Investing in exchange-traded funds (ETFs) on a monthly basis offers a strategic approach to building wealth with discipline and consistency. This method appeals to investors seeking to mitigate market volatility while gradually growing their portfolios. By adopting a systematic investment plan, individuals can benefit from dollar-cost averaging, reducing the impact of market timing and enhancing long-term financial stability.

Understanding how to effectively select ETFs, establish automatic contribution plans, and employ sound diversification strategies is essential for maximizing the potential of monthly investments. This guide provides a comprehensive overview of these key elements to equip investors with the knowledge needed for successful ongoing ETF investments.

Introduction to Investing in ETFs Monthly

Exchange-Traded Funds (ETFs) have gained significant popularity among individual investors due to their flexibility, diversification, and cost-efficiency. ETFs are investment funds traded on stock exchanges, much like individual stocks, that hold a diversified portfolio of assets such as stocks, bonds, or commodities. Their accessibility and variety make them an appealing choice for a broad range of investors seeking to build wealth over time.

Investing in ETFs on a monthly basis offers several advantages that support long-term financial growth. This approach facilitates dollar-cost averaging, a strategy where investors purchase a fixed dollar amount of ETFs regularly, regardless of market conditions. Such a strategy helps mitigate the impact of market volatility and reduces the risk of making poorly timed investment decisions. Additionally, monthly investments foster disciplined saving habits and enable investors to steadily accumulate wealth over time, smoothing out market fluctuations.

Investor Profiles Suited for Monthly ETF Investments

Monthly ETF investing is especially suitable for individual investors who prioritize long-term growth, risk management, and consistent saving habits. These investors often include:

- Individuals planning for retirement or other long-term financial goals

- New investors seeking a disciplined and straightforward approach to investing

- Professionals with steady income streams who want to automate their investment process

- Investors interested in building wealth gradually without the need for active market timing

Such investors benefit from the reduced emotional bias and the systematic nature of monthly contributions, which can lead to more stable and predictable wealth accumulation over time. The simplicity and transparency of ETFs, combined with the regularity of monthly investments, make it an accessible and effective strategy for a wide range of individual investors aiming to grow their financial future systematically.

Choosing the Right ETFs for Monthly Investment

Selecting suitable ETFs for consistent monthly contributions is essential for building a diversified and resilient investment portfolio. The right choices can help investors achieve their financial goals while managing risk effectively. When investing monthly, it is important to focus on ETFs that offer stability, liquidity, and alignment with your investment objectives.

Investors should evaluate various factors such as expense ratios, liquidity, underlying assets, and sector exposure to ensure that their monthly investments are both efficient and aligned with their risk tolerance and financial plans. Carefully analyzing these criteria helps in constructing a sustainable and profitable investment strategy over time.

Criteria for Selecting ETFs Suitable for Monthly Contributions

To optimize monthly investments in ETFs, investors need to consider specific criteria that ensure consistent growth, liquidity, and cost-effectiveness. These factors play a crucial role in maintaining the flexibility and reliability of your investment plan.

- Expense Ratios: Lower expense ratios reduce the cost of holding ETFs, thus increasing net returns over time. Opt for ETFs with expense ratios below 0.50% for long-term investments.

- Liquidity: High trading volume and assets under management (AUM) facilitate ease of buying and selling without significant price impact. ETFs with daily trading volume above 1 million shares are generally considered liquid enough for monthly contributions.

- Underlying Assets: Diversified underlying assets, such as broad market indices or sectors, help mitigate risks and ensure stable growth. Look for ETFs that track well-established indices or sectors aligned with your investment goals.

- Tracking Error and Performance: ETFs that closely track their benchmark indices with minimal tracking error are preferred for consistent performance, especially when making regular monthly investments.

