Understanding how to invest in stocks for retirement savings is essential for building a secure financial future. Stocks offer potential for long-term growth, making them a vital component of a comprehensive retirement plan. By making informed choices and strategic investments, individuals can maximize their savings and achieve their retirement goals.

This guide explores the fundamental principles of stock investing for retirement, different account options, strategies for selecting suitable stocks and funds, and best practices for monitoring and managing investments over time. It aims to equip you with the knowledge needed to make confident decisions that support a comfortable retirement.

Overview of investing in stocks for retirement savings

Investing in stocks remains one of the most effective strategies for building wealth over the long term, especially when planning for retirement. Stocks offer the potential for significant growth, which can outpace inflation and help ensure financial stability in later years. Understanding their role and how they compare to other investment options is essential for making informed decisions that align with retirement goals.

Stocks represent ownership in companies, allowing investors to participate in their growth and earnings. For retirement savings, stocks can contribute to a diversified portfolio that balances risk and reward. Their historical performance has demonstrated resilience and the capacity for substantial appreciation, making them a popular choice among long-term investors.

Role of stocks in retirement planning compared to other investment options

When planning for retirement, it is crucial to consider various investment options, each with its own risk profile and growth potential. Stocks are typically characterized by higher volatility but also higher returns over extended periods. In contrast, bonds and fixed-income securities tend to offer stability and regular income but lower growth prospects.

To illustrate, a diversified retirement portfolio might include stocks for growth, bonds for stability, and cash equivalents for liquidity. Stocks can significantly boost the potential growth of retirement savings, particularly in the early and middle stages of accumulation, when the focus is on maximizing capital appreciation. Over time, as retirement approaches, a shift toward more conservative investments helps preserve accumulated wealth.

| Investment Type | Expected Return | Volatility | |

|---|---|---|---|

| Stocks | 7-10% annually (historical average) | High | Long-term growth, risk-tolerant investors |

| Bonds | 3-5% annually | Low to Moderate | Stability, income-focused investors |

| Cash & Equivalents | 1-2% annually | Minimal | Liquidity, safety, short-term needs |

Fundamental principles of investing in stocks for long-term growth and stability

Successful stock investing for retirement hinges on key principles that promote steady growth while managing risks. These principles include diversification, patience, consistent contributions, and a long-term perspective.

Diversification involves spreading investments across different sectors and company sizes to reduce the impact of individual stock volatility. Patience is critical, as stock markets tend to fluctuate in the short term but generally trend upward over decades. Regular contributions, such as through dollar-cost averaging, help mitigate timing risks and capitalize on market dips. Maintaining a long-term outlook encourages investors to stay committed despite temporary downturns, allowing their investments to compound over time.

“Time in the market beats timing the market.”

Additionally, understanding the fundamental analysis of companies, such as evaluating earnings, revenue growth, and competitive advantages, empowers investors to make more informed choices. Rebalancing the portfolio periodically ensures alignment with evolving retirement timelines and risk tolerance.

Common misconceptions and risks associated with stock investments for retirement

Many investors harbor misconceptions that can lead to inappropriate investment strategies or undue stress. One common misconception is that stocks are inherently risky and should be avoided altogether. While stocks do carry volatility, their long-term potential often outweighs short-term declines, especially when invested with a disciplined approach.

Another misconception is that timing the market can lead to better outcomes. In reality, attempting to predict short-term movements can result in missed opportunities and losses. Instead, a consistent, long-term investment strategy tends to be more effective for retirement planning.

Risks associated with stock investments include market volatility, economic downturns, company-specific issues, and inflation risk. Market crashes, such as the 2008 financial crisis or the COVID-19 pandemic-induced downturn, can temporarily erode portfolio value. However, historical data shows that markets tend to recover over time, emphasizing the importance of staying invested and avoiding panic selling.

Investors should also be aware of the risk of over-concentration in a few stocks or sectors, which can amplify losses. Proper diversification, risk assessment, and alignment with individual retirement timelines are critical for managing these risks effectively.

Setting Financial Goals for Retirement Stock Investments

Establishing clear and well-defined financial goals is a fundamental step in creating an effective strategy for retirement stock investments. These objectives serve as a roadmap, guiding investment decisions and helping investors stay focused on their long-term aspirations. Proper goal setting ensures that individuals can tailor their investment approach according to their unique circumstances, including age, income level, and retirement aspirations.

