Learning how to invest as small business owner is essential for maximizing financial growth and securing long-term success. Understanding the fundamentals of managing both personal and business finances lays the foundation for making informed investment decisions that align with your unique goals. By carefully evaluating your current financial health and establishing clear investment objectives, you can create a strategic approach that fosters stability and growth.

This comprehensive guide explores various investment options suitable for small business owners, strategies for starting with limited capital, risk management techniques, and ways to leverage investments to fund business expansion. Additionally, it emphasizes the importance of legal and tax considerations to ensure compliant and tax-efficient investing, ultimately empowering you to make confident financial choices.

Fundamentals of Investing for Small Business Owners

Investing as a small business owner requires a clear understanding of both personal and business financial health. This foundational knowledge ensures that investment decisions support your overall financial stability and growth objectives. Proper assessment and strategic differentiation between personal and business investments enable owners to optimize returns while managing risks effectively.

Establishing sound investment practices begins with analyzing current financial conditions and defining clear goals aligned with your business and personal aspirations. This process involves evaluating assets, liabilities, income, and expenses to understand available capital and capacity for investment. By doing so, small business owners can make informed decisions that bolster their long-term financial security and business growth.

Assessing Current Financial Health

Accurate assessment of your financial health is crucial before entering the investment arena. It involves compiling all pertinent financial data into an organized format to identify strengths and areas needing improvement.

| Assets | Liabilities | Income | Expenses |

|---|---|---|---|

| Cash savings, inventory, equipment, property | Loans, credit card debts, outstanding bills | Monthly revenue, sales income, passive income streams | Operational costs, salaries, utilities, loan repayments |

Formula for Net Worth:

Net Worth = Total Assets – Total Liabilities

By calculating your net worth and analyzing cash flow patterns, you can determine your capacity for investment, identify surplus funds, and understand potential risks. Regularly updating this data maintains an accurate picture of your financial standing, essential for strategic investment planning.

Differentiating Personal and Business Investments

Distinguishing between personal and business investments is vital for effective financial management and compliance. Separating these investments helps clarify your risk exposure, tax obligations, and financial goals specific to each domain.

Strategies to maintain clear boundaries include:

- Creating separate bank accounts for personal and business finances.

- Keeping detailed records of transactions related to each domain.

- Allocating specific funds for business expansion and personal wealth building.

- Consulting with financial advisors to establish appropriate investment accounts and structures.

This separation simplifies tracking investment performance and ensures transparency, especially during tax filings or audits. It also facilitates targeted investment strategies aligned with each area’s specific financial objectives.

Common Investment Goals for Small Business Owners

Aligning investment strategies with well-defined goals enhances decision-making and prioritizes resource allocation. Understanding typical objectives helps owners tailor their investments to support both personal security and business growth.

Some common investment goals include:

- Building Emergency Funds: Ensuring liquidity to cover unforeseen expenses or downturns.

- Retirement Planning: Growing retirement savings through contributions to pension plans, IRAs, or other long-term vehicles.

- Business Expansion: Investing in new equipment, technology, or marketing to increase business capacity.

- Wealth Accumulation: Diversifying investments across stocks, bonds, or real estate to generate passive income and capital appreciation.

Setting clear, measurable goals with timelines helps prioritize investments, manage expectations, and evaluate progress effectively. Regular review and adjustment of these goals ensure that your investment strategies remain aligned with evolving business and personal circumstances.

Types of Investment Options Suitable for Small Business Owners

Understanding the array of investment options available is crucial for small business owners seeking to grow their financial resources while managing risks effectively. Choosing the right investment vehicles depends on individual risk tolerance, liquidity needs, and long-term financial goals. This section explores various investment options, comparing their features and suitability for small business owners.

Traditional Investment Vehicles

Small business owners can diversify their investment portfolio by considering traditional investment options, each with distinct risk profiles and potential returns. Recognizing the characteristics of stocks, bonds, real estate, and mutual funds enables informed decision-making aligned with personal and business financial strategies.

| Investment Type | Risk Level | Liquidity | Typical Return |

|---|---|---|---|

| Stocks | High | High | 7-10% annually over the long term |

| Bonds | Low to Moderate | Moderate | 2-5% annually |

| Real Estate | Moderate to High | Low to Moderate | Varies; typically 8-12% annual appreciation and rental income |

| Mutual Funds | Moderate | Moderate to High, depending on fund | 5-8% annually |

Alternative Investment Options

Beyond traditional assets, alternative investments like peer-to-peer (P2P) lending and crowdfunding are gaining popularity among small business owners. These options often provide diversification opportunities and access to new markets or asset classes that were previously less accessible.