Comparison Table of Popular ETFs for Monthly Investment

Below is a comparison of well-known ETFs across different categories, highlighting their expense ratios, liquidity, and underlying assets. This can serve as a guide to identify suitable options for monthly contributions.

| ETF Category | Expense Ratio | Liquidity (Average Daily Volume) | Underlying Assets |

|---|---|---|---|

| Broad Market Index | 0.03% | Over 2 million shares | S&P 500 Index (e.g., SPY) |

| Technology Sector | 0.10% | Approximately 5 million shares | Technology companies within NASDAQ 100 (e.g., QQQ) |

| International Markets | 0.09% | Over 1 million shares | Developed markets outside US (e.g., EFA) |

| Emerging Markets | 0.18% | Approximately 600,000 shares | Emerging economies (e.g., VWO) |

Examples of Popular ETFs for Monthly Investment

Investors often choose ETFs that represent broad indices or specific sectors for their monthly investments. Some of the most popular options include:

- SPDR S&P 500 ETF Trust (SPY): This ETF tracks the S&P 500 index, providing exposure to 500 of the largest US companies. Its high liquidity and low expense ratio make it ideal for monthly investments focused on the US market.

- Invesco QQQ Trust (QQQ): Focused on the NASDAQ 100, QQQ offers exposure to leading technology and growth-oriented companies, suitable for investors seeking sector-specific growth.

- Vanguard FTSE Developed Markets ETF (VEA): This ETF provides diversified exposure to developed markets outside North America, supporting international investment strategies.

- Vanguard FTSE Emerging Markets ETF (VWO): For investors interested in emerging economies, VWO offers exposure to markets such as China, Brazil, and South Africa, with a balance of risk and growth potential.

Setting Up a Monthly Investment Plan

Establishing a systematic approach to investing in ETFs on a monthly basis is essential for building wealth over time and maintaining disciplined investing habits. By automating your investments, you reduce emotional decision-making and ensure consistent contributions towards your financial goals.

This process involves selecting a brokerage account that supports automatic transfers, outlining clear investment amounts, and setting up the necessary arrangements to execute these plans seamlessly each month. An organized plan not only facilitates regular investing but also allows for effective tracking and adjustment as your financial circumstances evolve.

Steps to Establish Automatic Investment Plans with Brokerage Accounts

To successfully set up an automatic ETF investment plan, follow these structured steps that streamline the process and ensure smooth transactions each month:

- Open a Brokerage Account Capable of Automatic Transfers: Select a reputable brokerage platform that offers automated investment features, including recurring transfers and scheduled purchases of ETFs. Ensure the platform provides user-friendly interfaces and reliable transaction processing.

- Link Your Bank Account: Connect your primary bank account to your brokerage account, which is necessary for transferring funds regularly. Verify the linkage to confirm seamless transfers and avoid delays.

- Determine the Fixed Investment Amount: Decide on a specific dollar amount to invest each month. Maintaining a fixed contribution schedule simplifies budgeting and reinforces disciplined investing habits. For example, investing $300 every month irrespective of market conditions can help average out purchase costs over time.

- Set Up Automatic Transfers and Purchase Schedules: Configure your brokerage account to automatically transfer the predetermined amount from your bank account on a specific date each month. Some platforms also allow you to set up automatic ETF purchases immediately following the transfer, streamlining the entire process.

- Review and Confirm Settings: Double-check the transfer and purchase details, including dates, amounts, and ETF tickers. Confirm the setup to activate the automatic investment plan.

- Monitor and Adjust as Needed: Regularly review your investment progress through your brokerage platform. If your financial situation changes, update your automatic transfer amounts or scheduling accordingly to stay aligned with your goals.

Checklist of Account Requirements and Documentation for Automatic Transfers

Ensuring you have all necessary documentation and meet account requirements is crucial before initiating automatic investments. A well-prepared setup minimizes delays and facilitates a smooth investment process:

| Requirement | Description |

|---|---|

| Valid Government-Issued ID | Driver’s license, passport, or state ID to verify your identity during account registration. |

| Bank Account Information | Routing number and account number for linking your bank and enabling transfers. |

| Proof of Address | Utility bill, bank statement, or official correspondence to validate your residence. |

| Tax Identification Number (TIN) or Social Security Number (SSN) | Required for tax reporting and to establish your identity with the brokerage. |

| Funding Source | Initial deposit or sufficient funds in your linked bank account for the first transfer. |

| Agreement and Consent Forms | Electronic or paper signatures authorizing automatic transfers and ETF purchases. |

“Consistent, automated investments help smooth out market volatility and foster disciplined saving habits, making them a cornerstone of successful ETF investing over the long term.”