By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, investors can better assess their progress and make informed adjustments along the way. Clearly articulated goals also facilitate disciplined investing, which is crucial for accumulating sufficient retirement savings to meet future needs.

Defining Clear, Measurable Retirement Savings Objectives

Effective retirement planning begins with establishing precise savings targets that correspond with an individual’s current financial situation and future expectations. These objectives should consider factors such as expected lifestyle, inflation, and healthcare expenditures, ensuring that the goals remain realistic and attainable over time.

To define these goals:

- Assess current income, expenses, and savings capacity to determine how much can be allocated toward retirement investments each year.

- Estimate future expenses based on desired lifestyle, accounting for inflation and rising healthcare costs.

- Determine the total amount needed at retirement to sustain your lifestyle, considering factors like Social Security benefits, pensions, and other income sources.

- Set specific savings milestones that align with your retirement timeline, such as saving a certain amount by age 40, 50, or 60.

Example: A 30-year-old earning $50,000 annually might aim to save $10,000 each year towards retirement, targeting a nest egg that can generate sufficient income for their anticipated retirement age of 65.

Organizing Retirement Timelines and Corresponding Investment Strategies

The period leading up to retirement significantly influences the stock investment strategies employed. It is essential to align your investment approach with your age and the remaining timeline to retirement, balancing growth potential with risk management.

| Retirement Age Range | Investment Strategy |

|---|---|

| Below 40 | Focus on aggressive growth strategies, emphasizing equities with higher risk and higher return potential. Contribute regularly to maximize compound interest while tolerating market fluctuations. |

| Between 40 and 55 | Gradually shift towards a balanced portfolio, diversifying between stocks and bonds. Reduce exposure to high-volatility assets as retirement nears to preserve capital. |

| Above 55 | Prioritize capital preservation and income generation. Increase allocation to bonds, dividend-paying stocks, and other stable assets to reduce risk. |

This responsive approach ensures that investment risk aligns with the investor’s proximity to retirement, optimizing growth during early years and safeguarding assets in later stages.

Factors Influencing Retirement Savings Goals

Several key factors significantly impact the setting and adjustment of retirement savings goals. Recognizing these influences allows investors to develop more realistic and adaptable plans.

- Inflation: The rising cost of goods and services erodes purchasing power over time. Incorporating an average inflation rate—typically around 2-3% annually—into retirement goal calculations is vital to ensure savings keep pace with future costs.

- Lifestyle Expectations: Anticipated retirement lifestyle, including travel, hobbies, and living arrangements, directly affects the amount needed. A more active or luxurious lifestyle requires higher savings and investment returns.

- Healthcare Costs: Healthcare expenses tend to increase with age, often surpassing general inflation rates. Planning for potential medical costs, including insurance premiums, long-term care, and unexpected emergencies, is crucial for realistic goal setting.

- Longevity: Advances in healthcare have extended life expectancy. Planning for a retirement period that could span 20-30 years or more ensures that savings are sufficient to cover extended needs.

By carefully considering these factors, investors can establish flexible yet comprehensive retirement savings goals that adapt to changing circumstances and economic conditions, ultimately supporting a secure and comfortable retirement.

Understanding Different Types of Stocks and Investment Accounts

Investing for retirement involves selecting the right types of stocks and the appropriate investment accounts to maximize growth while managing risk. A thorough understanding of stock categories and the features of various investment accounts empowers investors to make informed decisions aligned with their financial goals and retirement timelines.

Stocks represent ownership in companies and come in various forms, each with distinct characteristics, risk levels, and income potential. Equally important are the different investment accounts available, each offering unique tax advantages and restrictions that influence long-term growth and retirement readiness.

Types of Stocks for Retirement Investing

Investors should familiarize themselves with the main categories of stocks to diversify their portfolios effectively. These categories differ in risk, growth potential, and income strategies, making them suitable for different stages of retirement planning.

- Blue-Chip Stocks: Shares of large, well-established, and financially stable companies with a history of reliable earnings and often paying dividends. Examples include companies like Apple, Microsoft, and Johnson & Johnson. These stocks are considered relatively safe and suitable for conservative investors approaching retirement.

- Growth Stocks: Shares of companies expected to grow faster than the overall market, often reinvesting earnings to fuel expansion rather than paying dividends. These stocks carry higher volatility and are suitable for investors with a longer time horizon who seek capital appreciation.

