Embarking on an investment journey in gold mining stocks offers a unique opportunity to diversify your portfolio while tapping into the potential of precious metal extraction. Understanding the nuances of this sector can unlock significant growth prospects and strategic advantages for savvy investors.

This guide provides a comprehensive overview of how to invest in gold mining stocks, covering industry fundamentals, key factors to consider, research techniques, investment strategies, and risk management practices to help you make informed decisions and optimize your investment outcomes.

Introduction to Investing in Gold Mining Stocks

Investing in gold mining stocks offers a unique opportunity to participate in the precious metals market through the lens of exploration, extraction, and production companies. Unlike directly purchasing physical gold, these stocks represent ownership in companies that mine and process gold, providing investors with exposure to the commodity’s price movements along with the potential for company growth and dividends. This investment avenue has historically been regarded as a way to diversify a portfolio, hedge against inflation, and capitalize on the cyclical nature of the gold industry.

Over the decades, gold mining stocks have demonstrated significant performance variability, often reflecting broader economic conditions, geopolitical stability, and fluctuations in gold prices. During times of economic uncertainty or inflationary pressures, these stocks tend to outperform other asset classes, owing to their perceived safe-haven status. Conversely, they are subject to operational risks, commodity price volatility, and regulatory challenges, which necessitate careful analysis and risk management by investors.

Roles within the Broader Investment Landscape

Gold mining stocks serve as a vital component of diversified investment portfolios, offering a balance between exposure to tangible commodities and corporate growth potential. They can act as a hedge during periods of inflation or currency devaluation, as rising gold prices generally translate into increased profitability for mining companies. Furthermore, they provide an opportunity to benefit from operational efficiencies, technological advancements, and strategic acquisitions within the industry.

Historical Performance and Significance

Historically, gold mining stocks have experienced cycles of boom and bust, closely tied to the price of gold and global economic conditions. For instance, during the gold price surge of the late 1970s and early 1980s, many mining companies saw their stock prices soar, reflecting the rising value of their reserves. The early 2000s marked a resurgence in interest, driven by increasing demand from emerging markets and inflation concerns, which propelled the stocks to new heights.

The 2008 financial crisis also underscored their role as a safe haven, with many mining stocks rallying amidst wider market turmoil.

Advantages of Investing in Gold Mining Stocks

Investors benefit from several key advantages when allocating funds to gold mining companies:

- Potential for leverage to gold prices: Mining stocks can amplify the gains experienced by physical gold due to operational efficiencies and exploration success.

- Dividend income: Many established mining firms offer dividends, providing income streams alongside capital appreciation.

- Growth opportunities: Acquisition of promising mining assets and technological innovations can lead to increased production and profitability.

- Portfolio diversification: Gold mining stocks often exhibit low correlation with traditional equities and bonds, enhancing portfolio resilience.

Risks Associated with Gold Mining Stocks

Despite their benefits, investing in gold mining stocks carries notable risks that require thorough consideration:

- Operational risks: Mine collapses, environmental issues, and regulatory delays can adversely impact production and profitability.

- Commodity price volatility: Fluctuations in gold prices directly influence company revenues and stock performance.

- Financial risks: High debt levels and capital expenditure requirements can strain company finances, especially during downturns.

- Geopolitical and regulatory risks: Political instability, taxation policies, and environmental regulations may pose challenges, particularly in resource-rich regions.

Investing in gold mining stocks involves balancing the potential for substantial gains with the inherent operational and market risks, making thorough research and strategic planning essential for success.

Understanding the Gold Mining Industry

The gold mining industry is a complex and vital component of the global commodities market, involving a range of companies from large-scale producers to innovative exploration firms. Grasping the structure and operational dynamics of this industry is essential for investors seeking to make informed decisions about gold mining stocks. This section provides a comprehensive overview of the industry’s organization, project lifecycle, and the key factors influencing profitability and operational success.

By understanding how the industry is structured and the stages involved in bringing a gold deposit from discovery to production, investors can better assess the risks and opportunities associated with investing in gold mining companies. Recognizing the main players and their roles, alongside the factors shaping industry trends, enables more strategic investment considerations tailored to market conditions and company fundamentals.

