | Contributions made with after-tax dollars, qualified withdrawals are tax-free | Same as traditional IRA; income limits apply | No immediate tax deduction; tax-free growth and withdrawals |

“Choosing the right retirement vehicle depends on income stability, savings capacity, and long-term financial objectives. Combining multiple options can optimize retirement outcomes for self-employed individuals.”

Types of Retirement Accounts for Self-Employed Workers

For self-employed individuals, selecting the appropriate retirement account is a crucial step toward securing financial stability in later years. The right account not only helps in long-term wealth accumulation but also offers specific tax advantages tailored to the unique needs of self-employed workers. Understanding the various options available allows self-employed individuals to make informed decisions that align with their income levels, business goals, and retirement timelines.

In this section, we will explore the primary retirement account options available to self-employed workers, including SEP IRA, Solo 401(k), SIMPLE IRA, and Traditional IRA. Each account type has distinct features, contribution limits, and tax benefits, making it essential to understand their advantages and disadvantages to optimize retirement planning strategies.

Retirement Account Options for Self-Employed Individuals

Self-employed workers have several retirement savings vehicles to choose from, each suited to different income levels, business structures, and saving preferences. Below is a comprehensive comparison of these options, highlighting their key features, contribution limits, tax advantages, and eligibility criteria.

| Account Type | Features | Contribution Limits (2023) | Tax Advantages | Eligibility |

|---|---|---|---|---|

| SEP IRA | Simplified Employee Pension Individual Retirement Account allowing employer contributions. Easy to set up and maintain. | Up to 25% of net earnings or a maximum of $66,000, whichever is less. | Contributions are tax-deductible; investments grow tax-deferred until withdrawal. | |

| Solo 401(k) | Designed for self-employed individuals with no employees other than a spouse. Offers higher contribution flexibility. | Employee contribution up to $22,500 (2023), plus employer contribution up to 25% of net earnings, total not exceeding $66,000. | Both employee and employer contributions are tax-deductible; gains grow tax-deferred. | |

| SIMPLE IRA | Designed for small businesses and self-employed persons seeking straightforward administration. | Employee contribution limit of $15,500 (2023), with a catch-up contribution of $3,500 for those aged 50+; employer matches up to 3% or a 2% fixed contribution. | Contributions are tax-deductible; investments grow tax-deferred. | |

| Traditional IRA | Provides flexibility for individuals to contribute independently of business structure. | Up to $6,500 (2023), with a $1,000 catch-up contribution for those aged 50+. | Contributions may be tax-deductible depending on income and participation in other retirement plans; earnings grow tax-deferred. |

Advantages and Disadvantages of Each Account Type

Choosing the most suitable retirement account involves weighing the benefits against potential limitations. Here are the key advantages and disadvantages of each option:

- SEP IRA

- Advantages:

- High contribution limits, allowing substantial tax-deferred growth.

- Simple to set up and maintain with minimal administrative costs.

- Flexible contributions; contributions are not mandatory every year.

- Disadvantages:

- Employer-only contributions; self-employed individuals cannot contribute as employees.

- Contribution percentage must be uniform for all eligible employees if applicable.

- Lower contribution limits compared to Solo 401(k) for some income levels.

- Solo 401(k)

- Advantages:

- High contribution limits combining employee and employer contributions.

- Loan options available in some plans.

- Flexibility to choose traditional or Roth options.

- Disadvantages:

- More complex to administer than SEP IRAs.

- Requires annual filings if assets exceed $250,000.

- Not suitable if hiring employees beyond a spouse.

- SIMPLE IRA

- Advantages:

- Easy to set up and administer with lower costs.

- Employer contributions are straightforward and fixed.

- Good for small businesses or sole proprietors with modest income.

- Disadvantages:

- Lower contribution limits compared to SEP IRA and Solo 401(k).

- Employer must contribute annually if participating.

- Less flexibility in contribution amounts.

- Traditional IRA

- Advantages:

- Widely accessible and simple to establish.

- Offers tax deductions depending on income and other retirement plans.