Strategies for Effective Monthly ETF Investing

Implementing a disciplined and well-informed approach is essential for maximizing the benefits of monthly ETF investments. This involves adopting proven strategies that help mitigate risks, adapt to changing market conditions, and promote consistent growth. By understanding and applying these strategies, investors can enhance their long-term financial stability and achieve their investment objectives more effectively.

Effective monthly ETF investing requires a combination of systematic methods and disciplined practices. These strategies focus on reducing exposure to market volatility, maintaining flexibility in response to financial developments, and fostering a stable investment routine. Employing such techniques can help investors stay committed to their plans while optimizing returns over time.

Dollar-Cost Averaging to Reduce Timing Risks

One of the most widely recommended strategies for monthly ETF investing is dollar-cost averaging (DCA). DCA involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach minimizes the impact of market volatility by spreading out purchase points, thereby reducing the risk of buying at market peaks and missing opportunities during downturns.

For example, an investor contributing $300 each month to an ETF will purchase more shares when prices are low and fewer shares when prices are high. Over time, this can lead to a lower average purchase cost compared to lump-sum investing. DCA helps to smooth out the effects of market fluctuations, encouraging discipline and patience in long-term investing strategies.

Regular investments reduce the risks associated with market timing and help cultivate consistent growth over time.

Monitoring and Adjusting Investment Amounts

Continuous monitoring of your investment portfolio is crucial for ensuring alignment with your financial goals and adapting to market conditions. Regular reviews allow investors to evaluate whether their current contribution levels meet their objectives or require adjustments. Factors such as changes in income, expenses, or market performance should inform decisions to increase, reduce, or maintain investment amounts.

Market conditions can be unpredictable; during bullish phases, an investor might consider increasing monthly contributions when financially feasible. Conversely, in economic downturns, maintaining regular investments can still be beneficial, as lower prices may present buying opportunities. Adjustments should be made gradually and based on a clear understanding of your overall financial plan to avoid impulsive decisions.

Periodic review and adjustment of investment contributions ensure that your portfolio remains aligned with evolving financial circumstances and goals.

Best Practices for Maintaining Discipline and Consistency

Consistency and discipline are cornerstones of successful ETF investing. Establishing best practices can help investors stay on track, avoid emotional decision-making, and foster long-term growth. The following practices are recommended:

- Set specific, measurable financial goals and adhere to a planned contribution schedule.

- Automate monthly investments to eliminate the temptation of manual intervention and impulsive decisions.

- Maintain a diversified portfolio to mitigate risks associated with sector-specific downturns.

- Keep a disciplined approach by resisting the urge to time the market or make frequent changes based on short-term market movements.

- Regularly review investment performance and adjust contributions only after careful analysis and consideration of your overall financial plan.

- Stay informed about market trends and economic indicators without overreacting to daily fluctuations.

- Maintain an emergency fund separate from your investment portfolio to avoid the need to liquidate ETF holdings prematurely during unforeseen expenses.

Discipline and consistency are vital in overcoming market volatility and ensuring steady progress toward your financial goals.

