Exploring how to invest in bonds vs stocks offers valuable insights into building a diversified and resilient investment portfolio. Understanding the fundamental distinctions, risk profiles, and strategic approaches can empower investors to make informed decisions aligned with their financial objectives. Whether seeking stability or growth, knowing when and how to allocate assets between bonds and stocks is essential for optimizing investment outcomes.

This discussion covers critical aspects such as performance trends, risk and return profiles, tax implications, and market timing considerations, providing a comprehensive guide for investors at all levels.

Overview of Investments in Bonds vs Stocks

Investing in bonds and stocks represents two fundamental approaches to building wealth and securing financial stability. Each asset class offers distinct characteristics, benefits, and risks that cater to different investor profiles and goals. Understanding these differences is essential for constructing a diversified portfolio aligned with personal risk tolerance and investment horizon.

Over the past five decades, bonds and stocks have demonstrated divergent performance trends. Historically, stocks have delivered higher average returns, driven by capital appreciation and dividends, but with increased volatility. Bonds, on the other hand, have provided more stable income streams and capital preservation, often serving as a buffer during market downturns. Analyzing these trends helps investors appreciate the long-term potential and limitations of each asset class, guiding their strategic investment decisions.

Key Differences in Ownership, Returns, and Risk

Ownership structures, potential returns, and associated risks fundamentally differentiate bonds from stocks. Bonds are debt instruments issued by corporations or governments, representing a loan made by the investor to the issuer. In contrast, stocks signify ownership in a company, granting shareholders equity stakes and voting rights. Returns on bonds primarily consist of interest payments, known as coupons, and the return of principal at maturity.

Stocks generate returns through price appreciation and dividends, which are not guaranteed and fluctuate with company performance and market conditions.

The risk profiles of these assets also diverge significantly. Bonds generally offer lower risk, especially government bonds, but with correspondingly lower yields. Corporate bonds carry higher risk relative to government bonds but remain less volatile than stocks. Stocks are more susceptible to market volatility, economic cycles, and company-specific risks, which can result in substantial capital losses. Their higher risk is often compensated by the possibility of greater returns over the long term.

Historical Performance Trends of Bonds and Stocks

Examining the last 50 years reveals contrasting performance patterns. During this period, stock markets have seen periods of rapid growth, such as the bull markets of the 1980s and 1990s, with cumulative annual returns often exceeding 8-10%. However, they have also experienced significant downturns, including the dot-com crash in 2000 and the financial crisis of 2008, which caused sharp declines.

Despite volatility, long-term equity investments have generally outperformed other asset classes.

Bonds have provided steady income and capital preservation, with long-term government bonds averaging annual returns in the vicinity of 5-6%. During periods of economic uncertainty, such as the 2008 crisis, bonds, especially government securities, acted as safe havens, reducing portfolio volatility. The low-interest-rate environment of recent years has compressed bond yields, but their stability remains valuable for risk-averse investors.

Comparison Table of Bonds vs Stocks

Understanding the key features of bonds and stocks through a comparative table helps clarify their roles within an investment portfolio:

| Feature | Bonds | Stocks |

|---|---|---|

| Ownership | Loan to issuer, no ownership rights | Ownership stake in a company, voting rights |

| Returns | Periodic interest payments (coupons) and principal repayment | Capital gains and dividends |

| Risk | Lower risk, subject to credit and interest rate risk | Higher risk, market volatility and company-specific risks |

| Liquidity | Generally liquid; varies with issuer and market | Typically highly liquid in major markets |

| Maturity | Specified maturity date, after which principal is repaid | Indefinite; can be sold anytime in liquid markets |

| Dividend Yields | Typically pays fixed interest, no dividends | Potentially pays dividends, which vary based on company performance |

Investor Profiles for Bonds and Stocks

Different investment vehicles suit varying investor profiles based on risk tolerance, investment horizon, and income needs. Bonds are generally favored by conservative investors seeking capital preservation and steady income, such as retirees or those nearing retirement. They are also suitable for investors with shorter time horizons who prefer less volatility and predictable returns.

Stocks attract investors with a higher risk appetite aiming for growth and wealth accumulation over the long term. Younger investors or those with a longer investment horizon often diversify with stocks to capitalize on market appreciation. Additionally, investors seeking income might favor dividend-paying stocks, while those comfortable with market fluctuations may pursue growth stocks for higher potential returns.