- Flexible investment options.

- Disadvantages:

- Lower contribution limits may restrict savings growth.

- Income limits may affect deductibility of contributions.

- Requires careful planning to maximize tax benefits.

Setting Retirement Goals and Budgeting

Establishing clear retirement goals and creating a disciplined budget are crucial steps for self-employed individuals aiming for a secure financial future. By systematically determining your target savings and understanding your future expenses, you can develop a tailored plan that aligns with your income, lifestyle aspirations, and time horizon. This proactive approach ensures that your retirement planning remains focused, achievable, and adaptable to changing circumstances.

Accurately assessing your retirement needs involves evaluating various factors, including your current age, income level, expected inflation rates, and lifestyle preferences. Developing a personalized savings plan requires careful calculation of how much you need to save periodically to reach your goals. Incorporating future expense estimates and inflation adjustments helps maintain the real value of your savings, allowing you to build a resilient financial strategy that supports your desired retirement lifestyle.

Calculating Retirement Savings Goals

Determining a realistic retirement savings goal involves a series of steps that account for your current situation and future aspirations. The process typically begins with estimating your desired annual income in retirement, which often ranges from 70% to 80% of your current earnings, adjusted for your planned lifestyle. Your age at retirement influences the number of years remaining to save, shaping the total amount needed.

Additionally, your expected Social Security or other income sources should be factored in to reduce the required savings target.

To calculate the total retirement savings goal, consider the following formula:

Total Savings Needed = (Annual Retirement Expenses – Expected Income) × Retirement Duration

For example, if you plan to retire at age 65 with annual expenses of $50,000, expecting $15,000 annually from Social Security, and anticipate living for 20 years in retirement, your target savings would be calculated as follows:

($50,000 – $15,000) × 20 years = $700,000

This estimate provides a baseline, which can be refined by considering inflation and investment growth over time.

Developing a Personalized Savings Plan

Creating an effective savings plan involves organized steps that align your income with your retirement goals, ensuring consistent progress. The following steps serve as a framework for developing a customized strategy:

- Assess your current income, expenses, and savings capacity to understand how much you can allocate toward retirement each month.

- Determine your target retirement date, which influences the amount you need to save annually to meet your goal.

- Calculate the future value of your current savings and projected contributions, considering expected rate of return on investments.

- Establish monthly or annual savings targets based on the gap between your current savings and the projected amount needed at retirement.

- Automate contributions to your retirement accounts to promote consistency and discipline in savings habits.

- Regularly review and adjust your plan to reflect changes in income, expenses, or life circumstances, ensuring ongoing alignment with your goals.

Implementing a structured approach ensures that your savings plan remains manageable and adaptable. Using tools like financial calculators or consulting with a financial advisor can enhance accuracy and provide personalized insights. Additionally, incorporating a buffer for unexpected expenses or market fluctuations helps safeguard your retirement plan against unforeseen challenges.

Estimating Future Expenses and Inflation Adjustment

Forecasting future expenses requires a comprehensive understanding of how costs evolve over time, particularly considering inflation’s impact. Typically, inflation causes the price of goods and services to increase annually, eroding the purchasing power of your savings if not properly accounted for. Therefore, accurate estimations must include adjustments for inflation to ensure your retirement fund remains sufficient to cover future expenses.

To estimate future expenses:

- Identify current expenses, such as housing, healthcare, food, transportation, and leisure activities.

- Estimate the inflation rate based on historical data or economic forecasts; a common long-term assumption is around 2-3% annually.

- Project each expense category into the future by applying the inflation rate over the number of years until retirement. This can be calculated using the formula:

Future Cost = Current Cost × (1 + Inflation Rate)Number of Years

- Sum these inflated costs to determine the total projected expenses at retirement.

For example, if current healthcare expenses are $5,000 annually and the inflation rate is 3%, in 20 years, the projected cost would be:

$5,000 × (1 + 0.03)20 ≈ $9,030

Incorporating inflation adjustments into your budgeting process ensures that your retirement savings plan remains realistic and capable of supporting your lifestyle throughout your retirement years.

