Understanding how to invest in bonds safely is essential for building a stable and reliable investment portfolio. Bonds are debt instruments issued by various entities, offering a fixed income over a specified period. Navigating the different types of bonds and assessing their safety can help investors make informed decisions, reduce risks, and achieve their financial goals with confidence.

Understanding Bonds and Their Types

Investing in bonds can be a prudent way to diversify an investment portfolio and generate steady income. To make informed decisions, it is essential to comprehend the fundamental nature of bonds, the various types available, and their unique characteristics. This knowledge helps investors align their risk appetite and financial goals with appropriate bond investments.Bonds function as debt instruments issued by entities seeking to raise capital.

When an investor purchases a bond, they are essentially lending money to the issuer, which agrees to pay periodic interest, known as coupon payments, and return the principal amount at maturity. Bonds are considered fixed-income securities because they provide predictable income streams and are generally less volatile compared to equities.

Types of Bonds

The bond market is diverse, encompassing several categories, each with distinct features, risk levels, and advantages. Understanding these differences enables investors to select bonds that best match their investment objectives and risk tolerances.

- Government Bonds: Issued by national governments, these bonds finance public sector projects and general government spending. They are usually regarded as the safest investments due to the backing of the government’s creditworthiness. Examples include U.S. Treasury bonds, UK gilts, and German bunds. Their interest rates tend to be lower, reflecting their lower risk, but they offer high liquidity and stability.

- Municipal Bonds: Issued by state, city, or local governments, municipal bonds fund public infrastructure projects such as roads, schools, and hospitals. They often offer tax-exempt interest income, making them attractive to investors in higher tax brackets. Municipal bonds carry moderate risk depending on the issuer’s financial health and the specific project involved.

- Corporate Bonds: Issued by companies to finance expansion, operations, or debt refinancing. These bonds generally offer higher yields compared to government bonds due to increased risk associated with the issuing corporation’s credit profile. Types include investment-grade bonds for financially stable companies and high-yield or “junk” bonds for riskier entities.

Comparison Table of Bond Types

The following table summarizes key aspects of different bond types, aiding investors in assessing their options:

| Bond Type | Issuer | Risk Level | Return Potential | Maturity Period |

|---|---|---|---|---|

| Government Bonds | National Governments | Low | Moderate to Low | 1 to 30+ years |

| Municipal Bonds | State or Local Governments | Moderate | Moderate | 1 to 30 years |

| Corporate Bonds | Private Companies | Varies (Moderate to High) | Potentially Higher | 1 to 30 years |

Understanding the fundamental differences in bond types allows investors to select instruments that match their risk tolerance and income requirements, fostering safer and more strategic investing.

Assessing the Safety of Bond Investments

Investing in bonds requires careful evaluation to ensure that your capital remains secure while generating steady income. Understanding how to assess bond safety involves examining several important factors that influence the risk profile of a bond investment. This process helps investors identify bonds that align with their risk tolerance and investment goals, minimizing potential losses and enhancing overall portfolio stability.A thorough assessment of bond safety entails analyzing issuer credibility, economic conditions, and independent credit ratings.

These elements collectively provide a comprehensive view of potential risks, such as default or market volatility. By paying close attention to these criteria, investors can make informed decisions that contribute to a resilient investment strategy.

Criteria for Evaluating Bond Safety

To gauge the safety of a bond, investors should consider multiple key indicators that reflect the issuer’s ability to meet its obligations and the broader economic environment. These criteria serve as benchmarks for assessing the riskiness of a bond:

- Credit Ratings: Independent evaluations of an issuer’s creditworthiness, provided by agencies such as Moody’s, Standard & Poor’s, and Fitch.

- Issuer Stability: The financial health, business model, and operational track record of the bond issuer, including its industry position and past performance.

- Economic Factors: Macroeconomic indicators like interest rates, inflation rates, and overall economic growth that influence market conditions and the issuer’s ability to repay.

- Market Conditions: Liquidity levels, market sentiment, and the overall demand for bonds that can affect their price stability and ease of trading.

- Interest Rate Environment: Changes in prevailing interest rates influence bond prices and yield attractiveness, impacting safety perceptions.