Risk and Return Profiles

Understanding the risk and potential returns associated with bonds and stocks is essential for constructing a balanced investment portfolio. Each asset class presents unique risk factors and return patterns that can influence investment decisions based on individual financial goals, risk tolerance, and market conditions.

While stocks typically offer higher growth potential, they also come with increased volatility and risk. Bonds, on the other hand, generally provide more stable income streams with comparatively lower risk but tend to deliver modest returns. Recognizing these differences helps investors align their investment choices with their financial objectives and risk appetite.

Risk Factors of Bonds versus Stocks

Investing in bonds and stocks involves distinct risk profiles shaped by various market and economic factors. Bonds are primarily affected by credit risk, interest rate fluctuations, and inflation, whereas stocks are more susceptible to market volatility, company performance, and economic cycles. It is crucial for investors to understand these risks to make informed decisions and develop strategies to mitigate potential losses.

For bonds, credit risk refers to the possibility that the issuer may default on interest payments or repay the principal late. Interest rate sensitivity involves bond prices decreasing when interest rates rise and vice versa. Economic downturns can also impact bond returns, especially for lower-rated or high-yield bonds.

Stocks, in contrast, experience fluctuations driven by company earnings, industry trends, geopolitical events, and overall economic health. Market volatility can cause sharp price swings, affecting short-term gains and losses. Despite these risks, stocks historically offer higher long-term returns, compensating for their increased volatility.

Expected Return Ranges in Different Economic Conditions

The potential returns from bonds and stocks vary significantly depending on economic environments. During periods of economic expansion, stocks tend to outperform bonds due to rising corporate earnings and investor confidence, typically generating annual returns of 8-12% on average over the long term. Conversely, in economic downturns or periods of uncertainty, stocks may produce negative returns or stagnate, while bonds, especially government bonds, often provide safer, stable yields around 2-4%.

In recessionary periods, high-quality bonds such as U.S. Treasuries can serve as a safe haven, delivering steady income with minimal risk. During inflationary phases, bonds with adjustable interest rates or inflation-protected securities tend to perform better. Meanwhile, some stocks, particularly those in sectors like utilities or consumer staples, may outperform during downturns due to their resilient demand.

Comparison of Volatility, Credit Risk, and Interest Rate Sensitivity

| Aspect | Bonds | Stocks |

|---|---|---|

| Volatility | Generally low; moderate fluctuations depending on interest rates and credit quality. | High; subject to market swings driven by economic news, earnings reports, and geopolitical events. |

| Credit Risk | Significant for corporate bonds; minimal for government bonds like U.S. Treasuries. | Not applicable in the traditional sense; company-specific risks impact stock prices. |

| Interest Rate Sensitivity | High; bond prices inversely correlate with interest rate movements. | Minimal; stock prices are influenced indirectly through economic conditions. |

Scenarios Where Bonds Outperform Stocks and Vice Versa

- Bonds outperform stocks: During periods of economic recession or financial crisis, investors seek safety, leading to increased bond prices, especially government bonds. When market volatility is high and stock prices decline sharply, bonds tend to provide stable income and preserve capital.

- Stocks outperform bonds: In times of economic growth, technological innovation, or corporate earnings booms, stocks typically generate higher returns. Low-interest-rate environments also encourage investment in equities, which can lead to substantial capital appreciation.

Investment Strategies for Bonds and Stocks

Developing effective investment strategies for bonds and stocks is essential for optimizing returns and managing risks in your portfolio. By understanding and applying various approaches, investors can better align their investments with their financial objectives and market conditions. This section explores common strategies such as buy-and-hold, dollar-cost averaging, and diversification, along with procedures for evaluating bonds and stocks to make informed decisions.

Additionally, a step-by-step guide is provided to assist in constructing a balanced portfolio tailored to both short-term and long-term financial goals.

Implementing sound investment strategies requires a disciplined approach and an understanding of the unique characteristics of bonds and stocks. Each strategy can serve different purposes within your overall financial plan. For example, buy-and-hold strategies tend to favor long-term growth, while dollar-cost averaging helps mitigate market volatility. Diversification, on the other hand, reduces risk by spreading investments across different asset classes and sectors.

