Learning how to invest in stocks short term offers investors opportunities to achieve rapid returns by leveraging various trading strategies. Understanding the fundamentals behind short-term trading enables traders to capitalize on market movements within brief timeframes, whether through day trading, swing trading, or momentum strategies.

This guide provides comprehensive insights into effective methods, crucial factors to consider, risk management techniques, and practical steps to navigate the dynamic landscape of short-term stock investments successfully.

Understanding Short-Term Stock Investment Strategies

Engaging in short-term stock investments requires a clear understanding of various strategies designed to capitalize on market movements over brief periods. Unlike long-term investing, where the focus is on holding assets for years, short-term trading emphasizes quick gains within days, hours, or even minutes. Mastering these approaches involves understanding the principles that drive market volatility and the specific techniques traders employ to seize opportunities efficiently and manage risks effectively.

Different short-term trading methods cater to various risk appetites and market conditions. These strategies include day trading, swing trading, and momentum trading, each with unique characteristics, tools, and timeframes. Recognizing the differences among these approaches allows investors to select the method that best aligns with their goals, expertise, and available resources, ultimately enhancing their potential for success in fast-paced trading environments.

Short-Term Stock Investment Strategies

To navigate the complexities of short-term trading successfully, it is essential to understand the fundamentals of each strategy. Here is a structured overview of the main types of strategies, their typical timeframes, associated risk levels, and common tools used by traders.

| Strategy Type | Time Frame | Risk Level | Typical Tools |

|---|---|---|---|

| Day Trading | Minutes to Hours within a single trading day | High | Real-time charting software, Level II quotes, news feeds, and technical indicators such as moving averages and RSI |

| Swing Trading | Several days to Weeks | Moderate to High | Technical analysis tools, trend lines, candlestick patterns, and volume indicators |

| Momentum Trading | Hours to Days | High | Momentum indicators such as MACD, RSI, volume analysis, and news catalysts |

Day Trading: Focuses on executing multiple trades within a single day, taking advantage of small price movements. It necessitates rapid decision-making, detailed technical analysis, and strict risk controls.

Swing Trading: Capitalizes on anticipated market swings or trend reversals over a few days to weeks. It involves holding positions longer to benefit from larger price moves, often based on chart patterns and fundamental news.

Momentum Trading: Aims to ride the wave of strong price movements driven by high trading volume or news events. It requires identifying stocks exhibiting significant momentum and entering trades early to maximize gains.

Key Factors to Consider Before Investing Short Term

Engaging in short-term stock investments requires careful analysis of various market factors to optimize potential returns and mitigate risks. Understanding these key considerations enables investors to make informed decisions rooted in market dynamics and technical insights.

Prior to entering short-term trades, it is essential to evaluate specific market indicators, technical analysis tools, and stock characteristics such as volatility and liquidity. These elements serve as critical guides to identify suitable trading opportunities and establish effective entry and exit points in a fast-paced environment.

Market Indicators and Technical Analysis Tools

Short-term investors rely heavily on a suite of technical analysis tools and market indicators that provide real-time insights into price movements and market momentum. Mastering these tools helps in timing trades accurately and understanding potential trend reversals.

| Indicator/Tool | Description | Use in Short-Term Trading |

|---|---|---|

| Moving Averages (MA) | Calculates the average price over a specified period, smoothing out short-term fluctuations. | Identify trend direction; common periods include 5, 10, 20-day MAs for quick signals. |

| Relative Strength Index (RSI) | Measures the magnitude of recent price changes to evaluate overbought or oversold conditions. | Values above 70 suggest overbought conditions, below 30 indicate oversold, signaling potential reversals. |

| Moving Average Convergence Divergence (MACD) | Shows the relationship between two moving averages of prices, highlighting momentum shifts. | Crossovers between MACD and signal line serve as entry or exit signals. |

| Volume | Represents the number of shares traded in a given period. | High volume often confirms price movements, indicating strong market interest. |

| Bollinger Bands | Overlay of a moving average with upper and lower bands representing standard deviations. | Price touching upper/lower bands can signify overbought/oversold conditions, respectively. |

Using these indicators collectively provides a comprehensive view of market momentum, trend strength, and potential reversal points, essential for short-term trading strategies.