- Dividend Stocks: Stocks of companies that regularly distribute earnings to shareholders as dividends. These stocks can provide a steady income stream, making them attractive for retirees seeking income stability alongside growth potential.

- Index Funds: Investment funds that aim to replicate the performance of a specific market index, such as the S&P 500. They offer diversification, low fees, and are suitable for investors seeking broad market exposure with minimal active management.

Comparison of Stock Types for Retirement Savings

Understanding the features, risks, and suitability of different stock categories aids in constructing a balanced retirement portfolio.

| Stock Type | Features | Risks | Suitability |

|---|---|---|---|

| Blue-Chip Stocks | Large, established companies; stable earnings; often pay dividends | Lower volatility; potential for limited growth compared to smaller firms | Conservative investors nearing retirement or seeking stability |

| Growth Stocks | Higher earnings potential; reinvest earnings for expansion | Higher volatility; potential for significant losses during downturns | Long-term investors with risk tolerance for capital appreciation |

| Dividend Stocks | Steady income through regular dividends; some growth potential | Market fluctuations can reduce dividend payments or stock value | Retirees seeking income and moderate growth |

| Index Funds | Diversified; low cost; tracks specific market index | Market risk; cannot outperform the index | All investors seeking broad market exposure with minimal management |

Investment Accounts for Retirement Savings

Choosing the appropriate investment account can significantly influence your retirement outcomes. Each account type offers different tax benefits, contribution limits, and restrictions, making it essential to select those aligning with your retirement strategy.

- Individual Retirement Account (IRA): A personal account with tax advantages, available in traditional and Roth options. Contributions may be tax-deductible (traditional) or tax-free upon withdrawal (Roth). Income limits and contribution caps apply, making them suitable for individuals seeking flexible retirement savings options.

- Roth IRA: Funded with after-tax dollars, allowing tax-free withdrawals in retirement. Ideal for younger investors or those expecting higher future income, with income eligibility restrictions and contribution limits.

- 401(k) Plan: Employer-sponsored account offering tax-deferred growth. Many employers provide matching contributions, enhancing savings. Contribution limits are higher than IRAs, but withdrawals are restricted until retirement age, with early withdrawals incurring penalties.

- Brokerage Accounts: Personal investment accounts without tax advantages, offering flexibility in investment choices and withdrawal timing. Suitable for supplementing retirement savings or investing after maximizing tax-advantaged accounts, but subject to capital gains taxes.

Understanding the features and restrictions of these accounts enables investors to develop a comprehensive strategy that optimizes growth, tax benefits, and access to funds during retirement.

Developing a Stock Investment Strategy for Retirement

A well-structured investment strategy is essential for building a robust retirement savings portfolio. It involves careful planning to balance growth potential with risk management, ensuring your investments align with your long-term financial goals. Creating such a strategy requires understanding how to diversify your holdings, allocate assets appropriately based on personal circumstances, and maintain discipline through regular review and rebalancing.A successful stock investment approach for retirement hinges on managing risk while maximizing growth over time.

This involves not only selecting the right stocks but also ensuring that your portfolio remains aligned with evolving market conditions and personal life stages. Implementing a disciplined process for periodic review and adjustment helps sustain your trajectory toward a secure retirement.