Strategies for Saving and Investing for Retirement

Developing effective strategies for saving and investing is essential for self-employed individuals aiming to secure a comfortable retirement. Maximizing contributions, diversifying investment options, and understanding the nuances of each asset class can significantly enhance retirement preparedness. Implementing these strategies requires a disciplined approach tailored to individual income levels, risk tolerance, and long-term goals.

By adopting strategic saving habits and choosing appropriate investment vehicles, self-employed workers can optimize their retirement funds, leverage tax advantages, and build a resilient portfolio capable of weathering market fluctuations. The following detailed methods and comparisons will aid in constructing a robust retirement investment strategy.

Maximizing Contributions to Retirement Accounts

To accelerate retirement savings, self-employed individuals should aim to contribute the maximum allowable amounts to their chosen accounts annually. This involves understanding the annual contribution limits set by tax authorities, which often increase periodically to account for inflation. For example, in the United States, the contribution limit for a Solo 401(k) in 2024 is $66,000, including employee deferrals and employer contributions, or 100% of earned income, whichever is less.

Strategies to maximize contributions include setting up automatic contributions aligned with income inflows, regularly reviewing and adjusting contribution levels in response to income changes, and taking advantage of catch-up contributions if over age 50. Additionally, leveraging tax deductions and credits associated with these accounts enhances the overall savings efficiency.