Role of Credit Rating Agencies and Their Rating Systems

Credit rating agencies play a pivotal role in assessing the safety of bonds by providing standardized ratings that reflect the issuer’s creditworthiness. These agencies analyze financial statements, debt levels, cash flow, and other relevant data to assign ratings that help investors evaluate relative risk levels.The rating systems typically categorize bonds into tiers such as:

Investment Grade: Ratings from AAA (highest quality, lowest risk) through BBB- (lower end of investment grade). Bonds in this category are considered relatively safe for most investors.

Non-Investment Grade (High-Yield or Junk Bonds): Ratings below BBB-, indicating higher risk of default but offering higher yields to compensate for the increased risk.

These ratings are updated periodically to reflect changes in the issuer’s financial situation or economic environment, serving as vital tools for investors to gauge bond safety.

Key Indicators for Assessing Bond Safety

When evaluating bonds, investors should analyze a comprehensive set of indicators that reveal the potential risks associated with each investment. These include:

- Issuer Creditworthiness: Examining credit ratings, financial ratios (such as debt-to-equity and interest coverage), and recent financial statements to assess the issuer’s ability to fulfill its debt obligations.

- Default History: Reviewing the issuer’s past record of default or late payments, which offers insight into their reliability.

- Economic and Industry Conditions: Considering how macroeconomic trends and industry-specific challenges could impact the issuer’s financial stability.

- Market Liquidity: Ensuring there is sufficient trading volume for the bond, which affects the ease of buying or selling without significant price fluctuations.

- Interest Rate Trends: Monitoring current and projected interest rate movements, as rising rates typically decrease bond prices, affecting safety perceptions.

- Inflation Rates: High inflation can erode real returns and impact the issuer’s ability to meet fixed payment obligations.

By systematically analyzing these key indicators, investors can better determine the relative safety of bond investments and construct a diversified, risk-conscious portfolio.

Strategies for Investing in Bonds Safely

Investing in bonds can be a prudent way to generate steady income and preserve capital when approached with sound strategies. Implementing effective methods to diversify and structure a bond portfolio helps mitigate risks and enhances overall investment stability. These strategies are essential for investors seeking to balance safety with returns, especially in fluctuating market conditions.

By adopting techniques such as diversification and bond laddering, investors can reduce exposure to any single issuer or interest rate environment. These methods, combined with a disciplined research and selection process, form the foundation of a resilient and secure bond investment approach. The following sections detail key strategies to help investors navigate bond markets with confidence.