Structure of the Gold Mining Industry

The gold mining industry comprises a diverse range of entities, primarily divided into major producers, mid-tier companies, and exploration firms. Each plays a distinct role in the lifecycle of gold extraction and contributes differently to the overall market landscape.

Major producers are large, well-established companies with extensive operational assets and significant annual gold output. Examples include Newmont Corporation, Barrick Gold, and AngloGold Ashanti. These companies often operate multiple mines across different regions, benefiting from economies of scale and diversified risk.

Exploration companies focus on discovering new gold deposits and often operate with higher risk but potentially higher rewards. They typically do not yet have producing mines but are crucial for the industry’s future growth. Some well-known exploration firms include Premier Gold Mines and Gold Fields Limited’s exploration subsidiaries.

The industry structure also involves service providers, equipment manufacturers, and financial institutions that support mining operations through technology, logistics, and funding solutions. This interconnected ecosystem sustains the overall health and development of gold mining activities.

Lifecycle of a Gold Mining Project

The process of developing a gold mine follows a systematic and multi-stage lifecycle, each phase presenting unique challenges and investment considerations. Understanding this progression helps investors evaluate the maturity and risk profile of different companies and projects.

- Exploration: This initial stage involves discovering promising mineral deposits through geological surveys, sampling, and geophysical methods. Successful exploration results in resource estimates and the identification of viable deposits.

- Feasibility Study and Permitting: Once a deposit is identified, detailed studies assess economic viability, environmental impact, and regulatory requirements. Securing permits can be time-consuming but is essential for advancing to production.

- Development and Construction: This phase includes building the necessary infrastructure, such as processing plants, roads, and power supplies. Capital expenditure (CapEx) is significant at this stage, and project financing is often secured.

- Production: After commissioning, the mine begins extracting and processing ore to produce gold. Operational costs, efficiency, and recovery rates directly influence profitability.

- Reclamation and Closure: Once the deposit is exhausted or operations are no longer viable, environmental reclamation and mine closure activities are undertaken to restore the site.

The entire project lifecycle can span over a decade, with substantial capital investment and regulatory oversight at each stage, making project management and strategic planning critical.

Factors Influencing Gold Mining Operations and Profitability

Several key factors impact the operational efficiency and profitability of gold mining companies, often dictating their financial health and stock performance. Awareness of these influences enables investors to better understand industry dynamics and company prospects.

- Gold Price Fluctuations: The profitability of mining operations is highly sensitive to changes in the gold price. A rise in gold prices can significantly improve margins, while a decline can threaten viability, especially for marginal projects.

- Operational Costs: These include extraction, processing, labor, transportation, and energy expenses. Companies with lower production costs are better positioned to withstand price downturns and maintain profitability.

- Geopolitical and Regulatory Environment: Political stability, mining rights, environmental regulations, and taxation policies vary across regions. Stable jurisdictions tend to offer lower risks, while changes in regulation can impact project timelines and costs.

- Resource Quantity and Grade: The size and grade of a deposit determine the potential lifespan and richness of a mine. Higher-grade ore typically yields higher returns and shorter payback periods.

- Technological Advancements: Innovations in extraction and processing can enhance recovery rates, reduce costs, and extend mine life. Companies investing in technology often outperform competitors in operational efficiency.

- Environmental and Social Factors: Community relations, environmental stewardship, and sustainability practices influence operational licenses and social license to operate, affecting overall profitability.

Understanding these factors allows investors to evaluate the resilience and growth potential of gold mining companies amid changing market and regulatory conditions.

Key Factors to Consider Before Investing

Investing in gold mining stocks requires a comprehensive understanding of various critical factors that influence the potential returns and risks associated with these investments. Recognizing and evaluating these elements can help investors make informed decisions, minimize risks, and optimize their investment strategies in this dynamic sector.

Several fundamental metrics and external factors shape the performance of gold mining companies. These include operational parameters such as reserve ounces, production costs, and profit margins, as well as broader macroeconomic influences like gold prices, geopolitical stability, and currency fluctuations. Additionally, environmental, social, and governance (ESG) considerations are increasingly shaping investor preferences and company valuations in today’s responsible investing landscape.