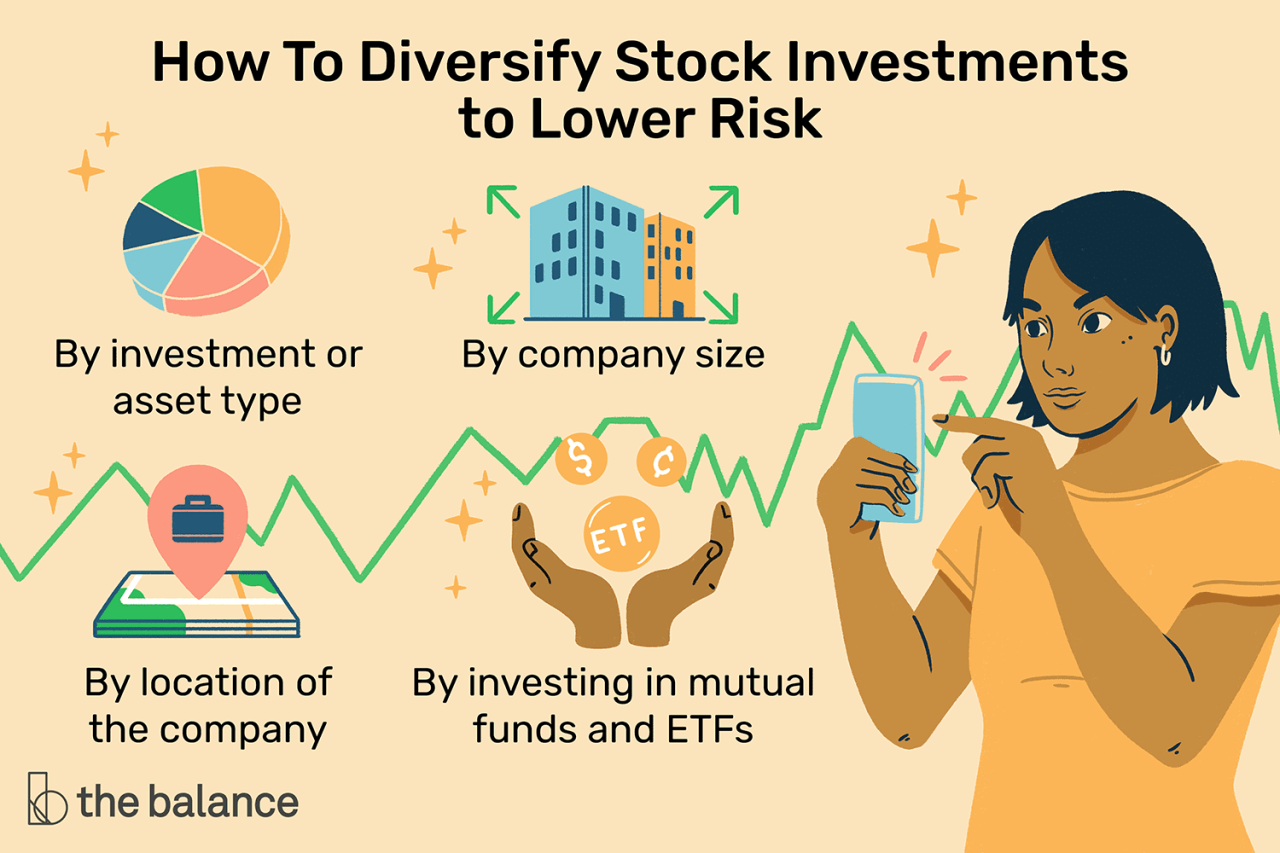

Diversifying Investment Options for Retirement Portfolios

A well-balanced retirement portfolio benefits from diversification across various asset classes, which mitigates risk and enhances potential returns. Self-employed investors should consider a mix of stocks, bonds, mutual funds, and exchange-traded funds (ETFs) aligned with their risk appetite and investment horizon. Each asset class offers distinct advantages and considerations, making diversification a key component of a resilient retirement plan.

Stocks provide growth potential but come with higher volatility, while bonds offer stability and income generation. Mutual funds pool investor money to invest across multiple securities, providing instant diversification, whereas ETFs offer similar diversification with the flexibility of trading throughout the day, often at lower costs.

Comparison Table of Investment Options

| Investment Type | Risk Level | Expected Returns | Liquidity |

|---|---|---|---|

| Stocks | High | 8-12% annually over long term | High; can be sold during market hours |

| Bonds | Low to Moderate | 3-5% annually | Moderate; varies with bond type, generally liquid |

| Mutual Funds | Moderate | 6-10% annually, depending on fund type | Moderate to high; redemption times vary |

| ETFs | Moderate to High | Similar to stocks and mutual funds, varies by ETF | High; traded like stocks during market hours |

Note: Higher risk investments, such as stocks, tend to offer higher returns but require a longer investment horizon and tolerating volatility. Conversely, bonds provide stability but usually yield lower returns, making them suitable for conservative investors nearing retirement.

Tax Implications and Benefits of Retirement Contributions

Understanding the tax implications of various retirement accounts is crucial for self-employed individuals aiming to maximize their savings while minimizing tax liabilities. Effective tax planning can significantly enhance the growth potential of your retirement funds by leveraging available tax advantages.

Each retirement account type offers distinct tax benefits, influencing how contributions are made, taxed, and withdrawn. Recognizing these differences enables self-employed workers to select the most appropriate strategies aligned with their financial goals and current tax situation.

Tax Advantages of Retirement Account Types for Self-Employed Individuals

Self-employed individuals have access to a variety of retirement accounts, each with unique tax benefits. These advantages can reduce current taxable income, provide tax-deferred growth, or allow for tax-free withdrawals depending on the account type.

Below is an overview of the primary retirement accounts and their associated tax benefits:

| Retirement Account | Tax Benefit | Key Features |

|---|---|---|

| Traditional IRA | Potential deduction for contributions, tax-deferred growth | Contributions may be deductible depending on income and participation in other retirement plans; taxes paid upon withdrawal |

| Solo 401(k) | Higher contribution limits; deductible contributions; tax-deferred growth | Allows for both employee and employer contributions, maximizing retirement savings with immediate tax advantages |

| SIMPLE IRA | Immediate tax deduction; tax-deferred growth | Designed for small businesses and self-employed workers; contributions are tax-deductible |

| Roth IRA | Contributions are made with after-tax dollars; qualified withdrawals are tax-free | Contributions are not deductible, but earnings grow tax-free and withdrawals are tax-free if rules are met |

| SEP IRA | Tax-deductible contributions; tax-deferred growth | Allows for substantial contributions, suitable for high-income self-employed individuals |

Procedures for Claiming Deductions and Reporting Contributions

Properly claiming deductions and accurately reporting your retirement contributions on tax forms is essential to benefiting from the tax advantages offered by these accounts. The process varies depending on the account type and your overall tax situation.