Assessing the creditworthiness of bonds through credit ratings and evaluating stocks with valuation metrics such as Price-to-Earnings (P/E) ratios and dividend yields are crucial steps in the decision-making process. Building a comprehensive and balanced portfolio involves evaluating these factors in alignment with your specific financial timeline and risk tolerance.

Buy-and-Hold Strategy

The buy-and-hold strategy involves purchasing securities and retaining them over an extended period regardless of short-term market fluctuations. This approach is particularly effective for long-term investors aiming for steady growth, benefiting from compound interest and market appreciation over time. It requires patience and discipline, as it minimizes transaction costs and capital gains taxes associated with frequent trading. Investors should select quality bonds and stocks with strong fundamentals, and periodically review their holdings to ensure they align with their evolving financial goals.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is an investment technique where a fixed amount of money is invested at regular intervals, regardless of market conditions. This strategy helps to reduce the impact of volatility by purchasing more shares or bonds when prices are low and fewer when prices are high. DCA encourages disciplined investing and mitigates the risks associated with market timing. For example, an investor contributing $500 monthly to a diversified stock and bond portfolio benefits from automatic price averaging, which can potentially lower the average cost of investments over time.

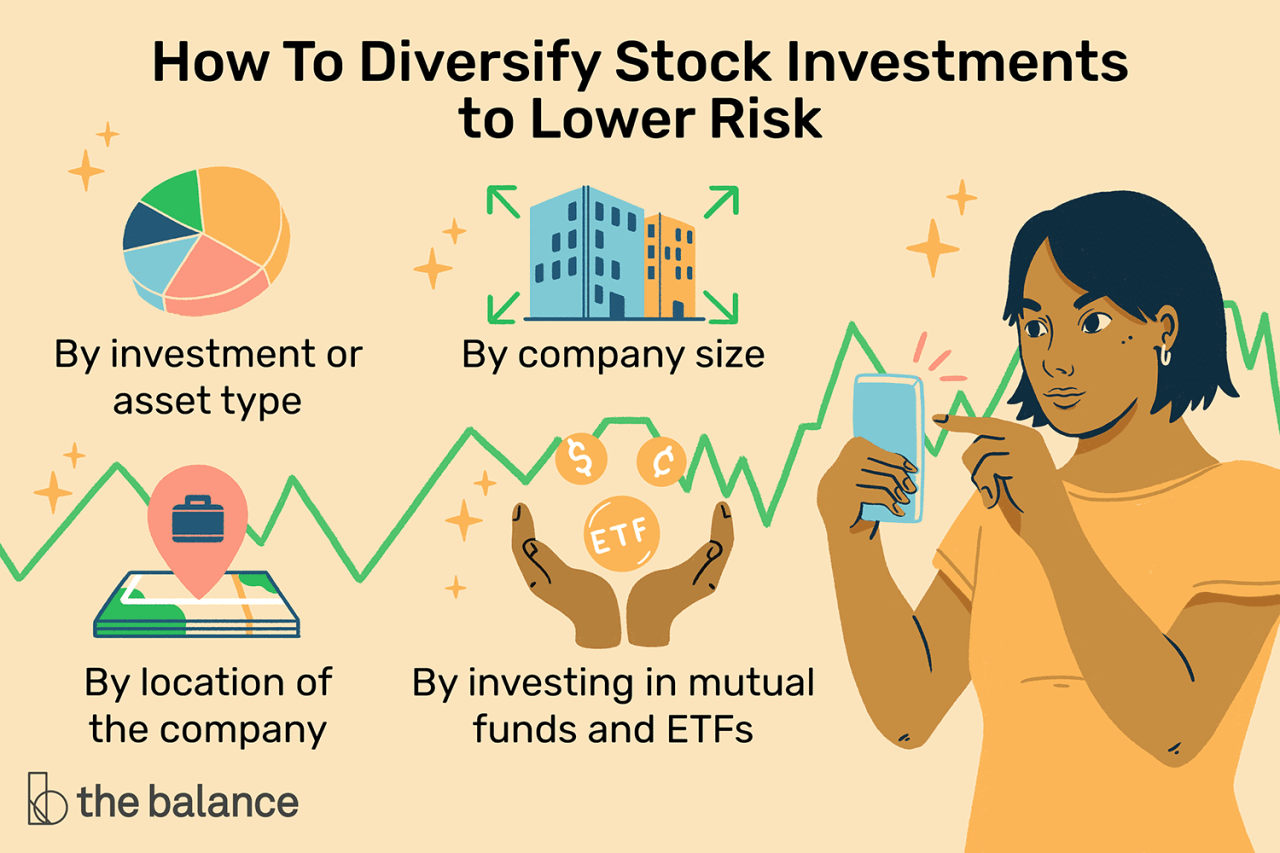

Diversification of Assets

Diversification involves spreading investments across various asset classes, sectors, and geographic regions to reduce overall risk. A well-diversified portfolio can withstand market downturns better because losses in one area may be offset by gains in another. For bonds, diversification might include holding government, municipal, and corporate debt with different maturities and credit qualities. For stocks, it involves investing across different industries such as technology, healthcare, and consumer goods.

Diversification is a fundamental principle that aims to enhance risk-adjusted returns and provide stability during volatile periods.

Assessing Bond Credit Ratings

Evaluating bond credit ratings is a critical step in determining the risk associated with a bond investment. Credit rating agencies like Standard & Poor’s, Moody’s, and Fitch provide ratings that reflect the issuer’s creditworthiness, ranging from high-grade (e.g., AAA, Aaa) to speculative or junk status. Higher-rated bonds typically offer lower yields but carry less default risk, making them suitable for conservative investors.

Lower-rated bonds may offer higher yields but come with increased risk of default. Investors should analyze these ratings alongside other factors such as issuer financials, economic conditions, and bond covenants to make informed choices.

Evaluating Stock Valuation Metrics