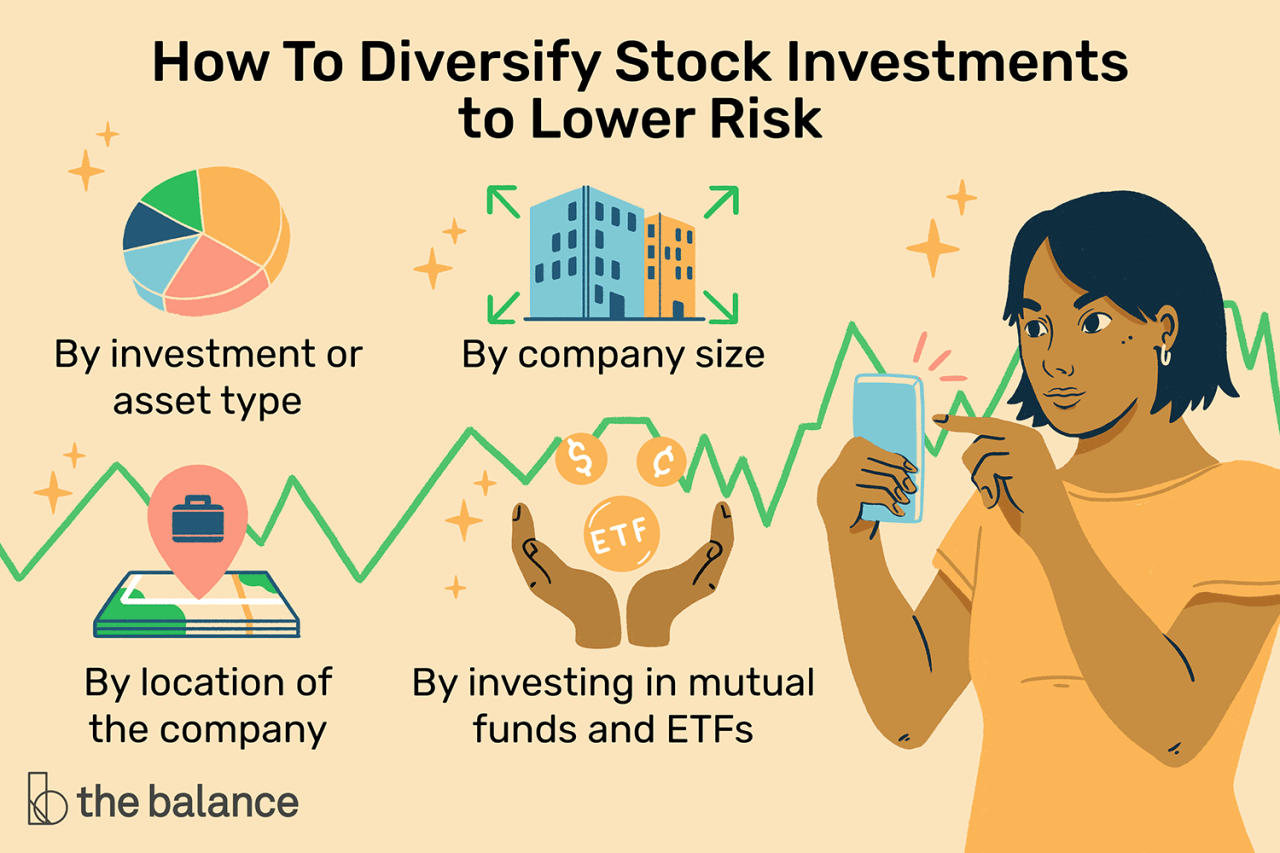

Diversifying Your Stock Portfolio for Risk Management and Long-Term Growth

Diversification is a cornerstone of prudent investing, particularly for retirement savings, as it helps mitigate the impact of adverse market movements on your overall portfolio. Spreading investments across various sectors, geographic regions, and company sizes reduces dependence on any single asset class or market trend, lowering overall risk.A diversified portfolio might include a mix of large-cap stocks for stability, mid- and small-cap stocks for growth potential, and international equities for exposure to global markets.

Additionally, incorporating different industries such as technology, healthcare, consumer goods, and energy can protect against sector-specific downturns. This balance enables investors to ride out volatility and capitalize on opportunities across different segments of the economy.

“Diversification does not eliminate risk but helps manage it more effectively, creating a smoother path toward retirement savings goals.”

Methods for Asset Allocation Based on Age, Risk Tolerance, and Retirement Timeline

Adjusting asset allocation according to personal factors ensures that your investment strategy remains aligned with your evolving financial situation and goals. Age, risk tolerance, and the proximity to retirement are key considerations in determining the proportion of stocks versus other asset classes.For younger investors with a longer horizon, a more aggressive allocation—such as 80-90% in stocks—can maximize growth, accepting higher volatility.

As retirement approaches, gradually shifting toward a more conservative mix, like 50-60% in stocks with increased bond holdings, helps preserve capital and reduce risk. For example, a 30-year-old might adopt an 80% stock allocation, while a 60-year-old nearing retirement might reduce this to 50%. Asset allocation strategies can be summarized as:

- Growth phase (early career): Higher stock percentage, lower bonds.

- Pre-retirement phase: Gradual reduction in stocks, increased bonds and cash equivalents.