Operational Metrics: Reserve Ounces, Production Costs, and Profit Margins

Understanding a mining company’s operational efficiency and resource base is vital. Key metrics include:

- Reserve Ounces: The total amount of economically recoverable gold the company estimates to have in its deposits. Higher reserves generally indicate a longer operational lifespan and potential for sustained production.

- Production Costs: The all-in sustaining costs (AISC) per ounce of gold produced. Lower costs can result in higher profit margins, especially when gold prices are volatile or declining.

- Profit Margins: The difference between revenue from gold sales and total production costs. Strong margins often reflect efficient operations and favorable market conditions.

Assessing these metrics enables investors to differentiate between financially robust companies and those potentially vulnerable to price swings or operational challenges. A company with substantial reserves, low production costs, and healthy profit margins is likely to be more resilient during periods of market downturns.

Market and Economic Influences: Gold Prices, Geopolitical Stability, and Currency Fluctuations

External economic and geopolitical factors significantly impact the profitability and valuation of gold mining stocks. These include:

- Gold Prices: As the primary product, fluctuations in gold prices directly affect revenue streams. A rising gold price typically benefits miners, but falling prices can squeeze profit margins, especially for companies with higher production costs.

- Geopolitical Stability: Political unrest or conflicts in key mining regions can disrupt operations, delay projects, and impact supply. Stable geopolitical environments tend to minimize operational risks and foster investor confidence.

- Currency Fluctuations: Since gold is priced in U.S. dollars globally, a weaker dollar can increase gold prices, providing a boost to mining companies’ revenues when converted back to local currencies. Conversely, a strong dollar can depress gold prices and reduce profitability.

Investors should monitor these macroeconomic indicators and geopolitical developments to gauge the potential risks and opportunities associated with gold mining stocks. For example, during periods of dollar weakness and rising geopolitical tensions, gold prices often surge, benefiting miners with operational exposure in relevant regions.

Environmental, Social, and Governance (ESG) Considerations

In recent years, ESG factors have gained prominence among investors assessing the sustainability and ethical impact of their investments. For gold mining companies, ESG considerations encompass:

- Environmental Impact: The company’s approach to minimizing ecological disruption, managing waste, and reducing carbon emissions. Companies adopting sustainable practices often enjoy better community relations and reduced regulatory risks.

- Social Responsibility: Engagement with local communities, fair labor practices, and respecting indigenous rights. Strong social credentials can enhance a company’s reputation and operational stability.

- Governance: Transparent management practices, adherence to regulations, and effective risk management strategies. Good governance can mitigate operational and reputational risks, attracting responsible investors.

Investors integrating ESG considerations into their analysis are increasingly prioritizing companies with strong sustainability credentials, as these companies may be better positioned to navigate regulatory changes, societal expectations, and environmental challenges. A focus on ESG factors can also influence stock valuations, investor sentiment, and long-term viability.

How to Research Gold Mining Stocks

Effective research is essential for making informed investment decisions in gold mining stocks. By analyzing financial statements, evaluating management teams, and comparing different companies, investors can identify promising opportunities and avoid potential pitfalls. A thorough approach to research enhances confidence and helps build a resilient investment portfolio in this specialized sector.

Investors should adopt comprehensive methods to scrutinize company performance, operational efficiency, and industry positioning. This process involves detailed financial analysis, management assessment, and comparative evaluation across multiple companies to determine which stocks align with investment goals and risk tolerance.

Analyzing Company Financial Statements

Financial statements offer vital insights into the health and operational efficiency of a gold mining company. Key aspects to examine include cash flow, debt levels, profitability, and asset management. Understanding these figures helps assess whether a company can sustain its operations, fund growth, and withstand market fluctuations.

Focus on the following financial metrics:

- Cash Flow Analysis: Positive operating cash flow indicates the company generates enough cash from its mining activities to cover expenses, invest in growth, and return value to shareholders. Analyzing cash flow statements helps identify liquidity and operational efficiency.