Assessing Stock Volatility and Liquidity

Volatility and liquidity are pivotal factors influencing the success of short-term investments. High volatility can present lucrative opportunities but also increases risk, while adequate liquidity ensures that positions can be entered and exited efficiently without significant price impact.

Volatility measures the degree of price fluctuation within a specific period, often represented by standard deviation or average true range (ATR). Liquidity refers to how easily a stock can be bought or sold in the market without affecting its price.

To evaluate volatility, investors examine historical price ranges, ATR, or standard deviation metrics. Stocks with high ATR values, for example, tend to experience larger swings, which can be advantageous for active traders seeking quick profits.

Liquidity assessment involves analyzing trading volume and bid-ask spreads. Stocks with consistently high trading volumes and narrow bid-ask spreads facilitate smoother transactions, allowing traders to execute strategies without undue slippage.

| Metrics | Implication | Ideal Range for Short-Term |

|---|---|---|

| Average Daily Trading Volume | Higher volumes indicate better liquidity and ease of transaction. | At least 1 million shares traded daily for highly liquid stocks. |

| Bid-Ask Spread | The difference between the highest bid and lowest ask price. | Narrow spreads (less than 1% of share price) preferable for quick trades. |

| Historical Price Range | Measures the extent of price fluctuations over a specific period. | Moderate to high ranges suggest potential for profit within short periods, but also increased risk. |

Criteria for Selecting Suitable Stocks for Short-Term Investment

Choosing the right stocks is fundamental to successful short-term trading. Certain criteria help filter stocks that are more aligned with rapid trading objectives, balancing potential returns with manageable risk levels.

- Strong Liquidity: Stocks with high trading volume to ensure quick execution without significant price impact.

- Clear Trend Direction: Stocks exhibiting a defined upward or downward trend as indicated by technical tools like moving averages.

- Volatility Levels: Moderate to high volatility, providing sufficient price movement for profit opportunities.

- Recent News or Catalysts: Stocks affected by news, earnings reports, or sector movements that can trigger swift price changes.

- Technical Patterns: Formation of recognizable patterns such as breakouts, flags, or pennants that signal potential entry points.

- Stable Market Conditions: Avoid trading during periods of extreme market uncertainty or low volume, which can impair execution and increase risk.

Risk Management and Capital Preservation Techniques

Effective risk management is essential for short-term stock investors aiming to protect their capital while maximizing potential gains. Implementing structured strategies helps in minimizing losses, avoiding emotional pitfalls, and ensuring disciplined trading practices. This section explores key techniques used to manage risk prudently and safeguard investments in volatile markets.

By adopting proven risk management methods, investors can navigate market fluctuations more confidently and sustain their investment growth over time. These techniques serve as foundational tools that support disciplined decision-making and help prevent common mistakes that can erode capital.

Risk Management Strategies

In short-term trading, deploying a combination of risk management strategies can significantly reduce exposure to unexpected market swings. The following techniques are widely recognized for their effectiveness:

- Stop-Loss Orders: Automatically sell a stock once it reaches a predetermined price point to limit potential losses.

- Position Sizing: Adjust the size of each trade based on the total capital and risk tolerance, ensuring no single trade jeopardizes overall portfolio health.