Peer-to-peer lending allows investors to lend money directly to individuals or small businesses via online platforms, earning interest over time. Crowdfunding involves raising capital through small contributions from a large number of people, often in exchange for products, equity, or other rewards.

- Peer-to-Peer Lending

- Pros: Higher potential returns than traditional savings; helps diversify income sources; relatively straightforward to access online.

- Cons: Risk of borrower default; less liquid than stocks or bonds; platform risks and regulatory uncertainties.

- Crowdfunding

- Pros: Access to early-stage investment opportunities; supports innovative projects; can generate significant capital.

- Cons: High risk of project failure; potential for lower returns; requires thorough due diligence.

Guidance for Selecting Suitable Investments

Choosing the right investment options involves assessing your risk appetite, financial goals, and investment horizon. Small business owners should consider a balanced approach, integrating both traditional and alternative investments based on their capacity to withstand market fluctuations and their need for liquidity.

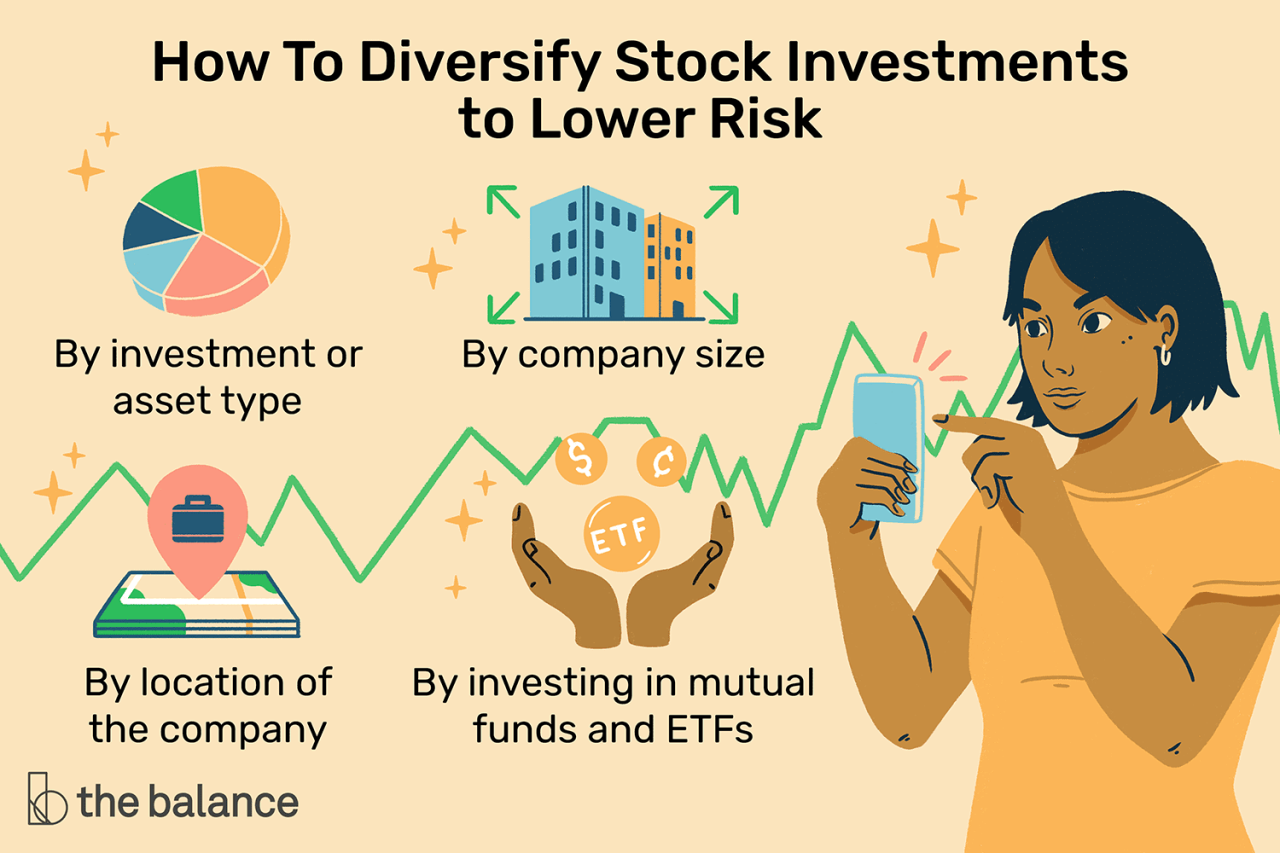

A prudent strategy balances risk and return, aligning investment choices with long-term business goals and personal financial stability. Diversification across various assets helps mitigate potential losses while optimizing growth potential.