- Debt Levels: Excessive debt may increase financial risk, especially during periods of declining gold prices. Review the company’s debt-to-equity ratio and interest coverage ratio to evaluate its leverage and ability to service debt obligations.

- Profitability Metrics: Look at net income, gross profit margins, and return on assets to understand how effectively the company manages costs and generates profits from its mining operations.

Assessing these financial indicators collectively provides a comprehensive picture of a company’s financial stability and potential for growth.

Evaluating Management Teams and Operational Efficiency

The strength of a company’s management team significantly influences its strategic direction and operational success. An experienced and transparent leadership team can navigate industry challenges, optimize operations, and deliver shareholder value.

When evaluating management, consider their track record within the industry, previous success in resource development, and ability to adapt to market conditions. Additionally, scrutinize corporate governance practices and transparency levels, including communication with shareholders and adherence to regulations.

Operational efficiency is another critical factor. It involves analyzing production costs, mine throughput, recovery rates, and technological innovation. High operational efficiency often correlates with lower costs per ounce, which can be advantageous during periods of declining gold prices.

Some ways to assess operational efficiency include:

- Review of production costs per unit—such as cash costs and all-in sustaining costs (AISC)—to determine profitability margins.

- Analysis of mine life and reserves to gauge long-term sustainability.

- Assessment of technological advancements that improve recovery rates and reduce costs.

Comparison of Mining Companies

Comparing different gold mining companies enables investors to identify relative strengths and weaknesses, helping guide investment decisions. A clear comparison includes key data points such as share price, market capitalization, and production volume to provide a snapshot of each company’s size, valuation, and operational scale.

Below is a representative comparison of three notable gold mining companies:

| Company Name | Share Price (USD) | Market Cap (USD Billion) | Annual Production (Ounces) |

|---|---|---|---|

| GoldCorp Inc. | $1,850 | 22.5 | 2.3 million |

| Newmont Corporation | $55.50 | 45.8 | 6.2 million |

| Barrick Gold Corporation | $18.20 | 33.1 | 4.7 million |

This comparison highlights variations in company valuation, scale of operations, and market perception. Larger market caps and higher production volumes often indicate more established firms with diversified assets, but may also come with different risk profiles. Investors should analyze these data points in conjunction with other factors such as exploration potential, financial health, and management quality to make well-informed investment choices.

Investment Strategies for Gold Mining Stocks

Investing in gold mining stocks offers a diverse array of strategic approaches, each aligned with different risk tolerances and investment objectives. Understanding these strategies enables investors to optimize their portfolio and navigate market fluctuations effectively. Whether aiming for steady income, capital appreciation, or high-risk speculative gains, selecting an appropriate approach is crucial to long-term success in this sector.

Effective strategies involve not only choosing the right stocks but also implementing methods for diversification, monitoring performance, and adjusting positions as market conditions evolve. Below, we explore key investment approaches, diversification techniques, and management practices essential for optimizing investments in gold mining stocks.

Valuation and Value Investing

Value investing involves identifying gold mining stocks that are undervalued relative to their intrinsic worth, based on fundamental analysis. Investors focus on financial metrics such as price-to-earnings (P/E) ratios, book value, cash flow, and dividend yields to determine whether a stock is trading below its true value. Historical data shows that undervalued stocks tend to appreciate over time, providing opportunities for long-term gains.

In this approach, investors conduct thorough financial statement analysis, considering factors such as reserve levels, production costs, debt levels, and management efficiency. Recognizing cyclical patterns in commodity prices and understanding the company’s cost structure can help identify undervalued stocks with potential for future growth as market conditions improve.

Growth Investing

Growth investing focuses on companies within the gold mining sector that demonstrate strong potential for expansion and increased profitability. These stocks often exhibit higher P/E ratios, reflecting expectations of future earnings growth driven by technological advancements, exploration success, or favorable regulatory environments.

Investors adopting this strategy seek companies with promising development projects or innovative extraction techniques that can lead to increased production capacity and higher revenues. Regularly analyzing exploration updates, project pipelines, and management’s strategic vision is essential in this approach. Growth investors are generally willing to accept higher volatility due to the potential for substantial capital appreciation.