Assessing stocks involves analyzing various valuation metrics to determine if a stock is fairly valued, undervalued, or overvalued. Common metrics include the Price-to-Earnings (P/E) ratio, which compares a company’s stock price to its earnings per share, and dividend yield, which indicates the income return on investment. Additionally, metrics like Price-to-Book (P/B) ratio and Price-to-Sales (P/S) ratio provide further insight into a company’s valuation relative to its assets and revenues.

Investors should also review financial statements, earnings growth, and industry trends to form a comprehensive assessment of a stock’s potential for long-term growth and stability.

Building a Balanced Investment Portfolio

Constructing a balanced portfolio involves strategic selection and allocation of bonds and stocks based on individual risk tolerance, investment horizon, and financial objectives. The process begins with defining clear short-term and long-term goals, followed by determining an appropriate asset allocation. Typically, younger investors might emphasize stocks for growth, while older investors may prefer bonds for income and stability. The steps include selecting a mix of securities, diversifying across sectors and maturities, and periodically rebalancing to maintain the desired allocation.

For example, an investor with a 20-year horizon might allocate 70% to stocks and 30% to bonds, adjusting this ratio as their goals evolve or market conditions change.

Aligning Investment Choices with Financial Goals

Aligning investments with financial goals involves selecting assets and strategies that support both short-term needs and long-term aspirations. For immediate expenses or upcoming purchases, more conservative instruments like short-term bonds or dividend-paying stocks can provide liquidity and income. For retirement savings or wealth accumulation, growth-focused stocks and higher-yield bonds may be appropriate. Investors should consider their risk appetite, time horizon, and income requirements, employing strategies such as systematic investing, tax-efficient placements, and periodic reviews to ensure their portfolio remains aligned with their evolving objectives.

Advantages and Disadvantages of Bonds and Stocks

Investing in bonds and stocks offers distinct benefits and challenges that are essential to understand for making informed investment decisions. While both asset classes can contribute to a diversified portfolio, their inherent characteristics influence their suitability based on individual risk tolerance, investment goals, and market conditions. Recognizing the advantages and disadvantages of each can help investors optimize their strategies and manage expectations effectively.Understanding the benefits and limitations associated with bonds and stocks can provide clarity on their roles within an investment portfolio.

Bonds often serve as stable income sources and lower-risk options, whereas stocks generally offer higher growth potential but come with increased volatility. Evaluating these factors enables investors to align their choices with their financial objectives and risk appetite.