- Retirement phase: Conservative mix prioritizing income generation and capital preservation.

Effective asset allocation also considers individual risk tolerance, which varies based on personal comfort with market fluctuations. Conservative investors may prefer a more balanced or bond-heavy portfolio, while aggressive investors might accept higher volatility for greater growth potential.

Regular Review and Rebalancing of the Stock Portfolio

Maintaining a well-balanced stock portfolio requires a disciplined approach to review and rebalancing. Market fluctuations can cause your portfolio to drift away from your original asset allocation, either becoming overly aggressive or too conservative.Establishing a review schedule ensures your investments stay aligned with your long-term goals. Typically, investors review their portfolios semi-annually or annually. During these reviews, assess the performance of individual holdings, overall diversification, and whether your current allocation reflects your risk tolerance and retirement timeline.Rebalancing involves readjusting your investments to restore your target allocation.

For instance, if stocks have appreciated significantly and now constitute 70% of your portfolio instead of your intended 60%, you would sell some stocks and reallocating those funds into bonds or cash equivalents. This practice helps lock in gains and prevent overexposure to market risks. Example rebalancing intervals include:

- Annually, on a fixed date such as the start or end of the year.

- When allocations drift by more than 5-10% from your target mix.

Effective rebalancing maintains the risk profile suitable for your retirement goals, ensuring steady progress toward financial security while managing exposure to market volatility.

Selecting stocks and funds for retirement savings

Choosing the right stocks and investment funds is a crucial step in building a robust retirement savings portfolio. The process involves evaluating various factors to ensure that investments align with your financial goals, risk tolerance, and time horizon. Proper selection can enhance growth potential while managing risks associated with market fluctuations, ultimately supporting a comfortable retirement.Making informed choices requires a clear understanding of the financial health, growth prospects, dividend policies, and market positioning of potential investments.

Additionally, utilizing a variety of screening tools and resources can streamline this process, helping investors identify stocks and funds that meet specific criteria suited for retirement planning. Selecting a diversified mix tailored to different risk levels can help optimize long-term growth while safeguarding against significant losses.

Criteria for choosing stocks and funds

Understanding the essential criteria for selecting stocks and funds enhances decision-making in retirement planning. These criteria include:

- Financial Health: Evaluating a company’s balance sheet, income statement, and cash flow statements to gauge stability. Key indicators include low debt-to-equity ratios, consistent revenue growth, and positive cash flow.

- Growth Potential: Analyzing earnings growth trends, industry position, and innovation capacity to assess future expansion prospects. Companies with a history of steady growth and a strong competitive edge are often favorable.

- Dividends: Considering dividend yield and payout history, especially for investors seeking income during retirement. Reliable dividend-paying stocks can provide consistent cash flow and signal financial strength.

- Market Position and Industry Stability: Investing in companies with a strong market share and resilience within stable or growing industries can reduce volatility and enhance long-term returns.

Screening tools and resources for stock and fund selection

Effective screening tools and resources are invaluable for identifying suitable investment options that align with retirement goals. They provide filters based on financial metrics, valuation ratios, and other quantitative data, allowing investors to streamline their analysis.

- Financial News Platforms: Websites like Yahoo Finance, Bloomberg, and CNBC offer comprehensive financial data, news, and analysis to inform investment decisions.

- Stock Screeners: Tools such as the Finviz Stock Screener, Morningstar, and MarketWatch enable investors to filter stocks based on criteria like P/E ratio, dividend yield, market cap, and growth metrics.

- Fund Screening Tools: Morningstar’s fund screener and Vanguard’s fund research tools help identify mutual funds and ETFs aligned with risk tolerance and investment objectives.

- Official Regulatory Filings: EDGAR database and company annual reports provide detailed financial disclosures essential for due diligence.

Examples of diversified stock and fund selections for different risk levels

Diversification across various asset classes and risk profiles helps mitigate potential losses and smooth returns over the long term. The following examples illustrate a balanced approach suitable for different risk appetites:

Conservative Risk Level

Focuses on stability and income generation, emphasizing dividend-paying stocks and bond funds. Examples include:

- Stocks: Large-cap blue-chip companies with a history of stable dividends such as Johnson & Johnson, Procter & Gamble, and Coca-Cola.

- Funds: Bond funds like Vanguard Total Bond Market ETF or Fidelity U.S. Bond Index Fund provide income and lower volatility.