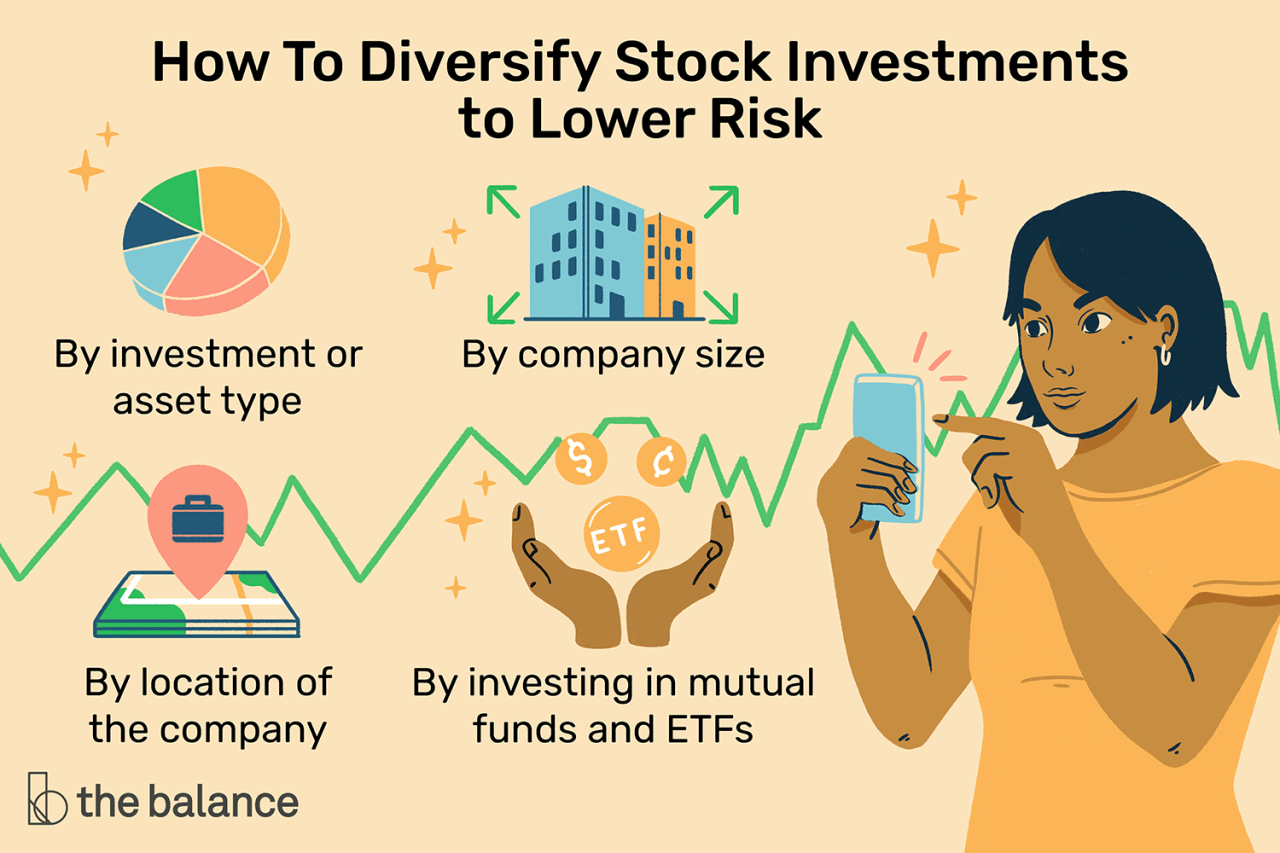

Diversifying Bond Portfolios to Minimize Risk

Achieving diversification across different types of bonds and issuers is vital for reducing overall portfolio risk. A well-diversified bond portfolio minimizes the impact of default or interest rate fluctuations on total returns.

- Invest in bonds from various sectors and issuers, including government, municipal, and corporate bonds, to spread risk across different credit profiles and economic sectors.

- Include bonds with varying credit ratings, balancing higher-yielding, lower-rated bonds with safer, investment-grade options.

- Allocate investments across different maturities to avoid overexposure to any particular interest rate environment.

- Utilize bond funds or ETFs that pool diversified bonds, providing instant exposure to multiple securities and reducing individual issuer risk.

Laddering Bonds to Balance Maturity Dates and Income Streams

Bond laddering involves constructing a portfolio with bonds that mature at different intervals. This strategy helps manage interest rate risk while providing a predictable income stream and flexibility to reinvest maturing bonds.

- Determine your investment horizon and income needs to establish appropriate maturity intervals, such as 1, 3, 5, 7, and 10 years.

- Select individual bonds for each maturity segment, prioritizing safety and credit quality for longer-term holdings.

- Reinvest proceeds from maturing bonds into new bonds with longer or similar maturities, maintaining the ladder structure over time.

- Monitor interest rate trends and adjust the maturity distribution to optimize yields and liquidity.

Step-by-Step Guide for Researching, Selecting, and Purchasing Bonds Safely

To ensure safety in bond investments, a systematic approach is essential. The following table Artikels a comprehensive process from initial research to purchase, emphasizing safety considerations at each stage.

| Step | Action | Details and Safety Considerations |

|---|---|---|

| 1 | Identify Investment Goals | Determine your risk tolerance, income needs, and investment horizon to select appropriate bond types and maturities. |

| 2 | Conduct Preliminary Research | Review issuer credit ratings from agencies like S&P, Moody’s, or Fitch. Focus on investment-grade bonds to prioritize safety. |

| 3 | Analyze Market Data and Trends | Examine current interest rates, yield curves, and economic indicators to assess potential risks and opportunities. |

| 4 | Select Bonds Based on Criteria | Choose bonds with strong credit ratings, appropriate maturities, and favorable yield-to-maturity ratios. Avoid overly volatile or high-risk bonds. |

| 5 | Evaluate Issuer Financial Health | Review issuer financial statements, debt levels, and credit outlooks to ensure ongoing safety and reliability. |

| 6 | Place Orders through Reputable Channels | Use established brokers or financial institutions to purchase bonds, ensuring transparency and security of transactions. |

| 7 | Monitor Investment Performance | Regularly review issuer credit ratings, interest rate environment, and your portfolio’s diversification to maintain safety standards. |

Following this step-by-step approach enhances the safety and efficacy of bond investments, helping investors build resilient portfolios aligned with their financial goals.