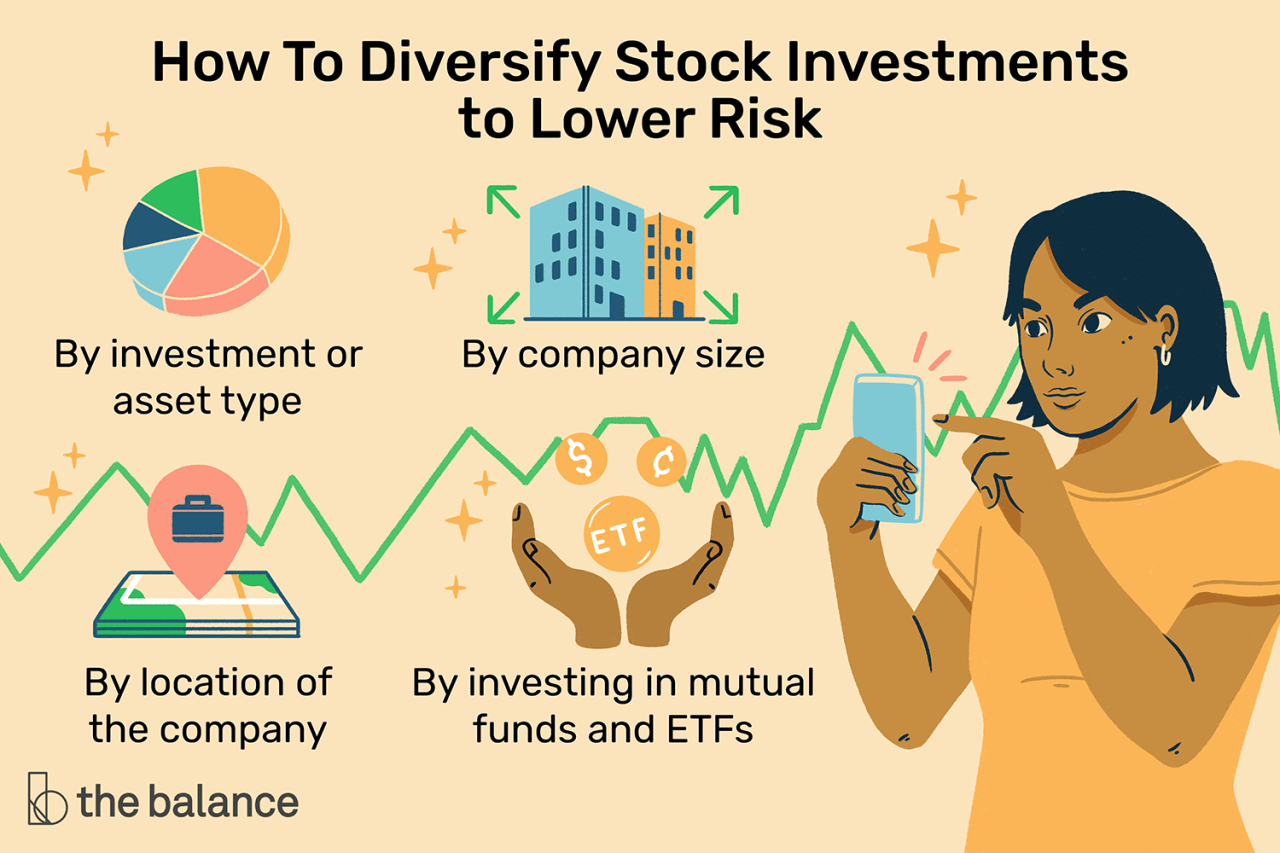

- Diversification: Spread investments across various sectors and asset classes to reduce dependency on individual stocks and mitigate sector-specific risks.

Organizing Risk Management Procedures

Structured risk management procedures enhance discipline and consistency in trading practices. The following table summarizes essential techniques, their objectives, and practical implementation tips:

| Technique | Purpose | Implementation Tips |

|---|---|---|

| Stop-Loss Orders | Limit potential losses per trade and protect capital during unfavorable market movements. | Set stop-loss at a percentage below the entry price, typically 1-2%, based on volatility. Use trailing stops to lock in profits as the stock moves favorably. |

| Position Sizing | Manage risk exposure by controlling the amount invested in each position. | Determine risk per trade, such as 1-2% of total capital, and adjust position size accordingly. Use a consistent formula to calculate lot size based on stop-loss distance. |

| Diversification | Reduce portfolio volatility by spreading investments across different assets. | Invest in stocks across various sectors, avoid over-concentration, and incorporate different asset classes like ETFs or bonds where appropriate. |

Avoiding Common Pitfalls in Short-Term Trading

Successful short-term trading requires vigilance against behaviors that can undermine risk management efforts. Key pitfalls include:

- Overtrading: Engaging in excessive trades can lead to high transaction costs and emotional exhaustion, often resulting in poor decision-making. Maintaining a trading plan and sticking to predefined criteria helps prevent impulsive actions.

- Emotional Decision-Making: Reacting to market fluctuations based on fear or greed can cause significant losses. Developing and adhering to objective strategies, along with disciplined execution, reduces emotional biases.