Benefits of Investing in Bonds

Bonds are popular among conservative investors primarily due to their stability and predictable income streams. They act as debt instruments issued by governments, municipalities, or corporations, promising fixed or variable interest payments over a specified period. The primary advantages of bonds include:

- Stable Income Generation: Bonds typically offer regular interest payments, providing a steady income that is suitable for retirees or those seeking predictable cash flows.

- Capital Preservation: When held to maturity, bonds generally return the principal amount, making them less susceptible to market fluctuations compared to stocks.

- Lower Volatility: Bonds tend to exhibit less price volatility, offering a safer investment option during economic downturns.

- Diversification Benefits: Including bonds in a portfolio can reduce overall risk and improve stability, especially when combined with equities.

Advantages of Investing in Stocks

Stocks are considered an equity investment, representing ownership in a company. They are favored for their potential to generate substantial growth and wealth accumulation over time. The key benefits include:

- Growth Potential: Stocks have historically provided higher returns compared to bonds, especially during bull markets. Investors can benefit from capital appreciation as companies expand and increase their earnings.

- Ownership Rights: Stockholders often enjoy voting rights in corporate decisions and may receive dividends, creating a sense of ownership and participation in company performance.

- Higher Liquidity: Stocks traded on major exchanges are generally easy to buy and sell, providing flexibility in managing investments.

- Dividend Income: Regular dividend payments can supplement income, especially from established companies with a history of consistent dividends.

Disadvantages and Risks

Despite their benefits, both bonds and stocks carry inherent risks that investors must consider:

- Interest Rate Risk for Bonds: When prevailing interest rates rise, existing bond prices tend to fall, potentially leading to capital losses if bonds are sold before maturity. For example, if an investor holds a 10-year bond at a 3% coupon rate and market rates increase to 4%, the bond’s market value decreases to align with current yields.

- Market Volatility for Stocks: Stock prices can fluctuate dramatically within short periods due to economic, political, or company-specific factors. This volatility can result in significant losses, especially if investments are sold during downturns.

- Liquidity Risks: While stocks are generally liquid, certain bonds, particularly those issued by smaller entities or with lower credit ratings, may face difficulties in being sold quickly without a discount.

- Risk-Return Tradeoff: Higher potential returns from stocks come with increased risk, including the possibility of losing principal. Conversely, bonds offer safety but with limited growth prospects, which may not keep pace with inflation over the long term.

Comparing bonds and stocks reveals differences in liquidity, growth opportunities, and risk factors. Stocks typically provide greater growth potential and liquidity but at the cost of higher volatility and risk. Bonds, by contrast, tend to offer stability and fixed income, making them suitable for risk-averse investors or those nearing retirement, but they may limit growth during periods of rising inflation or interest rates.

Tax Implications and Costs

Investors need to understand the tax treatment and associated costs linked to bonds and stocks to optimize their investment returns and ensure compliance with fiscal regulations. These factors can significantly influence the net gains from each asset class and should be carefully considered when constructing an investment portfolio. The differences in how bond interest and stock dividends are taxed, along with transaction costs and management fees, can impact the overall profitability and tax efficiency of an investment.

Strategies that consider these costs and tax implications can help investors maximize after-tax returns, balancing risk and income in their investment approach.

Tax Treatment Differences Between Bond Interest and Stock Dividends

Understanding the tax treatment of income generated from bonds and stocks is crucial for investors aiming to optimize their after-tax returns.

Bond interest income is generally taxed as ordinary income at the investor’s marginal tax rate. This means that the income from bonds is subject to the same tax rate as wages or salary, which can be relatively high depending on the investor’s tax bracket. For example, if an investor is in a 35% tax bracket, the interest earned on bonds will be taxed at that rate, reducing the net income received.

In contrast, stock dividends can be taxed differently depending on the type of dividend. Qualified dividends, which meet certain holding period requirements and are paid by U.S. corporations or qualified foreign companies, are taxed at a lower capital gains rate, typically ranging from 0% to 20%. Non-qualified or ordinary dividends are taxed as ordinary income, similar to bond interest, but with some distinctions based on jurisdiction and individual circumstances.

Key Point: Bond interest is taxed as ordinary income, while qualified stock dividends may benefit from preferential tax rates, making dividends potentially more tax-efficient if received as qualified dividends.