Risks Associated with Bond Investments

Investing in bonds offers a relatively stable income stream and capital preservation, but it is not without risks. Understanding these potential pitfalls is essential for making informed investment choices and safeguarding your portfolio. Recognizing the nature of each risk helps investors develop strategies to mitigate their impact and enhance the safety of their bond investments.While bonds are generally considered safer than equities, they are susceptible to various risks that can affect returns and principal value.

These risks can stem from changes in interest rates, creditworthiness of issuers, inflation levels, and market liquidity. A comprehensive grasp of these factors enables investors to balance risk and reward effectively and to implement measures that shield their investments from adverse effects.

Interest Rate Risk

Interest rate risk, also known as market risk, arises from fluctuations in prevailing interest rates, which inversely affect bond prices. When interest rates rise, existing bond prices tend to fall, leading to potential capital losses if bonds are sold before maturity. Conversely, declining interest rates can increase bond prices but may lower yields for new issues.Investors can manage interest rate risk through diversification across bonds with different maturities, often referred to as a laddering strategy.

Shorter-duration bonds are less sensitive to interest rate changes, providing a measure of protection. Additionally, holding bonds to maturity ensures that investors receive the face value, though this does not eliminate price risk if liquidity needs arise prematurely.

Credit Risk

Credit risk pertains to the possibility that the bond issuer may default on interest payments or fail to return the principal at maturity. This risk is particularly relevant for lower-rated or high-yield bonds, which tend to offer higher yields to compensate for increased default probability.Mitigating credit risk involves thorough credit analysis before purchase, selecting bonds issued by financially stable entities, and diversifying across multiple issuers.

Investors may also consider investing in government bonds, which typically carry lower credit risk due to the backing of the issuing country’s government.

Inflation Risk

Inflation risk, or purchasing power risk, occurs when rising inflation erodes the real value of bond income and principal. Fixed-rate bonds are especially vulnerable because their payments remain constant regardless of inflation levels, diminishing their real return over time.To mitigate inflation risk, investors can allocate funds to inflation-protected securities such as Treasury Inflation-Protected Securities (TIPS) or diversify into assets that tend to outperform inflation, like equities or commodities.

These strategies help preserve the real value of investment returns amidst inflationary pressures.

Liquidity Risk

Liquidity risk involves the difficulty of buying or selling bonds without significantly impacting their price. Less traded bonds, or those issued by smaller entities, may not have an active secondary market, leading to potential challenges in exiting investments at fair value.Investors can reduce liquidity risk by focusing on bonds with higher trading volumes and established markets. Maintaining a diversified portfolio across various issuers and maturities also enhances liquidity flexibility.

Additionally, understanding the timing and costs associated with selling bonds before maturity is vital for effective portfolio management.

| Risk Type | Description | Potential Impact | Mitigation Strategies |

|---|---|---|---|

| Interest Rate Risk | Risk from fluctuations in market interest rates affecting bond prices. | Capital losses if rates rise; reduced income if rates fall. | Diversify maturities; laddering strategy; hold bonds to maturity. |

| Credit Risk | Risk of issuer defaulting on payments. | Loss of interest income or principal. | Perform credit analysis; diversify issuers; prefer government bonds. |

| Inflation Risk | Loss of purchasing power due to rising inflation. | Reduced real returns over time. | Invest in TIPS; diversify into inflation-resistant assets. |

| Liquidity Risk | Difficulty in selling bonds without affecting price. | Potential losses or inability to exit position timely. | Choose highly traded bonds; diversify holdings; understand market conditions. |

Best Practices for Safe Bond Investment

Investing in bonds can be a reliable strategy for generating steady income and preserving capital when approached with diligence and strategic planning. Implementing best practices ensures that your bond investments align with your financial goals while minimizing risks. Adopting disciplined procedures and maintaining ongoing assessments of your portfolio are essential components of a safe bond investment approach.