- Ignoring Risk Limits: Failing to set and respect stop-loss levels or position sizes can lead to disproportionate losses. Regularly reviewing risk parameters ensures consistent adherence to risk management protocols.

By recognizing these common errors and integrating robust risk controls, investors can better preserve their capital and maintain a disciplined approach to short-term stock trading.

Practical Steps for Entering Short-Term Stock Positions

Engaging in short-term stock trading requires a systematic approach to identify optimal entry and exit points, monitor market movements effectively, and execute trades with precision. Establishing a clear, step-by-step process can help traders capitalize on short-term opportunities while managing risks efficiently. This structured methodology ensures consistency in trading activities and enhances the likelihood of achieving favorable outcomes in fast-paced markets.

Below is a comprehensive guide outlining the essential procedures involved in entering short-term stock positions, from initial analysis to trade execution, complemented by a flowchart that visualizes this process.

Analyzing Stocks and Setting Entry and Exit Points

Effective short-term trading begins with thorough analysis to identify promising stocks and determine precise entry and exit levels. This involves combining technical analysis, which studies price charts and indicators, with a keen understanding of market momentum and volume. Establishing clear criteria for entry allows traders to act swiftly when favorable conditions arise, while predefined exit points safeguard profits and limit losses.

- Technical Analysis: Use candlestick patterns, moving averages, support and resistance levels, and momentum indicators like RSI or MACD to gauge stock strength and timing.

- Setting Entry Points: Identify breakouts above resistance, bounce from support levels, or signals from technical indicators suggesting upward momentum.

- Determining Exit Points: Establish profit targets based on recent price swings, technical resistance levels, or indicator signals; similarly, set stop-loss orders just below support levels or trendlines to minimize downside risk.

- Using Limit and Stop Orders: Place limit orders for entries at desired price levels and stop orders for exits to automate trade execution and ensure disciplined trading.

Accurate analysis combined with disciplined order placement facilitates timely trades aligned with market movements, increasing the potential for short-term gains.

Tracking Market Movements and Executing Trades Efficiently

Staying abreast of real-time market data and executing trades promptly is critical in short-term trading. Efficient tracking involves utilizing advanced trading platforms that provide live quotes, news feeds, and real-time alerts, enabling traders to react swiftly to changing conditions.

- Monitoring Price Trends: Use real-time charts and technical indicators to observe ongoing market momentum, volume spikes, and price breakouts or breakdowns.

- Utilizing Alerts and Notifications: Set custom alerts for specific price levels, technical signals, or news events that could influence stock directions.

- Trade Execution Techniques: Employ direct market access (DMA) platforms for rapid order placement, or utilize algorithmic trading tools for executing predefined strategies swiftly.

- Maintaining Discipline: Stick to predetermined entry and exit points, avoiding impulsive decisions driven by market noise or emotional reactions.

Efficient tracking and execution rely heavily on technological tools and disciplined trading routines, ensuring that traders can capitalize on fleeting opportunities with minimal delays.

Flowchart of the Typical Short-Term Trading Process

Research and Market Analysis → Identify Potential Stocks → Technical and Fundamental Screening → Set Entry and Exit Criteria → Place Orders (Limit/Stop) → Monitor Market Movements → Adjust Orders as Needed → Execute Trades Promptly → Review and Record Trade Outcomes

This organized flow ensures a logical progression from initial research to trade completion, emphasizing the importance of preparation, timely execution, and ongoing evaluation in short-term stock trading.

Monitoring and Adjusting Short-Term Investments

Effective management of short-term stock investments requires continuous oversight and timely adjustments to maximize returns and mitigate risks. Market conditions can change rapidly, and traders must be prepared to respond promptly to evolving scenarios. This section explores techniques for ongoing monitoring, procedures for adjusting positions, and the tools best suited for real-time tracking to ensure investment objectives are met efficiently.

Maintaining a vigilant approach allows investors to capitalize on favorable movements while limiting exposure to adverse price shifts. Leveraging technology and a disciplined strategy for adjustments ensures that short-term trades remain aligned with market developments and personal risk tolerance.