For traditional accounts such as the Traditional IRA, Solo 401(k), or SEP IRA, self-employed individuals typically claim deductions on their Schedule C or Schedule F, and report contributions on Form 1040.

- Maintain detailed records of all contributions made during the tax year, including receipts and bank statements.

- Ensure contributions do not exceed annual limits set by the IRS for each account type.

- For IRA contributions, report on Form 8606 if deductibility is partial or non-deductible contributions are made.

- Include total contributions on the appropriate lines of Form 1040, and attach schedules if necessary, such as Schedule 1 or Schedule C, depending on the account.

- Consult IRS Publication 590-A and 590-B for specific instructions and limits relevant to your retirement accounts.

Timely and accurate reporting ensures you maximize your tax benefits and remain compliant with IRS regulations, ultimately supporting your long-term retirement savings strategy.

Choosing a Financial Advisor or DIY Investment Approach

Deciding whether to work with a professional financial advisor or to manage your retirement investments independently is a critical step for self-employed individuals. Your choice impacts not only the management of your funds but also your peace of mind and ability to make informed investment decisions. Understanding the criteria for selecting the right advisor and exploring effective self-managing strategies can help you align your retirement planning with your personal goals, risk tolerance, and lifestyle.

Self-employed individuals often face unique challenges in retirement planning due to fluctuating income and limited access to traditional employer-sponsored plans. Whether opting for professional guidance or taking a do-it-yourself approach, making informed decisions is essential to building a secure financial future. This section provides insights into selecting a qualified financial advisor tailored to self-employed needs, as well as practical steps and tools for managing your investments independently.

Criteria for Selecting a Financial Advisor for Self-Employed Retirement Planning

Choosing the right financial advisor requires careful evaluation of their qualifications, experience, and approach to working with self-employed clients. Consider the following criteria to ensure your advisor aligns with your retirement goals:

- Certifications and Credentials: Look for credentials such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Registered Investment Advisor (RIA), which indicate professional competence and adherence to ethical standards.

- Specialization in Self-Employed Retirement Planning: Choose an advisor with experience and a track record in helping self-employed individuals, freelancers, or small business owners optimize their retirement strategies.

- Fee Structure Transparency: Understand whether they charge a flat fee, hourly rate, or a percentage of assets under management. Transparent fee structures help avoid conflicts of interest.

- Reputation and Reviews: Seek testimonials or references from other self-employed clients to gauge satisfaction and effectiveness.

- Communication Style and Accessibility: Ensure the advisor communicates clearly, is responsive, and is available for ongoing support, especially as your financial situation evolves.

- Alignment with Your Values and Goals: The advisor should understand your self-employment context and prioritize strategies that suit your income variability and retirement aspirations.

Steps for Self-Managing Investments

For those choosing to take control of their retirement investments, leveraging online tools and resources can empower effective decision-making. The process involves several steps to establish, monitor, and adjust your investment portfolio:

- Define Your Investment Goals and Risk Tolerance: Use online questionnaires and calculators to clarify your retirement timeline, desired income, and risk appetite.

- Select Appropriate Retirement Accounts: Open accounts such as a Solo 401(k), SEP IRA, or SIMPLE IRA, depending on your income level and business structure.

- Research Investment Options: Utilize reputable financial websites, ETFs, mutual funds, and stocks that align with your strategy. Tools like Morningstar or Vanguard’s platform offer detailed fund analyses.

- Construct a Diversified Portfolio: Balance equities, bonds, and alternative investments to match your risk profile, using online portfolio builders or robo-advisors for guidance.

- Automate Contributions and Rebalancing: Set up automatic transfers and periodic rebalancing schedules through your investment platform to maintain your desired asset allocation.