Transaction Costs, Management Fees, and Tax Efficiency

The costs associated with investing in bonds and stocks can vary significantly and influence overall investment returns.

When evaluating costs, it is essential to consider transaction fees, management expenses, and tax efficiency. Bonds, especially individual securities, may involve higher transaction costs if actively traded, but generally, bond funds or ETFs can offer lower costs and diversification. Management fees for bond funds are usually modest but can add to the expense over time.

Stocks can be purchased with relatively low transaction fees, especially through online brokerages, and index funds or ETFs often have very low management fees, making them cost-effective options. However, active stock mutual funds tend to have higher management fees, which can eat into returns.

Tax efficiency is critical when managing investments. For bonds, holding them in tax-advantaged accounts like IRAs or 401(k)s can defer taxes on interest income, enhancing after-tax returns. For stocks, investment in tax-advantaged accounts allows dividends and capital gains to grow without immediate tax burdens, especially beneficial for long-term growth strategies.

| Aspect | Bond Investment | Stock Investment |

|---|---|---|

| Tax Treatment | Interest taxed as ordinary income | Dividends taxed as qualified or ordinary income |

| Transaction Costs | Moderate, higher if trading individual bonds; lower in funds | Lower, especially in ETFs and index funds |

| Management Fees | Typically modest, varies by fund | Often lower in index funds; higher in actively managed funds |

| Tax Efficiency | Enhanced through tax-advantaged accounts | Optimized via long-term holdings and tax-advantaged accounts |

Strategies to Optimize After-Tax Returns

Implementing effective strategies requires understanding the tax implications and costs associated with each asset class.

- Use tax-advantaged accounts such as IRAs and 401(k)s to defer or eliminate taxes on interest and dividends, maximizing growth potential.

- For bonds, consider holding municipal bonds if available within taxable accounts, as their interest income is often tax-exempt at the federal level, and sometimes state or local levels.

- In stocks, focus on holding investments long-term to benefit from lower capital gains tax rates on qualified dividends and long-term capital gains.

- Employ tax-loss harvesting by selling underperforming stocks to offset gains elsewhere, reducing overall tax liability.

- Balance high-yield bonds, which generate more taxable income, with stocks or municipal bonds to diversify tax implications and income sources.

By tailoring investment strategies to account for tax considerations and transaction costs, investors can significantly improve their net returns and build a more efficient portfolio aligned with their financial goals.

Market Conditions and Timing

Understanding how economic indicators influence the performance of bonds and stocks is crucial for making informed investment decisions. Market timing can significantly impact returns, especially when considering the economic cycle’s phases. Recognizing the interplay between macroeconomic data and market movements allows investors to optimize their asset allocations and navigate volatility effectively.Economic indicators such as GDP growth, inflation rates, unemployment figures, and consumer confidence serve as vital signals of the overall health of the economy.

These indicators directly influence both bond and stock markets but in different ways. For example, rising inflation often leads to higher interest rates, which can depress bond prices but may also signal a robust economy that could benefit certain stock sectors. Conversely, declining economic growth may prompt investors to favor bonds for their relative safety, while stocks might underperform due to diminished corporate earnings.Timing investments in bonds versus stocks requires careful analysis of these indicators within the context of the current economic cycle.

During expansion phases, stocks tend to outperform as corporate earnings grow, whereas bonds may offer lower yields. In contrast, during recessions or economic downturns, bonds—particularly government bonds—are often preferred due to their safety and fixed income characteristics. Understanding where the economy stands in the cycle helps investors align their strategies accordingly.Analyzing interest rate trends and stock market signals involves a combination of technical and fundamental approaches.

Monitoring central bank policies and interest rate decisions provides insight into future rate movements. For instance, an anticipated rate hike usually leads to falling bond prices, especially in the short term. Conversely, stock market signals such as earnings reports, valuation metrics, and market sentiment indicators (like the VIX) help gauge investor confidence and potential market direction.

- Track central bank statements and monetary policy minutes to anticipate changes in interest rates.

- Observe yield curves; an inverted yield curve often signals an upcoming recession, suggesting a shift towards bonds.

- Follow leading economic indicators to assess the economy’s trajectory and adjust asset allocations accordingly.