For instance, a business owner with a high risk tolerance and a long-term horizon may favor equities and real estate, while those seeking stability might prefer bonds and fixed-income instruments. Regular review and adjustment of the investment portfolio ensure alignment with evolving business circumstances and financial objectives.

Strategies for Investing with Limited Capital

Starting to invest as a small business owner does not require a large initial sum. With strategic approaches, even limited funds can be effectively utilized to build a diversified investment portfolio. Employing methods tailored for small-scale investors enables you to grow your wealth gradually while managing associated risks.

Implementing specific strategies such as micro-investing and dollar-cost averaging allows small business owners to enter the investment arena confidently. These approaches help in smoothing out market volatility and optimizing returns over time, even when available capital is minimal. Establishing a systematic investment plan and choosing suitable platforms further supports sustainable growth and risk mitigation.

Methods to Start Investing with Minimal Funds

Small business owners often face cash flow constraints, making it essential to adopt investment methods that require low initial capital. Micro-investing and dollar-cost averaging are practical solutions that facilitate regular investment with small amounts, making investing accessible and manageable.

- Micro-investing: Enables investing tiny amounts of money into diversified portfolios through specialized platforms. These platforms often allow starting investments with as little as $5, making them perfect for those with limited funds.

- Dollar-cost averaging (DCA): Involves consistently investing a fixed amount of money at regular intervals, regardless of market fluctuations. This approach reduces the impact of volatility and minimizes the risk of investing a lump sum at an inopportune time.

Step-by-Step Procedures for Setting Up an Investment Account

Properly establishing an investment account lays the foundation for disciplined investing. The following procedures provide a clear roadmap for small business owners to start their investment journey efficiently:

- Determine your investment goals: Clearly define whether you’re aiming for growth, income, or a combination, to guide your platform and asset class choices.

- Research suitable investment platforms: Choose platforms that cater to small investors, offer low minimum deposits, and have transparent fee structures.

- Gather necessary documentation: Prepare identification proof, proof of address, and relevant business documents if necessary.

- Create an account: Complete the online registration process by providing personal and financial details as required.

- Fund your account: Make your initial deposit using a bank transfer, debit card, or other available methods, ensuring compliance with platform requirements.

- Select investments: Choose diversified assets aligned with your risk tolerance and investment objectives.

- Implement your investment plan: Set up automatic contributions if possible, to maintain consistency and discipline in investing.

Approaches to Maximize Returns While Minimizing Risks with Small Amounts

Optimizing returns and managing risks are crucial, especially when working with limited capital. Small investors should adopt diversified strategies, leverage compound interest, and stay informed to make smarter decisions.

- Diversification: Spread investments across various asset classes and sectors to mitigate risk. Micro-investing platforms often provide diversified portfolios tailored for small investors.

- Consistent contributions: Regularly investing even small amounts helps to capitalize on dollar-cost averaging, reducing exposure to market timing risks.

- Reinvestment of dividends and interest: Reinvesting earnings accelerates growth by compounding returns over time.

- Continuous education and monitoring: Stay updated on market trends and review investment performance periodically to make necessary adjustments.

Comparison of Low-Capital Investment Platforms

Different platforms offer various features suited for small-scale investors. The following table compares some of the most popular options based on features, minimum deposit requirements, fees, and investment choices:

| Platform Name | Minimum Deposit | Fees | Investment Options | Unique Features |

|---|---|---|---|---|

| Acorns | $5 | Round-up fee of $1, $2, or $3/month | ETFs, diversified portfolios | Automatic micro-investing from spare change |

| Robinhood | $0 | Commission-free trading; no account minimum | Stocks, ETFs, options, cryptocurrencies | Real-time trading with no commissions |

| Stash | $5 | Monthly fee of $1-$3 depending on plan | Stocks, ETFs, retirement accounts | Educational resources for beginners |

| Wealthfront | $500 | 0.25% annual management fee | Automated diversified portfolios | Robust planning tools and tax optimization |

| M1 Finance | $100 | Zero commission; optional premium plans | Custom portfolios, ETFs, stocks | Automated investing with full customization |

Funding Business Growth Through Investments

For small business owners aiming to expand their operations, leveraging investments as a means to fund growth is a strategic approach. Identifying opportunities that align with the business’s goals and financial capacity can provide sustainable pathways for development without overextending resources. Effective reinvestment of profits and careful evaluation of potential investment avenues can significantly enhance a business’s capacity to scale and thrive in competitive markets.