Techniques for Ongoing Monitoring of Trades

Ongoing monitoring involves tracking market movements, technical signals, and news that could impact the value of short-term stock positions. Investors should set up systematic alerts and utilize technical analysis tools to identify entry and exit points effectively. Real-time updates facilitate swift decision-making, which is crucial for short-term trading success.

Alerts can be customized based on specific price levels, percentage changes, or technical indicators such as moving averages, RSI, or MACD. Monitoring these signals helps traders recognize optimal moments to enter or exit positions, thereby enhancing profitability and controlling losses.

Regularly reviewing charts and price patterns enables traders to detect emerging trends or reversals, providing opportunities to adjust positions proactively. Keeping an eye on market news and economic data releases also informs decision-making, especially when such events cause significant volatility.

Procedures for Adjusting Positions Based on Market Changes

Adjusting short-term stock positions involves predefined strategies that align with market movements and risk management principles. When market conditions shift unexpectedly, traders should evaluate whether to tighten stops, take profits, or scale into/out of positions.

For instance, if a stock moves favorably and approaches a target profit level, executing a partial or full exit helps lock in gains. Conversely, if adverse signals emerge—such as a technical reversal indicator—reducing or closing the position limits potential losses. Dynamic stop-loss orders can be adjusted to reflect new support or resistance levels as the market evolves.

Having a clear plan before entering trades ensures prompt decision-making. It is advisable to adhere strictly to these plans and avoid emotional reactions, which can undermine short-term strategies. Regular reassessment of market conditions and the position’s performance facilitates timely and disciplined adjustments.

Adjustments should be rule-based rather than emotion-driven, emphasizing discipline and consistency with your trading plan.

Tools and Platforms Suitable for Real-Time Tracking

Utilizing advanced tools and platforms enhances the ability to monitor and manage trades efficiently in real time. The following tools are highly regarded among short-term traders:

- TradingView: Offers customizable charts, technical indicators, alert systems, and social sharing features, making it ideal for technical analysis and real-time alerts.

- Thinkorswim by TD Ameritrade: Provides comprehensive charting, real-time data, paper trading capabilities, and advanced order types suitable for active traders.

- E*TRADE Pro: Features customizable dashboards, real-time streaming quotes, and alerts that facilitate swift decision-making.

- MetaTrader 4/5: Popular among active traders for technical analysis, automated trading, and real-time monitoring across multiple markets.

- Interactive Brokers Trader Workstation (TWS): Offers professional-grade tools, real-time data, risk management features, and customizable alerts for active traders.

In addition to dedicated trading platforms, mobile apps from these providers enable traders to stay connected and respond swiftly, regardless of location. Integrating these tools into a disciplined monitoring routine ensures that traders are well-informed and able to adapt quickly to market shifts.

Common Tools and Platforms Supporting Short-Term Trading

Effective short-term stock trading relies heavily on the right tools and platforms that provide real-time data, comprehensive analysis, and flexible trading options. Choosing a platform with the appropriate features can significantly enhance decision-making, execution speed, and overall trading success. Traders need platforms that offer advanced charting, diverse order types, and robust analytics to navigate the fast-paced environment of short-term investment strategies.

These tools not only facilitate quick execution but also help traders analyze market trends, set precise entry and exit points, and manage risk effectively. The following overview highlights essential features to consider and introduces some of the most popular trading platforms used by short-term traders today.

Features to Look for in Trading Platforms

When selecting a platform for short-term trading, focus on the following key features:

- Advanced Charting Tools: Interactive charts with technical indicators, customizable time frames, and drawing tools to identify patterns and entry/exit points efficiently.

- Order Types: Access to various order options such as limit orders, stop-loss, take-profit, and trailing stops, allowing precise control over trades.

- Real-Time Analytics: Market depth, level II quotes, real-time news feeds, and customizable alerts to stay informed and react swiftly to market movements.

- Speed and Reliability: Fast execution speeds with minimal latency and a stable platform to prevent missed opportunities during volatile trading sessions.

- User Interface: An intuitive, user-friendly design that facilitates quick decision-making and reduces the likelihood of mistakes during rapid trades.