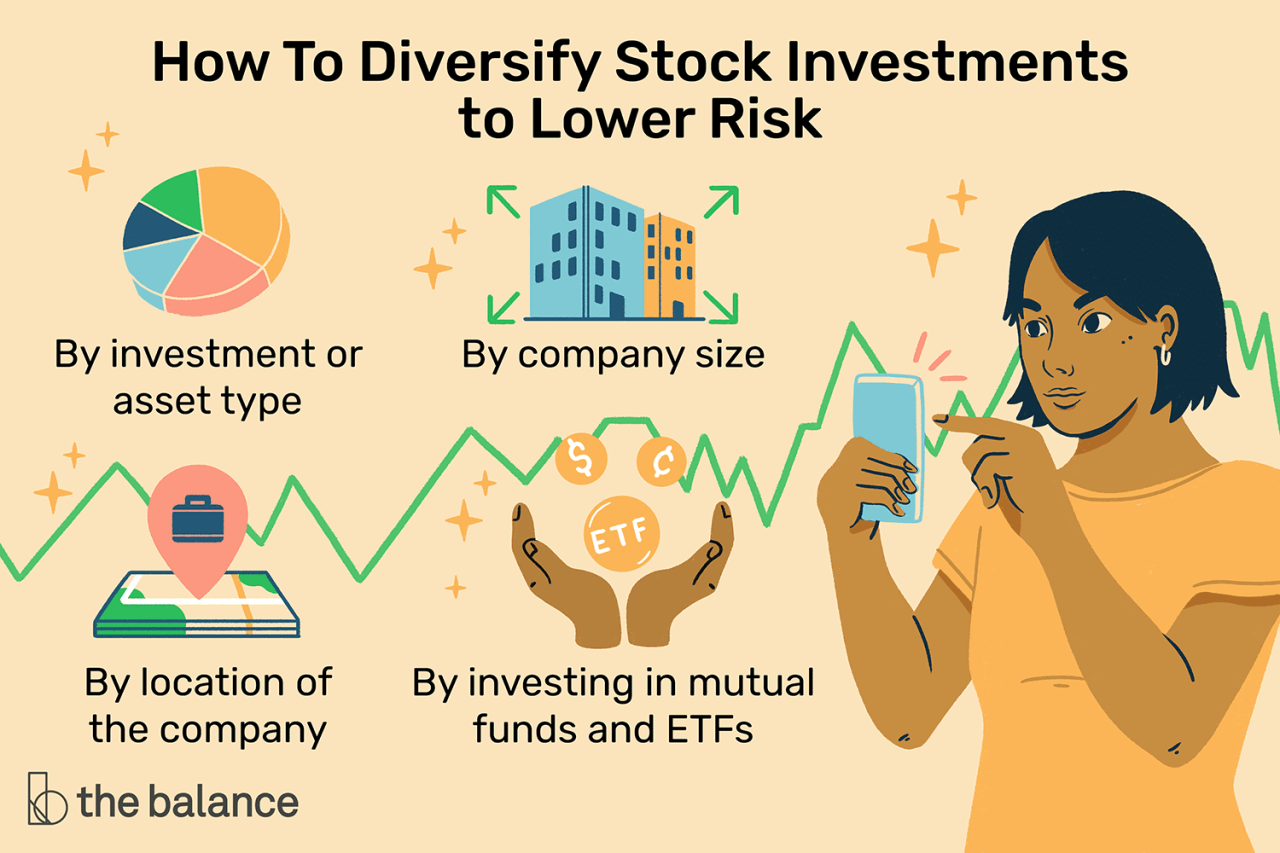

Managing Risks and Diversification

Consistent monthly investing in ETFs not only promotes disciplined savings but also plays a crucial role in managing investment risks through diversification. By spreading investments across various sectors and regions over time, investors can mitigate the impact of market volatility and sector-specific downturns.

Effective risk management relies on balancing portfolio allocations to ensure that no single sector or region disproportionately influences overall performance. This approach helps in building resilience against unforeseen economic shifts and ensures steady growth potential in the long term.

Diversification Strategies and Their Benefits

Implementing diversification strategies involves allocating investments across a variety of assets to reduce exposure to any single risk factor. The following table illustrates common diversification techniques, their specific approaches, and the benefits they provide to an ETF portfolio.

| Strategy | Approach | Benefits | Example |

|---|---|---|---|

| Sector Diversification | Investing in ETFs across different industry sectors such as technology, healthcare, finance, and consumer goods. | Reduces risk associated with sector-specific downturns; enhances growth opportunities across varied economic cycles. | Holding Technology ETF, Healthcare ETF, Financial ETF, Consumer Staples ETF in the same portfolio. |

| Regional Diversification | Allocating investments across geographically diverse markets like North America, Europe, Asia, and emerging markets. | Mitigates risks linked to regional economic or political instability; captures growth from different regions. | Including an S&P 500 ETF, European equity ETF, Asian market ETF, and Emerging Markets ETF. |

| Asset Class Diversification | Spreading investments among various asset classes such as equities, bonds, real estate, and commodities via ETFs. | Balances between growth and income; reduces volatility and provides a buffer during market downturns. | A combination of equity ETFs, bond ETFs, real estate investment trusts (REITs) ETFs, and commodity ETFs. |

| Market Cap Diversification | Investing in ETFs that target large-cap, mid-cap, and small-cap companies. | Ensures exposure to companies of different sizes, capturing growth opportunities across the spectrum. | Mixing large-cap ETF like a S&P 500 ETF with mid-cap and small-cap ETFs. |

Using these strategies diligently in a monthly investment plan allows investors to build a well-rounded portfolio. Regular investing ensures that over time, the average cost of purchasing ETFs aligns with market fluctuations, thereby reducing the risk of poor timing and enhancing long-term stability.