Moderate Risk Level

Balances growth and income, incorporating a mix of stocks and funds with moderate volatility:

- Stocks: Mid-cap stocks like Ross Stores or Parker-Hannifin, which offer growth potential with manageable risk.

- Funds: Balanced index funds such as Vanguard Balanced Index Fund or target-date funds aligned with expected retirement age.

Aggressive Risk Level

Prioritizes growth, suitable for investors with longer time horizons and higher risk tolerance:

- Stocks: Tech giants like Apple, Amazon, or emerging market equities with high growth potential but higher volatility.

- Funds: Sector-specific ETFs, such as technology or healthcare ETFs, and small-cap mutual funds that pursue higher returns.

Effective diversification considers asset allocation aligned with risk tolerance, investment horizon, and financial goals, ensuring a resilient retirement portfolio.

Practical procedures for investing in stocks for retirement

Investing in stocks for retirement requires careful planning and adherence to structured procedures to maximize gains and manage risks effectively. This segment provides a comprehensive guide to executing practical steps, from opening investment accounts to automating your savings strategy. Following these procedures ensures a smooth and disciplined approach to building a robust retirement portfolio through stock investments.Engaging in stock investments for retirement involves multiple stages that can seem complex initially.

However, understanding each step—such as account setup, order execution, and automation—empowers investors to make informed decisions and maintain consistency in their investment journey. This guide simplifies these processes, allowing you to focus on steadily growing your retirement savings.

Opening Investment Accounts

Successfully investing in stocks begins with establishing the appropriate investment account. This process involves choosing a reputable brokerage, preparing necessary documentation, and completing account registration. The latter forms the foundation for executing trades and managing your portfolio effectively.To open an investment account, follow these steps:

- Select a Brokerage Firm: Consider factors such as fees, available investment options, customer support, and user interface. Reputable firms like Fidelity, Vanguard, Charles Schwab, and TD Ameritrade offer comprehensive services suitable for retirement investing.

- Gather Required Documentation: Prepare essential documents, including:

- Valid government-issued identification (e.g., passport or driver’s license)

- Social Security Number (SSN) or Taxpayer Identification Number (TIN)

- Proof of address (utility bill, bank statement)

- Employment details and income information may be required for certain account types

- Complete Application Process: Fill out the online or paper application form, providing personal information, financial details, and investment objectives. Review and accept the terms and conditions.

- Fund the Account: Transfer funds via bank transfer, wire transfer, or other available methods. Initial deposits vary depending on the brokerage, often starting from $500 to $1,000.

Once approved and funded, your account is ready for stock transactions.

Executing Buy and Sell Orders

Efficient order execution is critical for optimizing investment outcomes. Understanding different order types ensures control over purchase and sale prices, especially in volatile markets.Before executing trades, consider the importance of setting specific parameters to manage risk and capitalize on market movements. The following step-by-step process guides you through placing various types of orders:

- Log into your brokerage account: Use your credentials to access the trading platform.

- Select the stock or fund: Enter the ticker symbol or search within your account dashboard to identify the asset you wish to trade.

- Choose the order type: Decide whether to place a market order, limit order, or stop order based on your trading strategy.

- Set the quantity: Specify the number of shares or dollar amount you intend to buy or sell.

- Review and confirm: Verify order details, including the total cost, and submit the order.

Specific order types include:

- Market Order: Executes immediately at the current market price, suitable for quick transactions.

- Limit Order: Sets a maximum price to buy or minimum price to sell, executing only if the stock reaches that price. This helps control purchase costs or sale profits.

- Stop Order (Stop-Loss): Becomes a market order once the stock hits a specified stop price, assisting in limiting downside risk.

To place limit and stop orders:

- Specify the desired limit or stop price during order entry.

- Monitor order status through your trading platform.

- Adjust or cancel pending orders if market conditions change unexpectedly.