Examples of Popular Trading Software

Several trading platforms are favored by short-term traders for their comprehensive features and reliability. Here are some notable options:

- MetaTrader 4 and MetaTrader 5: Widely used for forex and stock trading, these platforms offer advanced charting, numerous technical indicators, and automated trading capabilities through Expert Advisors.

- Thinkorswim by TD Ameritrade: Provides sophisticated charting tools, paper trading, and a broad range of technical analysis tools suitable for active traders.

- TradeStation: Known for its powerful analytics and customizable trading strategies, ideal for traders who rely heavily on technical analysis and automation.

- Interactive Brokers Trader Workstation (TWS): Offers extensive market data, advanced order types, and low commissions, making it suitable for professional short-term traders.

- TradingView: A web-based platform emphasizing social trading, with an intuitive interface, real-time data, and extensive charting tools, accessible from any device.

Comparison of Trading Platforms

| Platform Name | Key Features | User Friendliness | Cost |

|---|---|---|---|

| MetaTrader 4/5 | Advanced charting, automated trading, customizable indicators | Moderate; requires some learning curve | Free; some brokers may charge commissions or fees |

| Thinkorswim | Comprehensive technical analysis, paper trading, real-time news | High; intuitive interface for active traders | Commission-free; account minimums may apply |

| TradeStation | Robust analytics, custom strategies, automation | Moderate; suited for experienced traders | Variable; commission structures depend on trading volume |

| Interactive Brokers TWS | Low latency, extensive market data, multiple order types | Moderate; designed for professional traders | Low commissions; tiered fee structure |

| TradingView | Social trading, extensive charting, multi-asset support | High; user-friendly, web-based | Free basic; premium plans available for additional features |

Real-Life Examples of Short-Term Stock Investments

Examining real-world cases provides valuable insights into the practical application of short-term trading strategies. By analyzing both successful and unsuccessful trades, investors can better understand how entry and exit points influence outcomes, and what lessons can be learned to refine their approach. These examples highlight common scenarios faced by traders, illustrating the importance of timely decision-making, disciplined execution, and adaptive tactics in the fast-paced environment of short-term stock trading.

Below, a detailed table showcases selected case studies, emphasizing the strategies employed, the resulting outcomes, and key lessons derived from each experience. Such analyses serve as a practical reference for traders seeking to enhance their short-term investment techniques and avoid common pitfalls.

Case Study Table of Short-Term Stock Trades

| Stock Name | Strategy Employed | Outcome | Lessons Learned |

|---|---|---|---|

| Tech Innovators Inc. | Momentum Trading Based on Moving Averages | Profit of 8% within 2 days | Identified a strong upward momentum using a 5-day moving average crossing above the 20-day MA; timely exit before a reversal prevented larger gains. Emphasizes the importance of confirming momentum with volume indicators. |

| Pharma Solutions | Breakout Trading on Earnings Announcement | Loss of 5% after false breakout | Entered the trade on a breakout above resistance, but the stock quickly reversed due to profit-taking and market skepticism. Highlights the risk of false breakouts and the necessity of confirmation signals and stop-loss orders. |

| Green Energy Corp. | Swing Trading Using Short-Term Support and Resistance | Gain of 12% over 4 days | Bought near support levels identified through intraday charts and sold near resistance. Demonstrates the effectiveness of precise technical analysis and disciplined adherence to predefined entry and exit points. |

| Retail Chain Ltd. | Reversal Trading Based on Candlestick Patterns | Loss of 3% after premature exit | Recognized a bullish engulfing pattern and entered, but the stock reversed quickly, leading to a loss. Underlines the importance of verifying signals with additional indicators and patience in holding positions. |

| Automotive Parts Co. | Scalping Using Level 2 Market Data | Small profit of 0.5% per trade, cumulatively significant | Made multiple quick trades based on bid-ask spreads, capturing small profits repeatedly. Reinforces that scalping can be effective with a disciplined approach and proper tools, but requires quick decision-making and transaction costs management. |

Wrap-Up

Mastering how to invest in stocks short term requires a combination of strategic planning, disciplined execution, and ongoing market analysis. By applying the right techniques and tools, investors can enhance their chances of making profitable trades while managing potential risks effectively. Embracing continuous learning and careful monitoring will ultimately lead to more informed and confident investment decisions in the fast-paced world of short-term trading.