Speculative Trading

Speculative trading in gold mining stocks involves taking high-risk positions based on short-term market movements, geopolitical events, or commodity price fluctuations. This approach often relies on technical analysis, chart patterns, and market sentiment rather than fundamentals. Traders may engage in rapid buying and selling to capitalize on volatility.

Speculative strategies require close market monitoring, quick decision-making, and a readiness to accept significant losses. It’s common to use leverage or options in this context to amplify potential gains, but such methods also increase risk exposure. This approach suits experienced investors who can manage high levels of uncertainty and scope for rapid profit-taking or loss.

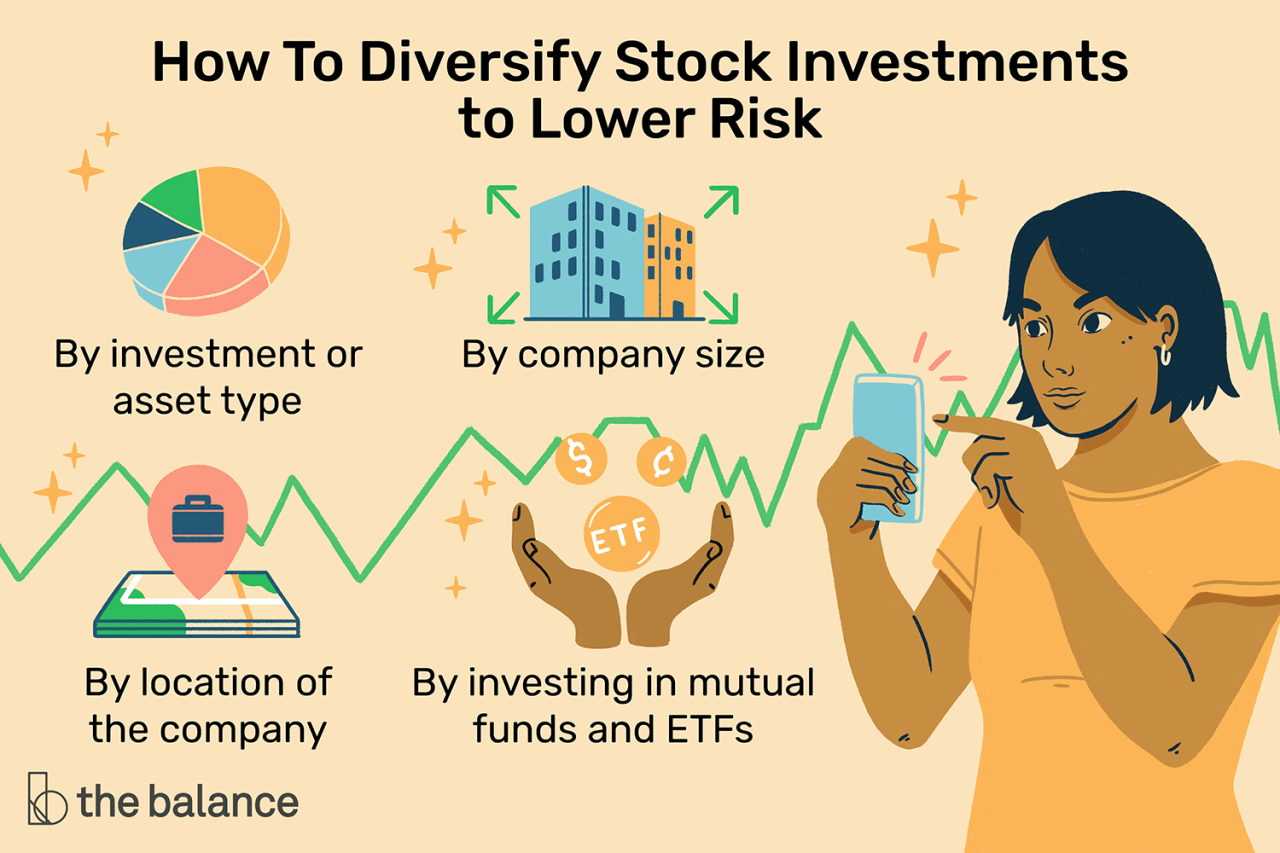

Methods for Diversifying within the Sector

Mitigating risks associated with investing in gold mining stocks involves implementing diversification strategies across various dimensions. This reduces dependency on individual company performance and specific market factors, leading to more resilient portfolios.