Automating Investments through Recurring Transfers and Dollar-Cost Averaging

Automation streamlines the process of consistent investing, reducing emotional decision-making and aligning with long-term retirement goals. Using recurring transfers and dollar-cost averaging (DCA) helps smooth out market fluctuations and build wealth steadily.The following table illustrates a typical setup for automating stock investments:

| Component | Description | Example | Benefits |

|---|---|---|---|

| Recurring Transfers | Regularly scheduled automatic transfers from your bank account to your investment account, ensuring consistent contributions. | $500 transferred every month on the 1st | Maintains disciplined saving habits and mitigates timing risks associated with market volatility |

| Dollar-Cost Averaging | Investing a fixed dollar amount at regular intervals, regardless of stock price fluctuations | Buying $200 worth of stocks every biweekly pay period | Reduces the impact of market timing, lowers average purchase price, and fosters long-term growth |

| Automation Tools | Use brokerage platform features to set up automatic investments and reinvest dividends | Activating automatic reinvestment of dividends to buy additional shares | Enhances compounding effects and simplifies portfolio management |

Implementing these procedures consistently ensures a disciplined investment approach, helping to achieve your retirement savings objectives efficiently and effectively.

Monitoring and managing stock investments for retirement

Maintaining a successful retirement investment portfolio requires ongoing oversight and strategic management. Regularly tracking your stock investments allows you to assess performance, identify opportunities for adjustments, and ensure alignment with your long-term retirement goals. Effective management also involves responding to market fluctuations and personal circumstances to optimize your savings growth and mitigate risks over time.Understanding how to monitor your investments and make informed decisions is crucial for safeguarding your retirement savings and achieving financial security.

This section provides guidance on evaluating performance, interpreting key indicators, and adjusting holdings appropriately to stay on course with your retirement strategy.

Tracking investment performance and interpreting key financial indicators

Keeping a close eye on your stock investments involves monitoring various metrics that reveal how well your portfolio is performing relative to your objectives. The most commonly used indicators include:

- Total Return: Reflects the overall gain or loss of your investment, including dividends and capital appreciation, over a specific period.

- Annualized Return: Shows the average yearly return, enabling comparison across different investments and timeframes.

- Benchmark Comparison: Evaluates your portfolio’s performance against relevant indices, such as the S&P 500, to assess relative success.

- Dividend Yield: Indicates the income generated from dividends relative to the stock’s current price, important for income-focused retirement planning.

- Volatility Measures: Metrics like standard deviation help evaluate the investment’s risk level and price fluctuations over time.

Regularly reviewing these indicators helps detect underperformers, recognize growth opportunities, and understand the risk profile of your holdings.

Methods for adjusting stock holdings based on market changes and personal circumstances

Adjusting your investment portfolio in response to market developments or shifts in personal situations is vital to maintaining a balanced and growth-oriented retirement plan. The adjustments should be deliberate and aligned with your predefined financial goals and risk tolerance.Strategies include:

- Rebalancing: Periodically adjusting the proportions of stocks and other assets to maintain your target allocation, which may drift due to market movements. For example, if equities grow significantly and exceed your planned allocation, selling some stocks to fund bond investments keeps your risk profile consistent.

- Tax-efficient Selling: Recognizing gains or losses to optimize tax liabilities, especially if you’re nearing retirement or in lower tax brackets.

- Shifting Focus: Moving investments from high-volatility stocks to more stable, dividend-paying stocks as retirement nears to reduce risk and generate income.

- Responding to Personal Changes: Adjusting your holdings if your financial situation, health, or risk tolerance changes, ensuring your portfolio remains aligned with your evolving needs.

For instance, a retiree approaching age 65 might shift from growth stocks to income-generating dividend stocks to secure steady cash flow and reduce exposure to market swings.

Best practices for maintaining a disciplined investment approach

Consistent discipline is essential for long-term success in managing retirement stock investments. Adopting best practices helps prevent impulsive decisions driven by market volatility or emotional reactions.Key tips include:

- Stick to Your Investment Plan: Follow your predefined asset allocation and rebalance periodically, rather than making impulsive trades based on short-term market movements.

- Avoid Market Timing: Focus on long-term growth rather than attempting to predict short-term market fluctuations, which can often lead to costly mistakes.

- Review Regularly: Conduct scheduled reviews—such as quarterly or biannual—to assess performance and make incremental adjustments.

- Keep Emotions in Check: Resist panic selling during downturns and avoid greed-driven buying during bull markets; a balanced emotional approach supports steady decision-making.

- Stay Informed and Educated: Continuously learn about market trends, economic indicators, and investment strategies relevant to retirement planning.

- Diversify Your Portfolio: Spread investments across various sectors and asset classes to reduce risk and improve resilience against market volatility.