- Monitor Performance and Stay Informed: Regularly review account statements, market news, and updates from financial news outlets to stay abreast of changes that may impact your investments.

- Adjust Strategies as Needed: Reassess your goals annually or after significant life events, and modify your investment allocations accordingly.

Pros and Cons of Professional Guidance versus Self-Directed Investing

Understanding the advantages and limitations of each approach can help you make an informed decision aligned with your confidence, expertise, and circumstances.

Professional Guidance: Experts provide personalized strategies, ongoing management, and reassurance. They have access to comprehensive research and can help optimize tax efficiencies.

- Pros: Expert advice tailored to your specific situation, time-saving, access to sophisticated investment tools, and ongoing portfolio management.

- Cons: Higher costs due to advisory fees, potential conflicts of interest, and reliance on the advisor’s expertise and integrity.

Self-Directed Investing: Empowers you to take control, reduces management fees, and allows flexibility based on your knowledge and comfort level.

- Pros: Cost-effective, flexible decision-making, educational growth, and full control over investment choices.

- Cons: Requires substantial time commitment, financial literacy, and the risk of making uninformed decisions that can impact retirement outcomes.

Strategies to Maximize Retirement Savings As a Self-Employed Person

For self-employed individuals, optimizing retirement savings requires a proactive approach to leverage available opportunities, maintain disciplined investment habits, and regularly review financial progress. Employing effective strategies can significantly enhance the growth of your retirement fund, ensuring financial security in your later years.

Implementing these strategies involves a combination of increasing contribution limits, automating savings processes, maintaining diversified investment portfolios, and establishing a routine for reviewing and rebalancing your retirement holdings. These practices not only help maximize savings but also foster disciplined financial behavior essential for long-term success.

Maximizing Contribution Limits and Leveraging Tax Advantages

Maximizing the amount contributed to retirement accounts is fundamental in building a substantial nest egg. Self-employed individuals should be aware of specific contribution limits set annually by the IRS for various retirement accounts, such as SEP IRAs, Solo 401(k)s, and SIMPLE IRAs. Increasing contributions up to or near these limits can significantly boost retirement savings, particularly when combined with tax benefits that reduce taxable income.

Additionally, some accounts allow for catch-up contributions if you are aged 50 or older, providing an opportunity to accelerate savings as retirement approaches. Taking full advantage of these limits not only enhances savings but also offers immediate tax deductions, reducing current taxable income.

Automating Savings and Investment Contributions

Consistency in contributions is a key factor in long-term retirement planning. Setting up automatic transfers from your checking account to your retirement accounts ensures that savings happen regularly without requiring manual intervention. This automation minimizes the risk of missed contributions and helps maintain disciplined saving habits.

For self-employed individuals, establishing automatic transfers aligned with income receipt times can smooth out cash flow fluctuations, ensuring ongoing contributions regardless of variable income streams. Automating investments within these accounts can also facilitate dollar-cost averaging, which helps mitigate market volatility risk over time.

Diversifying Investments for Risk Management and Growth

Diversification across asset classes, such as stocks, bonds, real estate, and other securities, reduces risk and increases the potential for stable growth. Self-employed individuals should develop a diversified portfolio that aligns with their risk tolerance, investment horizon, and retirement goals.

Spreading investments across different sectors and geographic regions can protect against market downturns in any single area. Including a mix of growth-oriented and income-generating assets balances potential for capital appreciation with income stability, especially important as retirement nears.

Maintaining Discipline Through Regular Contributions and Behavior

Consistency is vital to maximizing retirement savings. Developing a habit of regular contributions, regardless of income fluctuations, ensures steady progress towards retirement goals. Setting specific, measurable savings targets and monitoring progress helps maintain motivation and discipline.

Utilizing tools like automatic contribution increases annually or when income increases can further enhance savings. Staying committed during market downturns by avoiding panic selling and maintaining a long-term perspective helps sustain progress in wealth accumulation.