- Investing in a mix of large-cap, mid-cap, and small-cap mining companies to balance stability and growth potential.

- Diversifying geographically by including companies operating in different regions such as North America, Africa, and Australia to reduce regional geopolitical risks.

- Spreading investments across different stages of development—exploration, development, and production—to avoid overconcentration in any single phase.

- Incorporating gold ETF or mutual funds focused on mining stocks to gain broader exposure without selecting individual stocks.

- Balancing investments between companies with varying cost structures, reserve bases, and operational efficiencies.

Monitoring and Adjusting Investment Positions

Effective management of gold mining stock investments necessitates consistent monitoring of market conditions, stock performance, and company fundamentals. This involves establishing benchmarks, setting target prices, and defining stop-loss levels to protect gains and limit losses.

Regularly reviewing financial statements, operational reports, and commodity price trends helps determine whether a stock still aligns with initial investment thesis. Investors should also pay attention to macroeconomic factors such as interest rates, inflation expectations, and geopolitical events that influence gold prices and mining operations.

Adjusting positions based on updated information and market signals allows investors to capitalize on opportunities and mitigate risks. Maintaining flexibility and having a clear exit strategy are essential components of a successful investment approach in this sector.

Risks and Challenges in Investing

Investing in gold mining stocks offers the potential for significant returns, yet it also involves inherent risks and challenges that investors must carefully evaluate. Understanding these factors is essential to developing a robust investment strategy and safeguarding your capital against unforeseen setbacks. This section delves into the primary risks associated with gold mining stocks, how to recognize warning signs, and strategies to manage these risks effectively.The gold mining industry is subject to a variety of complex and often unpredictable risks that can impact stock performance.

These risks stem from market volatility, geopolitical factors, operational issues, and industry-specific challenges. Recognizing and mitigating these risks can enhance investment stability and improve long-term outcomes.

Potential Risks Associated with Gold Mining Stocks

The primary risks in investing in gold mining stocks encompass commodity price fluctuations, political and regulatory instability, operational hurdles, environmental concerns, and broader economic factors. Each poses unique challenges that can influence stock performance and overall profitability.

- Commodity Price Volatility: Gold prices are influenced by macroeconomic conditions, currency fluctuations, inflation rates, and investor sentiment. Sharp declines in gold prices can erode profit margins for miners, especially those with high production costs, leading to reduced stock values. For example, during the 2013-2015 period, gold prices dropped nearly 50%, adversely affecting many mining companies’ stock performance.

- Political Instability and Regulatory Risks: Gold mining operations often occur in regions with unstable political environments or evolving regulatory frameworks. Changes such as new taxation, land disputes, or mining bans can significantly hinder production and profitability. An illustrative case is the political unrest in regions like South Africa or Venezuela, which has led to operational disruptions and increased risk premiums for investments.

- Operational Challenges: Mining involves complex processes with risks related to project delays, cost overruns, technical failures, or accidents. Unexpected downtime, equipment failures, or difficulties in accessing reserves can diminish returns and impact stock performance.

- Environmental and Social Risks: Environmental regulations, community opposition, and sustainability concerns can lead to project delays, increased costs, or legal disputes. The rising emphasis on ESG (Environmental, Social, and Governance) standards demands that companies address these issues proactively to avoid reputational damage.

- Economic and Market Conditions: Broader economic factors such as interest rates, currency strength, and inflation influence investor appetite for gold and mining stocks. During times of economic stability, gold prices may stagnate, suppressing profits and leading to lower stock valuations.

Identifying Warning Signs and Developing Risk Management Strategies

Proactive identification of risks and implementation of strategies to mitigate them are crucial components of successful investing in gold mining stocks. Investors should monitor specific indicators and adopt risk management practices to navigate potential pitfalls effectively.The following are key warning signs and corresponding strategies:

Early detection of risk indicators can prevent significant losses and position investors to capitalize on emerging opportunities.