- Use technical analysis tools, like moving averages and volume trends, to identify market momentum and possible entry or exit points.

Adjusting asset allocations based on market outlook involves a strategic reassessment of risk tolerance and investment goals. During periods of economic stability and growth, increasing exposure to stocks can capitalize on higher earnings potential. Conversely, in uncertain or declining economic conditions, shifting towards bonds can help preserve capital and generate steady income. Investors should also consider laddering bond maturities and diversifying across sectors to mitigate risks associated with interest rate fluctuations and market volatility.

| Market Condition | Recommended Strategy |

|---|---|

| Economic Expansion | Increase allocation to stocks, focus on growth sectors |

| Economic Slowdown/Recession | Shift towards government bonds, diversify into defensive stocks |

| Rising Interest Rates | Reduce long-term bond holdings, look for short-term bonds or floating-rate debt |

| Falling Interest Rates | Consider locking in longer-term bonds, increase equity exposure if growth persists |

Interest rate trends and economic signals are like the compass guiding investment decisions—staying attuned to these can help investors navigate the complexities of market timing with greater confidence.

Practical Examples and Case Studies

Examining real-world examples and detailed case studies offers valuable insights into the practical application of investing strategies in bonds and stocks. These scenarios help illustrate how different investment choices can impact financial outcomes based on varying market conditions, investor goals, and risk tolerances. By analyzing concrete instances, investors can better understand the nuances of evaluating bond funds and stock indices, enabling more informed decision-making tailored to their individual circumstances.

Through a systematic presentation of case studies, this section highlights diverse investor profiles, their strategic approaches, and the resulting performances. Additionally, step-by-step procedures for assessing bond funds and stock indices are discussed, providing a clear framework for selecting suitable investment options. Descriptive scenarios with detailed financial data are included to demonstrate how different variables influence investment returns and risks.

Successful Bond Investment Example

Consider an investor who purchased a diversified municipal bond fund in 2010 with an initial investment of $50,000. Over a decade, the bond fund consistently provided annual interest payments averaging 3%, tax advantages due to municipal status, and capital appreciation driven by rising municipal bond prices. By 2020, the total value of the investment grew to approximately $65,000, factoring in interest reinvestment and market value appreciation.

This scenario exemplifies how bonds can generate stable income and preserve capital, especially for investors seeking lower-risk, tax-efficient income streams.

Successful Stock Investment Example

A different investor invested $50,000 in an index fund tracking the S&P 500 in 2010. Amid various market fluctuations over the decade, the stock market experienced significant growth, with the index compiling an average annual return of approximately 14.5%. By 2020, the investment would have grown to around $213,000, demonstrating the potential for substantial capital appreciation through equities. This highlights the higher growth potential of stocks, albeit with increased volatility and risk, suitable for investors with longer time horizons and higher risk tolerance.

Case Study: Evaluating Bond Funds and Stock Indices

Suppose an investor is considering adding either a corporate bond fund or a technology sector stock index to diversify their portfolio. The evaluation involves examining historical returns, volatility measures, expense ratios, and credit quality for bond funds, alongside analyzing index performance, sector trends, and valuation metrics for stocks. For instance, analyzing a bond fund’s average duration, credit ratings, and yield can provide insights into its risk-return profile, while reviewing the historical performance and P/E ratios of the stock index helps assess growth prospects and valuation levels.

This comparative analysis aids in choosing investments aligned with the investor’s objectives.

Descriptive Scenario with Financial Data

Imagine an investor aiming for moderate growth and income. They consider a bond fund with a 4% annual yield and a history of stable returns, versus an S&P 500 index fund with an average annual return of 10% over the past 10 years but with higher volatility. Financial data indicates that the bond fund’s NAV increased gradually, with lower standard deviation, emphasizing stability.

Conversely, the stock index experienced sharp rises and falls, but with a higher overall return. The investor’s decision hinges on their risk tolerance and income needs, demonstrating how detailed financial scenarios inform optimal investment choices.

Ultimate Conclusion

By examining the nuances of investing in bonds versus stocks, investors can develop balanced strategies that suit their risk tolerance and financial goals. Recognizing the unique advantages and limitations of each asset class enables more effective portfolio management and better preparation for changing market conditions. Ultimately, informed investment choices pave the way for sustained financial growth and stability.