Investments can serve as a catalyst for business expansion by generating additional income streams, increasing capital reserves, and enabling access to new markets or technologies. The key lies in pinpointing investment options that not only grow wealth but also complement and support the core business activities, ensuring long-term sustainability and resilience.

Identifying Investment Opportunities that Support Business Expansion

Small business owners should continually scan their industry landscape, market trends, and technological advancements to spot opportunities that can directly benefit their growth objectives. These include investments in equipment upgrades that improve efficiency, purchasing property for expansion, or funding research and development for new product lines. Additionally, exploring strategic partnerships or joint ventures can open doors to new customer bases or distribution channels.

Assessing the potential return on investment (ROI), alignment with the business’s long-term vision, and the risk profile of each opportunity is essential. Conducting market research, seeking advice from financial advisors, and analyzing competitors’ expansion strategies can provide valuable insights into viable investment avenues.

Methods for Reinvesting Profits into Business or Personal Investments

Reinvestment strategies are crucial for nurturing business growth and building personal wealth. Small business owners can adopt various methods to allocate profits effectively:

- Plowing profits back into the business to fund new product development, marketing campaigns, or infrastructure upgrades that enhance operational capacity.

- Setting aside a reserve fund for unforeseen opportunities or challenges, ensuring financial stability during expansion phases.

- Investing in technology and innovation to streamline processes, reduce costs, and stay competitive.

- Contributing to retirement or personal investment accounts to build long-term wealth, which can later be tapped into for additional business investments.

- Funding educational or skill development programs that increase the business owner’s expertise and networks, indirectly supporting business growth.

Processes for Evaluating Potential Investments Supporting Business Sustainability

Evaluating investment opportunities requires a systematic approach that considers both financial metrics and strategic fit. The following process can guide small business owners in making informed decisions:

- Define clear investment objectives aligned with business goals, such as revenue growth, market expansion, or operational efficiency.

- Conduct thorough due diligence including financial analysis, market research, and risk assessment. This involves reviewing financial statements, projected cash flows, and market conditions.

- Calculate expected ROI and payback period to determine the potential profitability and time needed to recover the investment costs.

- Assess strategic alignment ensuring that the investment complements existing operations and future plans.

- Review legal and compliance considerations to prevent regulatory issues or contractual complications.

- Implement a monitoring plan to track performance post-investment and make adjustments as necessary, ensuring ongoing alignment with business sustainability.

Investment Types that Generate Passive Income to Fund Business Activities

Passive income investments can provide a steady cash flow, which can be channeled back into the business or personal financial buffer. Several investment options are suitable for small business owners seeking income streams with minimal active management:

| Investment Type | Description | Advantages | Considerations |

|---|---|---|---|

| Dividend Stocks | Shares of companies that regularly distribute profits to shareholders. | Provides regular income and potential capital appreciation. | Subject to stock market volatility; requires initial research. |

| Real Estate Properties | Rental properties generating monthly rental income. | Appreciation potential and tax benefits; tangible asset. | Requires management effort; market fluctuations can impact income. |

| Peer-to-Peer Lending | Lending money through online platforms to individuals or small businesses. | Steady interest income; diversified lending options. | Risk of borrower default; returns depend on platform performance. |

| REITs (Real Estate Investment Trusts) | Investments in diversified real estate portfolios traded like stocks. | Liquidity and diversification; dividend yields. | Market risk; dividends may vary based on property performance. |

| Index Funds | Mutual funds tracking market indices, offering broad market exposure. | Passive growth and income, low fees. | Market risk; long-term horizon recommended. |

Generating passive income through diversified investments provides a financial buffer, enabling small business owners to reinvest in their core operations while maintaining steady cash flows.