Periodic Review and Rebalancing of Retirement Portfolio

Reviewing your retirement portfolio periodically—at least annually—ensures that your investment strategy remains aligned with your evolving goals, risk tolerance, and market conditions. Rebalancing involves adjusting your asset allocations to maintain your desired risk level, especially after significant market movements.

Rebalancing can be as simple as selling a portion of overperforming assets and reinvesting in underperforming ones to restore your target asset allocation. This disciplined approach prevents over-concentration in certain investments and helps optimize returns over the long term.

Additionally, a comprehensive review allows for reassessment of contribution levels, account beneficiaries, and the incorporation of new financial goals or life circumstances, ensuring your retirement plan remains robust and adaptable to change.

Common Mistakes and How to Avoid Them in Retirement Planning

Effective retirement planning requires careful attention to detail and awareness of common pitfalls that can jeopardize your financial security in later years. As a self-employed individual, understanding these errors and implementing strategies to prevent them is crucial for building a robust retirement nest egg. Awareness of potential mistakes and proactive measures can significantly enhance your ability to achieve your retirement goals and maintain financial independence.

Many self-employed workers encounter pitfalls such as underfunding their retirement accounts, neglecting to regularly review and adjust investment strategies, or failing to account for inflation’s impact over time. These errors can erode savings and reduce the purchasing power of your retirement funds. By recognizing these common mistakes early and adopting best practices, you can increase your chances of securing a comfortable retirement.

Underfunding Retirement Accounts

One of the most prevalent errors among self-employed individuals is not contributing enough to retirement accounts consistently. This often results from a lack of budgeting or underestimating future needs. Failing to contribute the maximum allowable amounts can significantly limit the growth potential of your retirement savings over time.

To avoid underfunding, establish a systematic savings plan that prioritizes retirement contributions as a non-negotiable expense. Regularly review your income and expenses to determine an affordable yet sufficient contribution rate. Utilizing automated transfers to your retirement accounts can help maintain consistent savings and prevent missed contributions during fluctuating income periods.

Neglecting to Review Investment Performance

Investment portfolios require ongoing monitoring to ensure they align with your retirement goals and risk tolerance. Many self-employed workers set their investments and forget to review their performance periodically, risking asset allocation drift or missed opportunities for rebalancing.

Implement a routine investment review schedule—at least annually—to evaluate the performance of your holdings. Use reputable investment tools or consult with financial professionals to assess whether adjustments are needed to optimize growth or reduce risk. Staying proactive helps ensure your portfolio remains aligned with your retirement timeline and market conditions.

Ignoring Inflation and Cost of Living Increases

Inflation gradually erodes the purchasing power of money, which can undermine your retirement savings if not properly addressed. Many individuals underestimate the impact of inflation on long-term savings, leading to underfunded retirement plans.

To safeguard against inflation, incorporate assets that historically outperform inflation, such as stocks or real estate, into your investment strategy. Additionally, consider inflation-adjusted annuities or savings vehicles that grow with inflation. Regularly recalculating your target retirement fund needs based on inflation projections ensures your savings goal remains realistic and adequate for future expenses.

Implementing Preventative Strategies

Proactively avoiding common mistakes involves disciplined planning and continuous education. Establishing clear, realistic retirement goals and maintaining consistent contributions are foundational practices. Regularly reviewing your investment performance and adjusting for inflation helps keep your plan aligned with your future needs.

Engaging in ongoing financial education is vital for staying informed about changing laws, tax benefits, and new investment options. Attending seminars, reading reputable financial publications, or consulting with qualified advisors can enhance your understanding and decision-making skills. Staying updated enables you to adapt your strategy to evolving market conditions and legislative changes, minimizing the risk of costly errors.

Final Thoughts

In conclusion, proactive retirement planning for self-employed individuals involves understanding available account options, setting clear goals, and adopting disciplined saving strategies. Staying informed about legal changes and avoiding common pitfalls can further enhance financial preparedness. With thoughtful planning and consistent effort, self-employed workers can confidently secure their retirement years and enjoy a comfortable future.