- Monitoring Commodity Prices: Regularly track gold price trends and forecasts from reputable sources. Sudden declines or increased volatility may signal increased investment risk, prompting reassessment of portfolio holdings.

- Assessing Political and Regulatory Environment: Stay informed about geopolitical developments and regulatory changes in countries where mining companies operate. Diversification across regions can mitigate country-specific risks.

- Evaluating Company Operational Health: Analyze financial statements, production reports, and management commentary to identify operational inefficiencies or delays. Companies with high operational leverage are more vulnerable to delays and cost overruns.

- Environmental and Community Relations: Review companies’ ESG disclosures, community engagement efforts, and compliance records. Poor ESG performance can lead to legal challenges and project suspensions.

- Implementing Diversification and Hedging: Spreading investments across different companies and regions reduces exposure to individual project risks. Utilizing financial hedging instruments like options can also protect against downward price movements.

Comparison of Risk Profiles Among Different Types of Gold Mining Stocks

Different categories of gold mining stocks carry distinct risk profiles, and understanding these differences aids investors in aligning their risk tolerance with appropriate investments.

| Risk Factors | Major Gold Mining Companies (Majors) | Exploration and Development Firms (Explorers) |

|---|---|---|

| Market Stability | Higher stability due to diversified operations, large cash reserves, and established production assets. | Lower stability, highly sensitive to project success and market sentiment, often more volatile. |

| Growth Potential | Moderate, primarily reliant on resource expansion and operational efficiencies. | High, with significant upside potential if exploration results lead to new gold deposits. |

| Operational Risks | Relatively lower, with established infrastructure and proven processes. | Higher, due to exploration risk, technical uncertainties, and potential delays in development. |

| Price Volatility | Less affected by short-term price swings, thanks to steady cash flow. | More susceptible to gold price fluctuations and exploration news. |

| Regulatory and Political Risks | Lower, given more experience in navigating regulations and diversified geographic presence. | Higher, often operating in politically volatile regions with evolving regulations. |

Understanding these risk profiles enables investors to make informed choices aligned with their investment objectives and risk appetite. While majors provide stability and consistent dividends, explorers offer high-risk, high-reward opportunities that could lead to substantial gains or losses depending on exploration outcomes and market conditions.

Regulatory and Tax Considerations

Investing in gold mining stocks involves navigating a complex landscape of government policies, mining regulations, and tax systems that can significantly influence investment outcomes. Understanding these factors is crucial for making informed decisions and optimizing returns within this sector.Regulatory frameworks and tax policies vary widely across jurisdictions, impacting everything from operational approvals to taxation rates on profits and dividends. Effective awareness of these differences can help investors anticipate potential hurdles and identify regions with favorable conditions for mining investments.

Moreover, compliance with local laws ensures smooth operations and prevents costly legal issues that could erode investment gains.

Jurisdictional Differences in Mining Laws

The legal environment governing gold mining activities varies significantly from country to country, and even within regions of the same country. These differences can affect exploration rights, environmental restrictions, labor laws, and licensing procedures. For example, countries like Canada and Australia generally offer transparent and well-established legal frameworks which encourage foreign investment, while some regions may impose stricter environmental regulations or longer licensing processes, potentially delaying project development.Understanding the specific legal requirements in each jurisdiction is essential.

It involves researching local mining codes, environmental regulations, and property rights. Investors should pay particular attention to the stability of the political environment, as frequent policy changes or political unrest can risk investments. Consulting local legal experts or mining consultants can provide valuable insights and help navigate the legal landscape effectively.

Procedures for Compliance and Tax-Efficient Investing

Ensuring compliance with local regulations is fundamental for sustainable investment in gold mining stocks. This includes obtaining necessary permits, adhering to environmental standards, and following reporting obligations. Non-compliance can lead to fines, suspension of operations, or loss of mining rights, all of which negatively impact investment returns.Tax considerations are equally vital for maximizing profitability. Different jurisdictions offer varying tax incentives, deductions, and rates on mining income, royalties, and dividends.