Discipline, patience, and adherence to your strategic plan are the cornerstones of successful retirement stock management.

Tax considerations and benefits related to stock investments for retirement

Investing in stocks for retirement offers numerous advantages, including favorable tax treatment that can significantly enhance your savings growth over time. Understanding the various tax implications, benefits, and strategies is essential to maximize your investment returns while minimizing tax liabilities. Proper tax planning ensures that your retirement portfolio remains efficient and aligned with your long-term financial objectives.Effective management of taxes related to stock investments involves awareness of the specific rules governing different retirement accounts, investment income, and capital gains.

Additionally, employing tax-efficient strategies such as harvesting dividends and gains can further optimize your retirement savings. Recognizing common pitfalls can also help you avoid costly mistakes that erode your nest egg, ensuring a smoother path toward a financially secure retirement.

Tax advantages of retirement accounts and investment strategies

Retirement accounts are designed to provide tax benefits that encourage long-term savings. The main types include traditional IRAs, Roth IRAs, 401(k)s, and other employer-sponsored plans. Each offers distinct advantages:

- Traditional IRA and 401(k): Contributions are typically tax-deductible, reducing your taxable income in the contribution year. Investment growth is tax-deferred, meaning you pay taxes upon withdrawal, often at a lower tax rate during retirement.

- Roth IRA and Roth 401(k): Contributions are made with after-tax dollars, but qualified withdrawals, including earnings, are entirely tax-free. This strategy is beneficial if you expect to be in a higher tax bracket during retirement.

Beyond account types, investment strategies such as focusing on tax-efficient funds, holding assets for the long term, and actively managing asset location within accounts help optimize tax benefits. Investing in index funds and ETFs typically results in lower capital gains distributions, further enhancing tax efficiency.

Procedures for tax-efficient harvesting of dividends and capital gains

Tax-efficient harvesting involves strategic management of income streams and asset sales to minimize tax liabilities. This process requires careful planning, particularly within a retirement savings context, to enhance after-tax returns.

- Dividend management: Reinvest dividends in tax-advantaged accounts to defer taxes or realize them in low-tax years if held in taxable accounts. Qualified dividends are taxed at lower rates, so recognizing their status can be advantageous.

- Capital gains harvesting: Regularly review your portfolio to identify gains and losses. Selling assets that have appreciated can realize gains with favorable tax rates if held long-term. Conversely, harvesting losses by selling underperforming stocks can offset gains and reduce overall tax liability.

- Utilizing tax-loss harvesting: This involves offsetting realized gains with realized losses, thereby reducing taxable income for the year. It is particularly useful in taxable accounts but requires careful record-keeping and adherence to IRS rules to avoid wash sale penalties.

To implement these procedures effectively, maintain detailed records of purchase dates, cost basis, and sale transactions. Consider consulting with a tax professional to align harvesting strategies with your overall retirement plan.

Common tax pitfalls and strategies to avoid them in stock retirement investments

Awareness of typical tax pitfalls can prevent costly errors that diminish your retirement savings. Some common issues include:

- Ignoring the tax implications of frequent trading: Excessive buying and selling can generate high short-term capital gains taxed at ordinary income rates, reducing overall returns.

- Failing to plan for required minimum distributions (RMDs): Traditional IRAs and 401(k)s require RMDs starting at age 72. Failure to take RMDs results in severe penalties, including a 50% excise tax on the amount not withdrawn.

- Overlooking the impact of state taxes: State income taxes vary and may tax retirement withdrawals differently. Planning withdrawals with state tax considerations in mind can optimize after-tax income.

- Neglecting to monitor the tax status of dividends and gains: Not tracking whether dividends are qualified or non-qualified, or if gains are long-term or short-term, can lead to higher-than-necessary tax bills.

To avoid these issues, establish a comprehensive tax plan aligned with your retirement investment strategy. Regularly review your portfolio with a financial advisor or tax professional to ensure compliance and optimal tax efficiency. Keeping abreast of current tax laws and adjusting your approach accordingly will help preserve your wealth and support your retirement goals.

Ending Remarks

In conclusion, investing in stocks for retirement savings requires careful planning, diversification, and ongoing management. By setting clear goals and staying disciplined, you can optimize your investment portfolio to grow steadily over the years. With the right approach, your retirement savings can flourish, ensuring peace of mind and financial independence in your later years.