These practices involve setting clear investment objectives, continuously monitoring credit ratings, staying informed about economic shifts, and regularly reviewing and rebalancing your bond holdings. Incorporating a structured checklist for ongoing safety assessments can significantly enhance your ability to respond to market changes effectively and safeguard your investments.

Establishing Clearly Defined Investment Goals

Setting specific, measurable, and realistic investment goals provides a foundation for making informed bond investment decisions. Whether aiming for income generation, capital preservation, or a combination of both, clearly defined objectives help determine appropriate bond types, maturities, and risk levels.

- Determine your target return and time horizon to align your bond selections accordingly.

- Assess your risk tolerance and how it influences your choice between government, municipal, or corporate bonds.

- Establish benchmarks to evaluate your investment performance regularly.

Monitoring Credit Ratings Consistently

Credit ratings serve as vital indicators of a bond issuer’s financial health and default risk. Regularly tracking ratings from agencies such as Moody’s, Standard & Poor’s, or Fitch helps you identify potential declines in creditworthiness and take timely action to mitigate risk.

- Subscribe to updates from credit rating agencies for changes in bond issuer ratings.

- Understand the implications of rating downgrades, which often lead to price declines.

- Adjust your portfolio as needed to avoid overexposure to lower-rated bonds that may pose increased risks.

Staying Informed About Economic and Market Changes

Economic conditions significantly influence bond markets. Staying updated on macroeconomic indicators, interest rate trends, inflation data, and fiscal policies enhances your ability to anticipate market movements and adjust your strategies proactively.

- Regularly review economic reports from reputable sources such as government agencies and financial news outlets.

- Follow central bank policies and interest rate decisions that impact bond yields and prices.

- Be aware of geopolitical events or fiscal policy shifts that could influence market stability and bond performance.

Procedures for Regular Portfolio Review and Rebalancing

Maintaining a balanced bond portfolio requires periodic review to ensure that your investment allocations continue to meet your goals and risk tolerance. Rebalancing involves adjusting holdings to maintain desired asset proportions, especially following market fluctuations.

- Set a review schedule, such as quarterly or biannual assessments, to evaluate portfolio performance.

- Compare current holdings against your original asset allocation plan.

- Identify bonds that have appreciated or depreciated significantly and decide whether to buy, hold, or sell based on your objectives.

- Reallocate funds to diversify or concentrate holdings, ensuring you remain aligned with your risk profile.

- Record changes and analyze the impact on your overall investment strategy.

Ongoing Safety Assessment Checklist

Implementing a structured checklist helps maintain vigilance over your bond investments, quickly identifying potential risks and opportunities to act proactively. The following items serve as a comprehensive guide for ongoing safety evaluations:

| Checklist Item | Assessment Criteria |

|---|---|

| Creditworthiness of Issuer | Review latest credit ratings and financial statements; monitor for downgrades or financial distress signals. |

| Interest Rate Environment | Assess current and projected interest rates; understand how changes may affect bond prices and yields. |

| Market Liquidity | Evaluate the liquidity of your bond holdings; ensure you can sell bonds without significant loss if necessary. |

| Economic Indicators | Track inflation rates, GDP growth, employment data, and fiscal policies influencing bond markets. |

| Portfolio Diversification | Ensure diversified exposure across sectors, issuers, and maturities to mitigate risks. |

| Yield Analysis | Compare bond yields to current market averages; identify any discrepancies indicating potential issues. |

| Legal and Structural Features | Review provisions such as call options, covenants, and maturity dates for risk considerations. |

| Reinvestment Risk | Assess the likelihood of having to reinvest proceeds at lower interest rates. |

Consistently applying this checklist helps you identify early warning signs and maintain a resilient bond investment portfolio aligned with your safety goals.

Epilogue

In conclusion, employing proper safety assessment criteria, diversifying your bond investments, and continuously monitoring economic factors are vital strategies to safeguard your investments. By adhering to best practices, investors can enjoy the benefits of bond investing while minimizing potential risks and ensuring long-term financial stability.