Legal and Tax Considerations for Small Business Investment

Investing as a small business owner involves navigating a complex landscape of legal requirements and tax implications. Proper understanding of these factors is essential to maximize investment benefits while ensuring compliance with applicable laws. This section provides guidance on the procedures for understanding tax implications, legal documentation needed, tax-efficient strategies, and a comparative overview of different investment types from a tax perspective.

Small business owners must approach investments with a clear understanding of both legal obligations and tax consequences. Effective management in this area not only prevents legal issues but also enhances overall profitability through strategic tax planning. Being informed about regulatory requirements and utilizing tax-advantaged investment options can contribute significantly to sustainable business growth.

Procedures for Understanding Tax Implications of Various Investments

Comprehending the tax implications associated with different investment types requires a systematic approach. Small business owners should start by consulting reliable resources such as tax codes, official government publications, and professional tax advisors. Conducting a thorough analysis of each investment’s tax treatment involves examining its classification—whether it is considered capital gains, ordinary income, or tax-exempt income—and understanding the relevant tax rates and exemptions.

Staying updated on changing tax laws through continuous education and professional advice is crucial. Many jurisdictions provide detailed guidance on the tax treatment of investments, including specific rules for small business owners. Utilizing accounting software tailored for small businesses can also aid in tracking taxable events and preparing accurate tax filings related to investment activities.

Legal Requirements and Documentation Needed for Investment Activities

Engaging in investment activities necessitates adherence to legal protocols and meticulous documentation. Small business owners should ensure proper authorization and record-keeping to demonstrate compliance and facilitate audits. Key legal requirements include establishing clear investment agreements, understanding ownership rights, and ensuring compliance with securities laws when applicable.

Documentation should encompass:

- Investment contracts or agreements detailing terms and conditions

- Proof of ownership or share certificates

- Records of fund transfers and transaction receipts

- Tax filings related to investment income

- Compliance certificates or licenses if required by local regulations

Maintaining organized records not only supports legal compliance but also assists in tax reporting and future audits. Leveraging legal counsel or financial advisors familiar with small business investments can help ensure all legal and documentation requirements are thoroughly met.

Common Tax-Efficient Investment Strategies Suitable for Small Business Owners

Tax efficiency is a key consideration when selecting investment options. Small business owners should incorporate strategies that minimize tax liabilities while maximizing returns. Examples include utilizing tax-advantaged accounts, investing in assets that offer tax credits or deductions, and timing investments to optimize tax periods.

“Tax-efficient investing involves structuring investments to reduce taxable income and leverage available tax incentives, ultimately enhancing net gains.”

Strategies include:

- Contributing to retirement plans such as SEP IRA, SIMPLE IRA, or Solo 401(k), which often offer immediate tax deductions and tax-deferred growth

- Investing in eligible small business stock or venture capital funds that qualify for tax credits or exemptions

- Utilizing depreciation and amortization schedules for business assets to reduce taxable income

- Engaging in tax-loss harvesting—selling investments at a loss to offset gains from other investments

Comparison Table of Tax Treatment for Different Investment Types

Understanding the tax treatment of various investment options enables small business owners to make informed decisions aligned with their financial goals. The table below summarizes common investment types, their typical tax implications, and relevant notes:

| Investment Type | Tax Treatment | Notes |

|---|---|---|

| Stocks and Equities | Capital gains taxed at applicable rates; dividends may be taxed as ordinary income or qualified dividends at lower rates | Holding period affects tax rate; long-term gains favored for tax efficiency |

| Bonds and Fixed Income | Interest income taxed as ordinary income; capital gains on bond sales may also be taxable | Municipal bonds may be tax-exempt at the federal level |

| Real Estate | Rental income taxed as ordinary income; capital gains may be deferred or reduced via 1031 exchanges | Depreciation can offset income; primary residence may have exclusions |

| Retirement Accounts | Contributions often tax-deductible; growth tax-deferred; withdrawals taxed as ordinary income | Examples include SEP IRAs, Solo 401(k)s; contribution limits vary |

| Equity in Small Business or Venture Capital | Qualifies for capital gains treatment; potential for tax credits if investing in qualifying startups | Subject to specific regulations; risks are higher but potential for significant tax benefits |

Summary

In conclusion, mastering how to invest as small business owner involves a balanced approach that considers your financial health, risk appetite, and growth aspirations. By diversifying your investments, managing risks effectively, and reinvesting wisely, you can build a resilient financial foundation that supports ongoing business development and personal wealth accumulation. Taking these strategic steps will help you turn investments into powerful tools for long-term success.