Tracking and Rebalancing Your Monthly ETF Portfolio

Maintaining a disciplined approach to tracking and rebalancing your ETF portfolio is essential for achieving your long-term financial goals. Regularly reviewing your investments ensures that your portfolio remains aligned with your evolving financial situation and market conditions. Proper rebalancing helps manage risk and optimize returns by maintaining the desired asset allocation over time.

Common Challenges and Solutions in Monthly ETF Investing

Investing in ETFs on a monthly basis offers numerous benefits, including dollar-cost averaging and disciplined investing. However, investors often encounter certain obstacles that can hinder their long-term success. Recognizing these challenges and understanding effective solutions is essential for maintaining a consistent and resilient investment approach.Market volatility, emotional reactions, and technical issues are among the most common hurdles faced by monthly ETF investors.

Overcoming these obstacles requires a combination of disciplined strategies, technological tools, and a clear understanding of investment principles. Addressing these challenges proactively can help investors stay focused on their long-term financial goals and avoid impulsive decisions that may undermine their investment plan.

Market Volatility and Its Impact on Monthly Investments

Market fluctuations are inherent to the investing landscape, especially in equities and sector-specific ETFs. During periods of high volatility, investors might feel tempted to alter their plan or withdraw investments prematurely. Such reactions can lead to poor timing and reduced long-term growth.To manage volatility effectively:

- Stick to a predetermined investment schedule regardless of short-term market movements.

- Maintain a diversified portfolio to cushion against sector-specific downturns.

- Utilize stop-loss or limit orders to protect investments from sudden drops.

- Focus on long-term trends rather than daily market noise, recognizing that markets tend to recover over time.

Overcoming Emotional Investing and Behavioral Biases

Emotional responses to market ups and downs can lead to impulsive decisions, such as panic selling during downturns or overbuying during rallies. These behaviors often contradict the disciplined approach necessary for successful long-term investing.Effective solutions include:

- Establishing and sticking to a clear investment plan that defines criteria for buying or selling.

- Regularly reviewing investment goals to reinforce commitment and reduce emotional influence.

- Using automated investment platforms to enforce discipline and eliminate impulsive actions.

- Practicing mindfulness and emotional awareness to recognize and control reactions driven by fear or greed.

Technical and Operational Challenges

Investors may encounter technical issues such as difficulties with online platforms, delayed transactions, or account management errors. These can disrupt the regularity of monthly investments and create frustration.To mitigate technical challenges:

- Choose reputable and user-friendly investment platforms with robust customer support.

- Regularly update account information and ensure the platform’s software is current.

- Set up automatic contributions where possible to maintain consistency despite technical glitches.

- Keep records of transactions and communications to resolve issues promptly.

Tips for Maintaining Long-Term Discipline

Long-term success in monthly ETF investing hinges on discipline and consistency. The following tips can help investors stay committed to their strategy through market fluctuations and changing circumstances:

- Define clear, achievable investment goals aligned with your financial timeline and risk tolerance.

- Automate contributions to reduce the temptation to alter schedules based on emotions or market conditions.

- Review your portfolio periodically but avoid overreacting to short-term market movements.

- Maintain a diversified portfolio to spread risk and reduce the impact of any single market event.

- Stay informed through reputable sources to understand market trends without becoming overwhelmed.

- Remember that investing is a marathon, not a sprint—patience and persistence are key.

- Seek professional advice if uncertain about portfolio adjustments or risk management strategies.

Final Conclusion

In summary, adopting a disciplined monthly investment routine in ETFs can significantly enhance your financial growth while managing risks effectively. By making informed choices, setting up automated plans, and maintaining ongoing portfolio review, you can build a resilient investment strategy that adapts to changing market conditions. Consistency and strategic management are the cornerstones of long-term success in ETF investing.