Investors should explore opportunities for tax-efficient investing, such as utilizing tax treaties, establishing holding companies in favorable jurisdictions, or timing investments to benefit from specific tax regimes.Effective strategies for tax efficiency include:

- Leveraging tax treaties to reduce withholding taxes on dividends or interest.

- Utilizing tax deferral opportunities through holding structures or deferred compensation plans.

- Monitoring changes in tax laws that could create new incentives or liabilities.

“Understanding and navigating the regulatory and tax landscape is essential for protecting your investments and maximizing returns in the gold mining sector.”

By thoroughly researching jurisdictional legal frameworks and implementing sound compliance and tax strategies, investors can enhance the stability and profitability of their investments in gold mining stocks while minimizing unforeseen risks.

Tools and Resources for Investing

Investing in gold mining stocks requires access to accurate, timely, and comprehensive information. Utilizing a variety of tools and resources can greatly enhance your ability to make informed decisions, track market trends, and stay compliant with regulations. The right combination of financial news platforms, industry reports, stock analysis tools, and regulatory sources can provide a strategic advantage in managing your investments effectively.Leveraging these tools effectively involves understanding their functions, access methods, and how to organize findings for practical application.

Exploring a curated list of online resources enables investors to streamline their research process and maintain a well-rounded perspective on the gold mining industry.

Financial News Platforms and Industry Reports

Staying updated with the latest news and industry insights is critical for timely investment decisions. Reputable financial news platforms, such as Bloomberg, Reuters, and CNBC, offer real-time updates on market movements, company announcements, and economic indicators relevant to gold mining stocks. Industry-specific reports from agencies like the World Gold Council or mining sector analysts provide detailed data on production, exploration activities, and industry trends that influence stock performance.Subscribing to newsletters and alerts from these sources ensures you receive relevant updates directly, helping to identify potential investment opportunities or emerging risks before they are broadly recognized.

Stock Analysis Tools and Market Data Services

Robust analysis tools are essential to evaluate individual gold mining stocks thoroughly. Platforms like Yahoo Finance, Morningstar, and TradingView offer comprehensive charting, financial ratios, and analyst ratings that support in-depth stock analysis. These tools often feature customizable screening functions to filter stocks based on criteria such as market capitalization, production levels, or financial health.Additionally, market data services such as FactSet, S&P Capital IQ, and MarketWatch provide access to historical data, earnings reports, and sector performance metrics.

Using these resources allows investors to perform technical and fundamental analysis, aiding in the development of sound investment strategies.

Regulatory Agencies and Compliance Resources

Awareness of regulatory requirements and compliance standards is vital for responsible investing. Agencies like the U.S. Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Financial Conduct Authority (FCA) provide essential guidelines, filings, and updates related to securities regulation. Accessing their official websites ensures transparency and helps investors verify the legitimacy of companies and disclosures.Furthermore, resources from tax authorities, such as the IRS in the United States, assist in understanding tax implications related to investments in mining stocks, including capital gains and dividend taxation.

Organizing Research Findings Using an HTML Responsive Table

Effective investment decisions depend on organized and accessible research data. Creating a structured reference using an HTML responsive table allows investors to compare resources efficiently, track their utility, and access relevant information rapidly.

| Resource Name | Type | Access Link |

|---|---|---|

| Bloomberg | Financial News Platform | https://www.bloomberg.com |

| Reuters | Financial News & Data | https://www.reuters.com |

| World Gold Council | Industry Reports | https://www.gold.org |

| Yahoo Finance | Market Data & Analysis Tools | https://finance.yahoo.com |

| SEC Filings | Regulatory Agency | https://www.sec.gov |

| Financial Conduct Authority | Regulatory Body (UK) | https://www.fca.org.uk |

Utilizing these tools systematically can significantly improve research quality, enhance decision-making, and support the development of a robust investment portfolio in gold mining stocks.

Final Summary

By gaining a clear understanding of the gold mining sector, evaluating key performance indicators, and implementing sound investment strategies, you can navigate the complexities of this industry with confidence. Ultimately, informed investing in gold mining stocks can serve as a valuable component of a diversified and resilient portfolio.